Understanding the intricacies of small business finance is not just an option; it’s a necessity for entrepreneurs eager to succeed in today’s competitive marketplace. By enrolling in a small business finance online course, you can equip yourself with the knowledge and skills to make informed financial decisions, manage cash flow, and prepare for future growth. Throughout this article, we will explore the components that make these online courses indispensable for any business owner.

Why You Need a Small Business Finance Online Course

A small business finance online course provides unparalleled flexibility and access to valuable information that can transform your financial management approach. Here are several compelling reasons why these courses are essential:

- Enhanced Understanding: Dive deep into the world of budgeting, forecasting, and financial analysis.

- Time Efficiency: Access course materials at your convenience, allowing you to learn at your own pace.

- Cost-Effective Learning: Many online courses are more affordable than traditional classroom education, providing great value.

Key Topics Covered in Small Business Finance Online Courses

When considering enrolling in a small business finance online course, you’ll find a variety of topics designed to hone your financial skills. Here’s a brief overview of what you can expect:

Understanding Financial Statements

Financial statements are the backbone of any business’s financial health. You’ll learn how to read and interpret balance sheets, income statements, and cash flow statements. This understanding will enable you to gauge the performance of your business accurately.

Mastering Budgeting Techniques

Budgets are vital for managing finances effectively. A comprehensive small business finance online course will walk you through different budgeting techniques, such as zero-based budgeting and flexible budgeting, ensuring you can allocate resources wisely.

The Importance of Cash Flow Management

For small businesses, cash flow management is critical. A well-structured online course will emphasize tracking incoming and outgoing cash, helping you avoid potential pitfalls. Efficient cash flow management can be the difference between thriving and merely surviving.

Financial Planning for Business Growth

With a strong foundation in finance, you’ll be better equipped to plan for your business’s growth. Small business finance online courses typically cover strategic financial planning, investment analysis, and financing options that can propel your business forward.

Visualizing Financial Concepts

Understanding Financial Health with Visual Aids

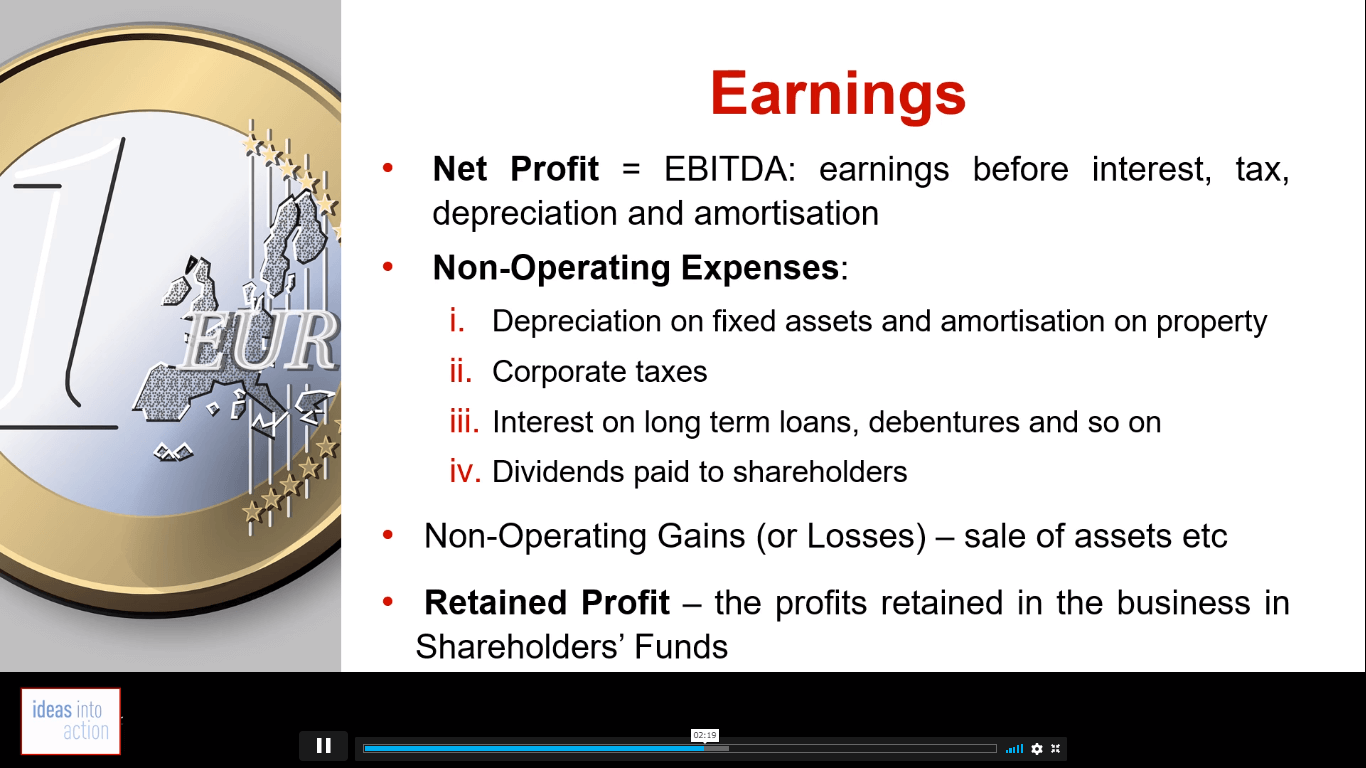

Utilizing visual aids helps in grasping complex financial concepts more effectively. The image above illustrates various aspects of business finance, serving as a fantastic resource to supplement your learning experience in a small business finance online course.

The Role of Financial Ratios

Understanding key financial ratios is crucial for analyzing your business’s performance. Courses will often cover financial ratios such as liquidity ratios, profitability ratios, and leverage ratios. Knowing how to compute and interpret these can help business owners make strategic decisions.

Learning From Real-World Case Studies

Online courses often incorporate real-world case studies that provide practical applications of financial theories. Engaging with these examples can enhance your understanding of small business finance and prepare you for real challenges you may face.

Networking Opportunities through Online Learning

Another significant advantage of small business finance online courses is the opportunity to connect with peers and industry experts. Networking can lead to mentorship opportunities, partnerships, and sharing of best practices.

The Future of Small Business Finance Education

As the landscape of business continues to evolve, so do the methods of teaching finance. Future-oriented courses will likely integrate technology, such as artificial intelligence and data analytics, to provide a modern approach to learning finance.

Flexibility to Fit Every Schedule

Many online courses are designed with the busy entrepreneur in mind. Whether you prefer to study in the early morning or late at night, a small business finance online course can fit around your commitments.

Choosing the Right Course for You

With the plethora of options available online, choosing the right small business finance online course can be challenging. Look for courses that offer:

- Accreditation: Ensure the program is recognized in the industry.

- Comprehensive Curriculum: Check that the course covers all essential topics.

- Positive Reviews: Seek feedback from past participants to gauge effectiveness.

Incorporating What You Learn into Your Business

Attending a small business finance online course is just the beginning. The real challenge lies in applying the knowledge gained. Consider creating a financial strategy that encompasses all aspects you’ve learned, from budgeting to cash flow management. By implementing these strategies, you can steer your business towards success.

Frequently Asked Questions about Small Business Finance Online Courses

It’s common for prospective students to have queries about such courses. Here are some of the most frequently asked questions:

- How long does it take to complete an online course? Course lengths vary, but many can be completed in a few weeks to a few months.

- Will I receive a certificate upon completion? Most accredited courses offer a certificate that can enhance your resume.

- Is financial experience necessary to enroll? While prior experience can be helpful, many courses cater to all skill levels.

The Final Takeaway

Investing in your education through a small business finance online course is a step towards ensuring the longevity and success of your enterprise. Armed with the right knowledge and skills, you can navigate the complexities of finance and position your business to achieve its goals. Embrace the power of learning, and remember that every great entrepreneur started by seeking to understand their business’s financial landscape.