Investing can be a daunting endeavor, especially for those who are just beginning their financial journey. However, mutual funds present an accessible and effective means to grow your wealth over time while mitigating risks associated with individual stock investments. Let us delve into the world of mutual funds and unveil their potential for smart investing. What are mutual funds and how do they work? We will answer these questions and provide you with insights to help you embark on your investment journey successfully.

Understanding Mutual Funds: What are Mutual Funds and How Do They Work?

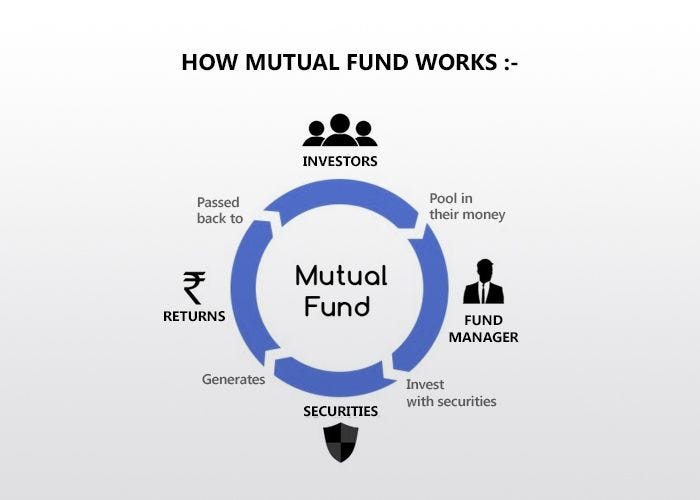

Mutual funds are investment vehicles that pool money from various investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective investment strategy not only makes it easier for investors to access different assets but also allows for spreading risk over a broad spectrum of investments. By participating in a mutual fund, individuals effectively become shareholders in a diverse portfolio, managed by professional fund managers.

Key Features of Mutual Funds: What are Mutual Funds and How Do They Work?

To fully grasp the concept of mutual funds, it is essential to understand their key features, which enable them to cater to different financial needs and goals.

- Professional Management: Mutual funds are typically managed by experienced professionals who make decisions based on detailed research and analysis. This professional oversight is a significant advantage for investors who may lack the time or expertise to manage their portfolios.

- Diversification: One of the greatest benefits of mutual funds is diversification, which entails spreading investments across various securities. This can significantly reduce risk as poor performance in a single investment is balanced out by others that may perform better.

- Liquidity: Mutual fund shares can generally be bought and sold on any business day. This liquidity provides investors with the flexibility to access their funds when required.

- Variety of Options: There are countless mutual funds available, catering to various investment objectives such as growth, income, or balanced strategies. Investors can choose the one that aligns best with their financial goals.

The Process of Investing: What are Mutual Funds and How Do They Work?

Investing in mutual funds is straightforward, but it’s essential to follow the right process. Here’s how it generally works:

- Determine Your Objectives: Before investing, think about your financial goals and risk tolerance. Consider whether you are saving for retirement, education, or simply building wealth.

- Research Funds: Use resources such as financial websites, reports, and ratings to analyze different mutual funds. Look into the fund’s performance, manager experience, and fee structure.

- Open an Account: You will need to set up an account with a financial institution, broker, or directly with a mutual fund company to start investing.

- Make an Investment: Decide on the amount you are willing to invest and select the mutual funds that align with your objectives. You can either make a lump-sum investment or opt for systematic investment plans (SIPs).

- Monitor Your Investment: While mutual funds are generally a long-term investment, it’s wise to periodically review your investment performance and adjust your portfolio as necessary based on your changing needs.

Common Types of Mutual Funds

Investors have a variety of mutual fund options to choose from, each tailored to meet specific financial goals:

- Equity Mutual Funds: These funds invest primarily in stocks and are suitable for those seeking capital appreciation over the long term.

- Debt Mutual Funds: Focused on income generation, these funds invest in fixed-income securities like government bonds and corporate securities, making them less volatile than equity funds.

- Balanced or Hybrid Funds: These funds invest in both equities and debt, offering the potential for growth while managing risk.

- Index Funds: Designed to replicate the performance of a specific market index, these funds typically have lower fees due to their passive management approach.

- Specialty Funds: These funds focus on specific sectors or strategies such as international markets or socially responsible investing.

Advantages of Investing in Mutual Funds: What are Mutual Funds and How Do They Work?

Understanding the advantages of mutual funds can help you appreciate their role in a well-rounded investment portfolio:

- Ease of Access: You can start investing in mutual funds with a relatively low amount, making them accessible to a wide range of investors.

- Tax Efficiency: Certain mutual funds provide tax advantages, such as tax-saving equity schemes, which can help reduce your tax burden.

- Transparency: Mutual funds are required to regularly disclose their holdings and performance data, keeping investors informed about their investment.

- Convenience: With options for automatic investments and reinvestment of dividends, mutual funds offer convenience in managing your investments.

Potential Risks of Mutual Funds

Every investment carries risk, and mutual funds are no exception. Here are some potential risks to keep in mind:

- Market Risk: The value of mutual funds can fluctuate based on market conditions, particularly for equity funds.

- Manager Risk: The performance of a mutual fund is often reliant on the skill of the fund manager; poor decision-making can lead to underperformance.

- Expense Ratio: Mutual funds charge fees for management, which can eat into your returns. Be sure to consider the expense ratio when selecting funds.

Conclusion: Unlocking Wealth with Mutual Funds

In summary, mutual funds are a compelling option for investors looking to increase their wealth responsibly and effectively. By pooling resources together, they offer opportunities for diversification, professional management, and accessibility. As you contemplate your investment journey, remember to explore the immense potential of mutual funds. Understanding what mutual funds are and how they work is the first step toward making informed investment decisions that align with your financial aspirations.

Regardless of where you are on your investment journey, mutual funds can be a powerful tool in building a secure financial future. With careful research and consideration, you can decide which mutual fund strategies align with your personal financial goals. Embrace the possibilities that mutual funds offer, and make smart investments that pave the way for a brighter tomorrow.