Are you looking to dip your toes into the world of investing but are unsure where to start? You’re not alone! Many beginners are eager to know more about short term investment options that can yield quick returns without a hefty commitment. In this article, we will explore various avenues you can consider, tips to navigate this journey effectively, and how to ensure your investments are aligned with your financial goals. Let’s embark on this exciting adventure of short term investing together!

What are Short Term Investment Options for Beginners?

Short term investments are typically defined as investment vehicles that you hold for less than a year. There are numerous short term investment options available, making it easier for beginners to choose investments that suit their financial status or comfort level. These instruments often offer liquidity, meaning you can easily convert them to cash when needed, which is ideal for beginners still finding their footing in the investment world. Some popular choices include high-yield savings accounts, certificates of deposit (CDs), money market accounts, and treasury bills. Now, let’s break these down further to help you understand.

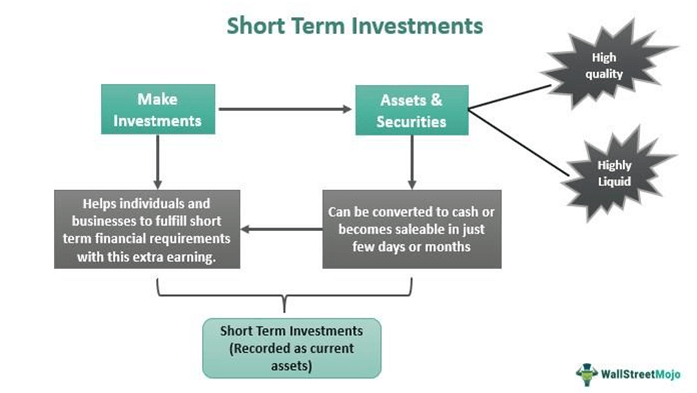

A Visual Guide to Short Term Investments

This visual guide offers a comprehensive overview of the different types of short term investments available. It’s important to understand each option in order to make informed decisions that align with your financial goals.

High-Yield Savings Accounts

One of the safest short term investment options for beginners is a high-yield savings account. These accounts typically offer interest rates significantly higher than traditional savings accounts, allowing your cash to grow without taking on too much risk. The best part? You can usually access your money whenever you need it, meaning it’s an excellent place to stash your cash while pursuing other investment opportunities. It’s a great way to begin understanding how interest accrues over time while you familiarize yourself with the overall market.

Certificates of Deposit (CDs)

Certificates of Deposit represent another solid choice for short term investment options for beginners. CDs offer a fixed interest rate over a specified term (which can range from a few months to several years). The catch? You’ll face a penalty if you withdraw your money before the CD matures. However, they are generally considered very safe, making them ideal for those wary of higher-risk investments. Plus, when you understand how interest rates are set, you can better select CD terms that meet your financial needs.

Money Market Accounts (MMAs)

Another option to consider in your journey of understanding short term investment options for beginners is a money market account (MMA). An MMA provides a hybrid solution that merges the features of checking and savings accounts. They often yield higher interest than regular savings accounts and give you access to funds via checks or debit cards. This added accessibility can be beneficial for managing your cash flow while still earning some interest. It allows for flexibility as you experiment with your investment strategies.

Exploring More Short Term Investment Options for Beginners

While the options above are foundational, there are other avenues you can explore! Look into index funds and exchange-traded funds (ETFs) that focus on short term investments. These funds often consist of a mix of securities, allowing you to diversify your portfolio without having to purchase individual stocks.

Treasury Bills

For those who prefer a low-risk option backed by the government, treasury bills (T-bills) are a great fit. T-bills are sold at a discount from their face value, and when they mature, you receive the full face value. The difference between the purchase price and the face value reflects your earnings. They’re easily accessible and provide solid security, perfect for novice investors looking to minimize risk as they begin their investing journey.

Peer-to-Peer Lending

If you’re open to more innovative solutions, consider peer-to-peer lending platforms as short term investment options for beginners. This allows you to lend money directly to individuals or small businesses through a platform that connects borrowers with investors. While this method offers potentially high returns, you must also consider the risks involved, including borrower defaults. Investing in several loans can help spread out your risk.

Strategies for Starting with Short Term Investments

Diving into short term investment options for beginners may seem overwhelming, but having a solid strategy in place makes it more manageable. Here are some strategies to consider:

- Set Clear Financial Goals: Before investing, define what you’re hoping to achieve in the short term. Are you saving for a vacation, a new car, or an emergency fund? Clarity will guide your choices.

- Educate Yourself: Research various investment options and stay informed on the financial market. Knowledge is power!

- Diversify Your Portfolio: Don’t put all your eggs in one basket! Spread your investments across different asset classes to mitigate risks.

- Monitor Your Investments: Keep track of how your investments are performing and adjust your strategy as needed. Being hands-on can lead to better results.

The Importance of Risk Management in Short Term Investments

One of the critical aspects of successfully managing short term investment options for beginners is understanding risk. Risk is an inherent part of investing, no matter the timeframe. To safeguard your investments, you must recognize your risk tolerance and diversify accordingly. Engaging in risk management doesn’t mean avoiding risk altogether; rather, it means making informed choices that align with your financial situation and personal comfort level.

Evaluating Your Risk Tolerance

Before delving into short term investments, assess how much risk you’re willing to take. Beginners should lean towards safer options while they build confidence and experience in their investment journey. As you gain knowledge, you can gradually expand your horizons and explore riskier investments that could provide higher returns.

Know When to Adjust Your Strategy

Financial markets are dynamic, and staying flexible in your investment approach is crucial. Monitor market trends and adjust your strategy when necessary. This adaptability can significantly enhance your potential for success.

Conclusion

Starting your investment journey can be exciting and intimidating all at once, especially when it comes to short term investment options for beginners. Remember, the key is to prioritize education, practice responsible risk management, and align your investments with your goals. Don’t shy away from seeking advice and utilizing resources available to you. With time and effort, you can navigate the world of investing like a pro. Happy investing!