Understanding economic terms is crucial for making informed decisions, whether you’re a policymaker, business owner, or average consumer. One of the most significant terms in economics is “recession.” In this article, we will explore the concept of recession, defining what it is, its causes, implications, and how it can be recognized in various economic indicators. Understanding recessions will empower you to better navigate the economic landscape and anticipate potential changes that could affect your finances.

Recession: Definition and Overview

A recession is commonly defined as a significant decline in economic activity that lasts for an extended period, typically visible across various sectors of the economy. Economists often identify a recession when the gross domestic product (GDP) falls for two consecutive quarters. However, there are additional factors and indicators that can signal a recession’s onset, such as rising unemployment rates, declining consumer confidence, and decreases in retail sales.

Recognizing a Recession: Definition of Indicators

To effectively identify a recession’s onset, it is essential to understand the key economic indicators that signal a downturn. Here are some of the most prominent indicators:

- Gross Domestic Product (GDP): A prolonged decrease in GDP is one of the clearest signs of a recession. Analysts examine quarterly and annual GDP growth rates to assess economic performance.

- Unemployment Rates: Rising unemployment is another critical indicator. During a recession, businesses often reduce their workforce to cut costs, resulting in higher unemployment rates.

- Consumer Spending: Consumer confidence tends to decline during recessions, leading to reduced consumer spending. This decline impacts businesses, which may respond by slowing production or laying off workers.

- Retail Sales: A consistent decrease in retail sales can indicate that consumers are becoming more conservative with their spending due to economic uncertainty.

- Manufacturing Activity: A decrease in manufacturing output can signal a downturn as businesses adjust to falling demand for goods and services.

Implications of a Recession: Definition of Effects on Society

The societal effects of a recession can be profound and widespread. Here are some of the critical implications that can arise during such economic downturns:

Economic Impact on Households

For individual families, a recession often means tighter financial constraints. Job losses and reduced job security contribute to increasing stress and anxiety among households. The decline in disposable income forces families to cut back on non-essential expenses, which ultimately impacts local businesses.

Business Challenges

Businesses face numerous challenges during a recession. As consumer spending declines, companies may experience reduced revenues, leading them to implement cost-cutting measures such as wage freezes, layoffs, or even closures. This situation creates a vicious cycle where the economic downturn exacerbates unemployment, further reducing consumer demand.

Governmental and Policy Responses

Governments often respond to recessions with various monetary and fiscal policies aimed at stimulating the economy. Lowering interest rates, offering bailouts to struggling industries, and implementing stimulus packages are common measures designed to alleviate the impacts of recession and promote economic growth.

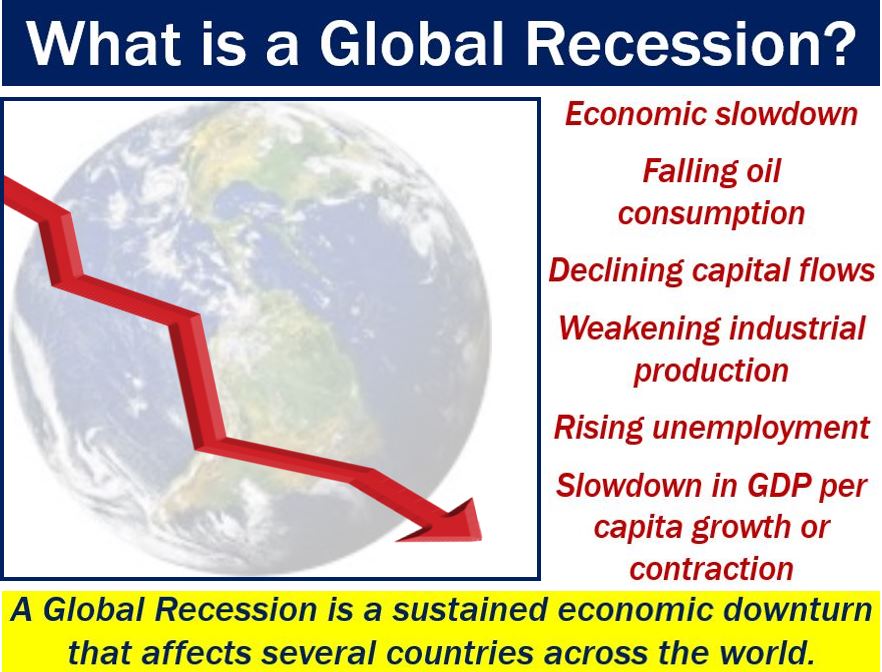

Visual Representation of Recession

Understanding Recession: Definition in Visual Context

This illustration provides a visual representation of recession, highlighting key dynamics and impacts on various economic factors. Understanding the definition of recession can aid in recognizing its effects on the broader economy.

Historical Context: Recession: Definition and Examples

Throughout history, economies around the world have experienced recessions. Notable examples include the Great Depression of the 1930s and the Great Recession of 2007-2009. In both cases, a combination of adverse economic factors, such as market crashes, banking failures, and decreases in consumer confidence, resulted in severe economic downturns impacting millions of people.

The Great Depression

The Great Depression was one of the most devastating economic downturns in modern history, marked by a 25% unemployment rate in the United States at its peak. It began with the stock market crash of 1929 and led to widespread poverty, widespread bank failures, and a significant drop in consumer spending. The global impact was felt for many years, leading to changes in economic policy and the way governments respond to economic crises.

The Great Recession

More recently, the Great Recession, which began in 2007, was triggered by the collapse of the housing market and the subsequent financial crisis. Many banks faced insolvency due to bad mortgage-backed securities, leading to an economic downturn that lasted until the early 2010s. The effects were profound, with millions losing jobs and homes, heavy governmental intervention in the banking sector, and the introduction of new regulations aimed at preventing a similar crisis in the future.

Staying Informed: Recession: Definition and Current Trends

As we navigate our current economic landscape, staying informed about potential signs of recession can empower individuals and businesses alike. By monitoring key economic indicators, engaging with trusted news sources, and utilizing economic forecasting tools, you can better prepare for potential downturns.

Economists are continually analyzing data, assessing trends, and developing models to predict future economic conditions. While no one can perfectly forecast when a recession may occur, being proactive and informed can help mitigate potential negative impacts on personal financial stability.

Conclusion: Preparing for a Possible Recession

In summary, understanding the concept of recession and its defining characteristics is essential for navigating the ever-changing economic landscape. By recognizing the critical indicators, implications for households and businesses, and historical context, you can better prepare yourself for potential future economic challenges.

As we move forward, remember that economic cycles are natural occurrences within market economies. Being equipped with knowledge will not only help you understand the complexities of recessions but also prepare you to respond effectively, enhancing your resilience during uncertain times.