Managing personal finances is a critical aspect of achieving financial stability and independence. One of the most effective tools to help individuals assess their financial health is a personal financial report. This document provides a detailed overview of an individual’s financial situation, outlining assets, liabilities, income, and expenses. By utilizing a personal financial report example, individuals can make informed decisions about budgeting, saving, and investing.

Understanding the Personal Financial Report Example

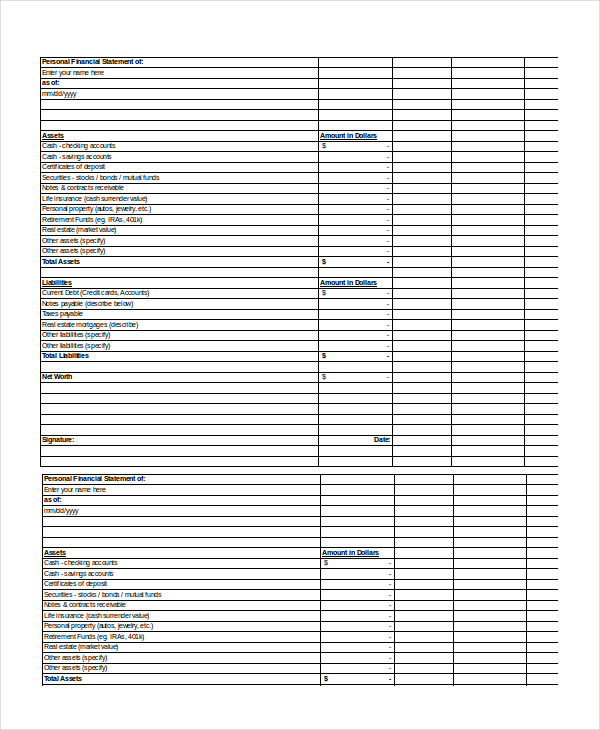

A personal financial report example serves as a blueprint for individuals looking to monitor their financial status. It typically includes sections for categorizing assets, outlining liabilities, detailing income streams, and tracking expenses. When created regularly, this report can highlight trends and help in financial forecasting.

Components of a Personal Financial Report Example

A comprehensive personal financial report will generally contain the following sections:

- Assets: This section lists all owned items of value, including cash, investments, property, and personal belongings.

- Liabilities: Here, individuals can document debts such as mortgages, credit cards, and loans.

- Net Worth: Calculated by subtracting total liabilities from total assets, this figure provides a snapshot of financial health.

- Income: This part details all sources of income, including salaries, investment returns, and any side earnings.

- Expenses: Tracking monthly or yearly expenses helps individuals understand their spending habits and necessary adjustments.

Visual Representation of a Personal Financial Report Example

Illustrative Personal Financial Report Example

The image above illustrates a well-structured personal financial report template that many individuals can adapt to their specific needs. Note how each section is logically organized to ensure clarity and ease of use. Utilizing such templates can significantly streamline the process of tracking and managing finances.

Implementing a Personal Financial Report Example in Your Life

Once the components of a personal financial report have been laid out, the key is to implement them into a regular financial review process. This can be effectively done at the end of each month or quarter. Here are a few steps to follow:

- Gather Documentation: Collect all necessary financial documents, such as bank statements, investment records, and receipts.

- Update Your Report: Input new information into your financial report, adjusting for any changes in income or expenses.

- Analyze Trends: Look for trends in your financial situation. Are you spending more in certain areas? Is your net worth increasing or decreasing?

- Set Goals: Based on your analysis, establish clear financial goals that can guide future budgeting and investing decisions.

Benefits of Using a Personal Financial Report Example

The usage of a personal financial report example provides several advantages including:

- Clarity: It prompts individuals to clearly see where they stand financially.

- Accountability: Regular updates ensure accountability in managing spending habits.

- Informed Decision Making: Having a clear financial picture allows for smarter investment and budgeting decisions.

- Goal Setting: The ability to set and measure progress towards financial goals.

- Preparation for Emergencies: By clearly understanding financial stability, individuals can better prepare for unforeseen circumstances.

Examples of Utilizing a Personal Financial Report Example for Major Life Events

There are specific life events where having an updated personal financial report can significantly impact decision-making. Here are a few:

- Buying a House: When considering the purchase of real estate, knowing your net worth and financial obligations is crucial for evaluating what you can afford.

- Planning for Retirement: A personal financial report can provide insights into whether you’re on track for retirement and what adjustments are necessary to meet savings goals.

- Educational Expenses: Understanding your financial position can help in planning for significant expenses like college tuition or other education-related costs.

- Investment Opportunities: A clear view of your finances can lead to better-informed investment decisions and readiness to take action when opportunities arise.

Making Adjustments Based on Your Personal Financial Report Example

Once you have compiled your personal financial report, it’s important to translate that information into action. Here are a few recommendations:

- Budgeting: Create a realistic budget that prioritizes necessities while allowing for savings and discretionary spending.

- Adjusting Spending Habits: Identify areas where expenses can be reduced without sacrificing quality of life. This may involve canceling unused subscriptions or dining out less frequently.

- Increasing Savings: Use the insights gained from the personal financial report to boost your savings rate and build an emergency fund.

- Debt Management: Develop a strategy for tackling high-interest debt, such as credit cards, which can significantly impact long-term financial health.

Conclusion: The Importance of a Personal Financial Report Example

In conclusion, utilizing a personal financial report example is an invaluable practice for anyone looking to gain control over their financial situation. By keeping this report up-to-date and reviewing it regularly, individuals can make informed decisions that lead to more stable financial outcomes. Whether you’re planning for retirement, preparing for a major purchase, or simply trying to manage your everyday expenses, a well-crafted personal financial report can pave the way for achieving your financial goals.

Establishing a routine that incorporates the evaluation of a personal financial report will ensure you remain financially aware and capable of navigating life’s financial challenges with confidence. Start creating your own report today and take the first step towards achieving your financial aspirations!