In today’s fast-paced world, the stock market provides endless possibilities for savvy investors. Among the various strategies employed by investors, day trading stands out as a popular choice. This technique involves buying and selling stocks within the same trading day, capitalizing on short-term market movements. Embracing this dynamic strategy can lead to significant rewards, but it requires both knowledge and discipline. The excitement and risk of the stock market attract many traders eager to explore opportunities through day trading.

The Allure of Stock Market Day Trading

Day trading involves taking advantage of the volatility inherent in the stock market. Traders aim to make quick profits by executing numerous trades throughout the day. While some traditional investors may hold onto stocks for the long term, day traders focus on short-term price movements and market trends, striving to close their positions by the end of each trading session. This approach requires a keen eye and a willingness to react quickly to changes in the market.

Understanding the Mechanics of Day Trading in the Stock Market

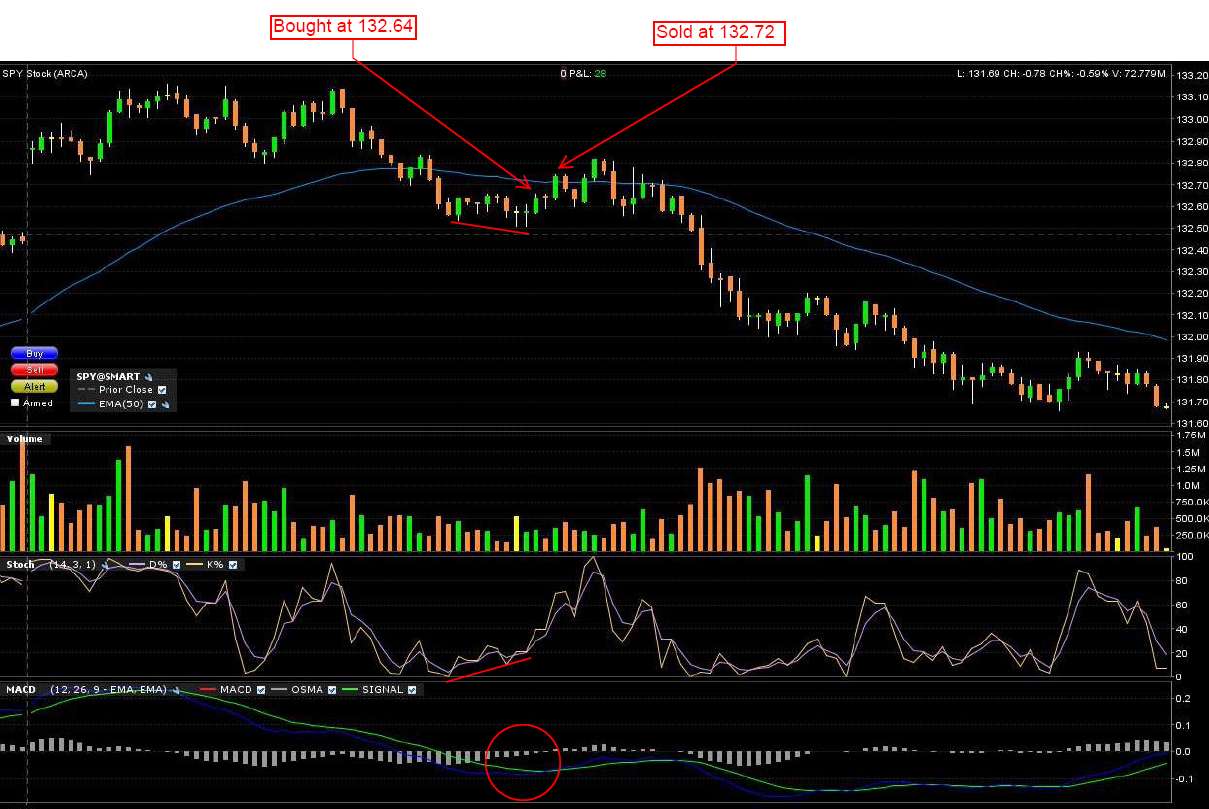

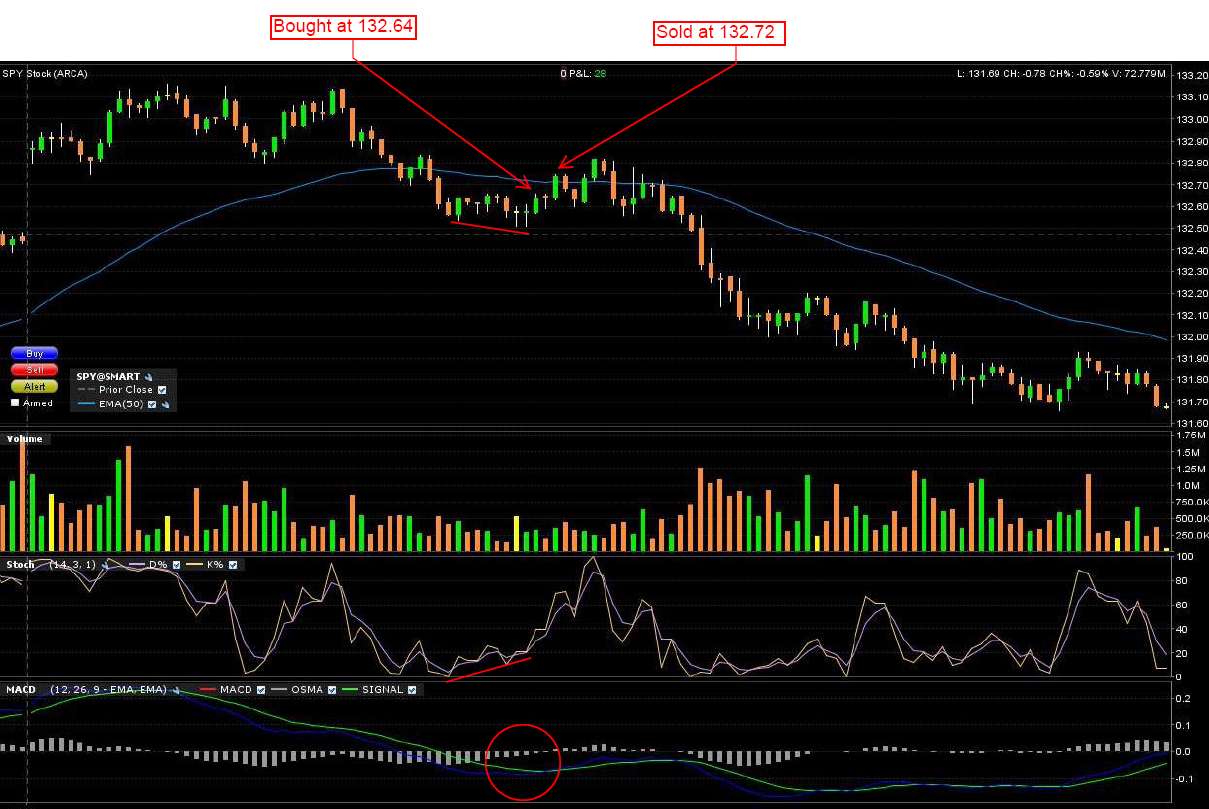

The stock market operates within a framework governed by various factors, including economic indicators, market sentiment, and global events. Day traders must remain informed and aware of developments that can influence stock prices. Tools like charts, technical analysis, and trading platforms play crucial roles in a trader’s decision-making process. Traders often utilize indicators like moving averages, volume trends, and price patterns to determine their next moves.

One of the fundamental principles of day trading is the use of liquidity. Stocks with high trading volumes tend to have more liquidity, allowing traders to enter and exit positions quickly without significantly impacting the stock price. Traders often steer clear of thinly traded stocks, focusing instead on more popular stocks that are actively traded. Major indices, such as the S&P 500, provide numerous opportunities for day trading due to their volatility and high volume.

Adopting Strategies for Success in Stock Market Day Trading

Successful day trading in the stock market requires a well-thought-out strategy. Traders often apply specific techniques to increase their chances of success. These strategies may differ based on individual preferences, risk tolerance, and market conditions. Here are some popular approaches:

- Scalping: This method focuses on making numerous small profits over short periods. Traders enter and exit positions quickly, aiming to capitalize on minor market fluctuations.

- Momentum Trading: Traders identify stocks that are moving significantly in one direction, usually on news or unexpected earnings reports. The goal is to ride the momentum until signs of reversal appear.

- Range Trading: This strategy involves identifying established support and resistance levels and making trades within that range. Traders benefit from price bouncing between these points.

Emphasizing Risk Management in Day Trading

In the stock market, every trader must accept that risk management is vital. Day trading can lead to swift losses if traders are not diligent. Setting stop-loss orders, which automatically sell a stock at a predetermined price, can help mitigate potential losses. Additionally, traders should only risk a small percentage of their overall capital on each trade, a common rule among seasoned day traders.

Another crucial aspect of risk management is the emotional control of a trader. The fast-paced nature of the stock market can lead to impulsive decisions driven by fear or greed. Practicing discipline and maintaining a clear mind can mean the difference between profit and loss. Successful traders often emphasize the importance of sticking to their trading plans, allowing them to adjust their strategies without being swept away by market emotions.

Tools and Resources for Stock Market Day Traders

In the era of technology, day traders have a wealth of resources at their fingertips. Whether through mobile applications or desktop platforms, a host of tools assist traders in making informed decisions. Online trading platforms usually provide essential features such as real-time quotes, charting tools, and news feeds that keep traders updated on market fluctuations.

Additionally, many traders participate in online communities and forums where they can share insights, strategies, and experiences with others. The exchange of information can be incredibly beneficial, particularly for novice traders who are still honing their skills in the stock market. Learning from the experiences of others can provide valuable lessons on the pitfalls to avoid and the best practices to adopt in day trading.

The Role of Market Research in Day Trading

Thorough market research is another cornerstone of successful day trading. Traders should engage in constant analysis of market conditions, keeping track of economic indicators, earnings reports, and geopolitical developments that can affect stock prices. Understanding market psychology and sentiment can also provide insights into potential price movements.

Utilizing fundamental analysis alongside technical analysis can enhance a trader’s understanding of the stocks they wish to invest in. While technical analysis focuses heavily on price patterns and trends, fundamental analysis examines company financials, industry trends, and overall economic conditions. Combining these approaches can provide a more comprehensive view of potential trading opportunities.

The Future of Day Trading in the Stock Market

As the stock market evolves, so too do the strategies and tools employed by day traders. New developments, including advancements in artificial intelligence and algorithmic trading, have transformed how traders analyze and execute trades. These technologies can process vast amounts of data in real time, allowing for rapid decision-making that is crucial in day trading.

Looking ahead, the proliferation of mobile trading applications has democratized access to the stock market, enabling a new generation of traders to enter the world of day trading. This accessibility can potentially lead to increased competition and innovative trading strategies as more individuals explore the possibilities of the stock market.

Building a Day Trading Plan

For anyone interested in venturing into the realm of day trading, building a comprehensive trading plan is essential. A solid plan outlines clear objectives, strategies, risk management parameters, and a review process to assess performance. By setting realistic goals and creating a structured approach, traders can navigate the complexities of the stock market with greater confidence.

In conclusion, stock market day trading presents both opportunities and challenges for traders willing to dedicate the time and effort to learn and adapt. By understanding the mechanics of the stock market, implementing effective strategies, and maintaining strong risk management, traders can position themselves for potential success. If you’re willing to embrace the excitement of day trading, the stock market awaits with an array of opportunities waiting to be explored!