Managing your finances can often feel overwhelming, especially with the countless expenses we face every day. However, utilizing a personal finance excel dashboard can simplify the process and help you stay on track with your budgeting, spending, and savings goals. In this article, we will explore the various components of a personal finance excel dashboard and how it can transform the way you approach your finances.

What is a Personal Finance Excel Dashboard?

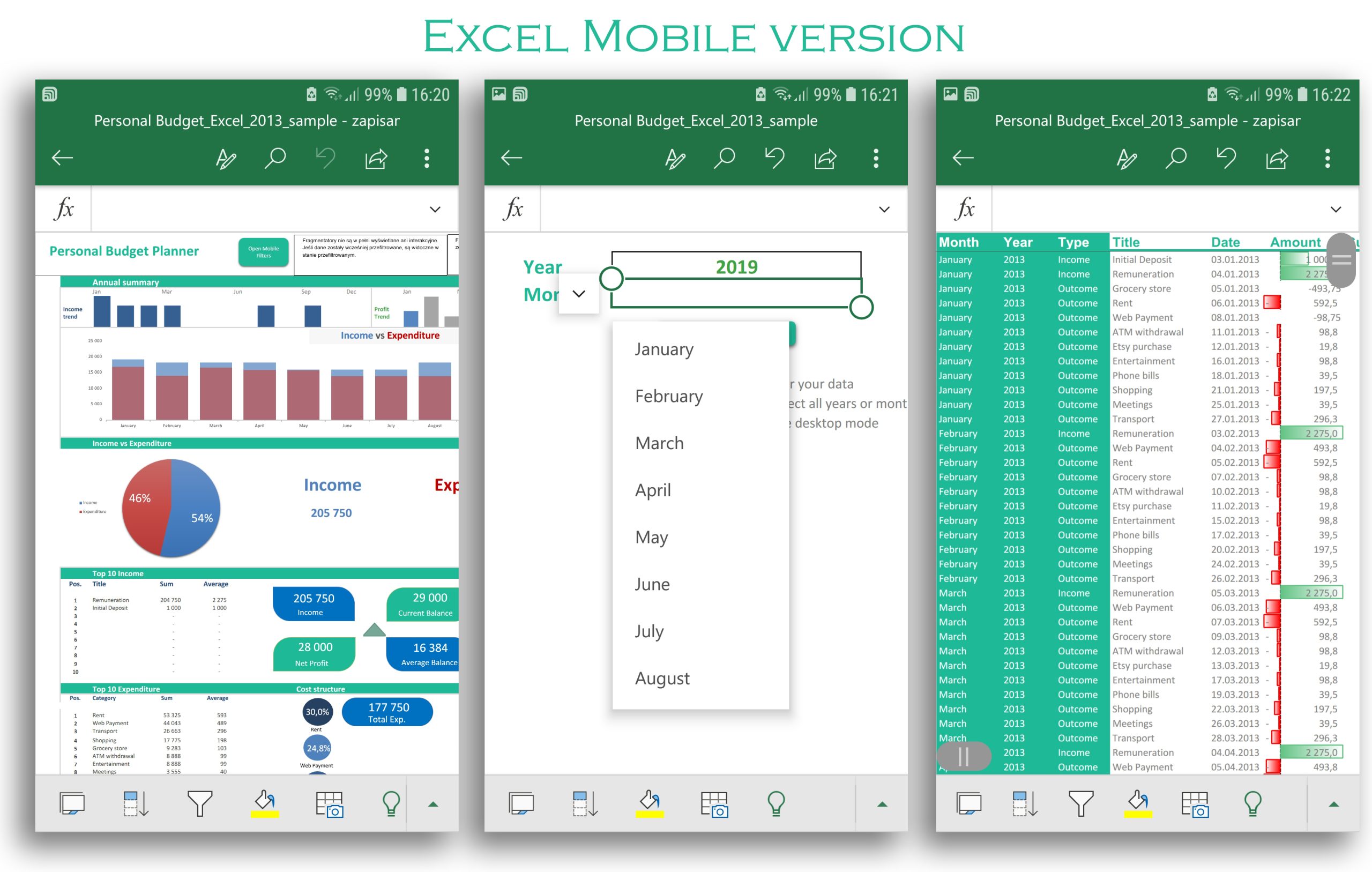

A personal finance excel dashboard is a powerful tool designed to help individuals and families manage their financial health effectively. It provides a comprehensive view of your income, expenses, and overall financial performance in a user-friendly and visually appealing format. By integrating various financial metrics and data points, such as your monthly income, fixed and variable expenses, and savings, this dashboard serves as a roadmap for achieving your financial goals.

Benefits of Using a Personal Finance Excel Dashboard

One of the most significant benefits of employing a personal finance excel dashboard is the level of clarity it brings to your financial situation. Often, people struggle to understand where their money goes each month, which can lead to unnecessary stress and poor financial decisions. With a well-structured dashboard, you can easily identify spending patterns, set budgetary limits, and track your progress toward your financial goals.

Moreover, a personal finance excel dashboard allows you to visualize your spending habits over time. This visual representation can serve as a powerful motivator. For instance, seeing how much you spent in a particular category or how your savings have grown can prompt you to make more conscious spending choices. It’s also helpful for anyone looking to take control over their finances, from students managing their limited budgets to families saving for a new home.

Key Features of a Personal Finance Excel Dashboard

When creating or evaluating a personal finance excel dashboard, several key features can enhance its effectiveness. Here are some aspects to consider:

- Income Tracker: This section should allow you to input various sources of income, whether from your job, freelance work, or other investments. Tracking your income is essential for understanding your cash flow.

- Expense Categories: Organizing expenses into categories (e.g., groceries, utilities, entertainment) lets you see where your money is going. This categorization helps identify areas where you can cut back.

- Budgeting Tools: Incorporating budgeting tools enables you to set limits for each category and compare actual spending against your budget.

- Graphs and Charts: Visual components like pie charts and bar graphs can offer an enticing snapshot of your financial health, making it easier to digest the information at a glance.

How to Create Your Personal Finance Excel Dashboard

Creating your personal finance excel dashboard doesn’t have to be complicated. Below are steps to guide you through the process:

- Gather Your Financial Information: Start by collecting data regarding your income and expenses. This may include past bank statements, bills, and income statements.

- Choose Your Categories: Define categories for income and expenses. Make sure your categories are as detailed as necessary to give you a clear understanding of your finances.

- Set Up Your Excel Spreadsheet: Start by creating a new sheet in Excel. Label your categories across the top and include a total row to calculate sums.

- Add Formulas: Use Excel’s formula capabilities to automate total calculations for income and expenses. This will save you time and reduce errors.

- Visualize Your Data: Create graphs and charts from your data. Utilizing Excel’s data visualization features can help you monitor your financial behavior easily.

Utilizing a Personal Finance Excel Dashboard for Goal Setting

A personal finance excel dashboard is an excellent tool for setting and tracking financial goals. Whether you want to save for a vacation, pay off debt, or build an emergency fund, your dashboard can help keep you accountable. By setting specific savings targets and utilizing the dashboard to monitor your progress, you’ll be more motivated to stick to your plans and make necessary adjustments as needed.

Tips for Staying on Track with Your Personal Finance Excel Dashboard

1. **Regular Updates**: Make it a habit to update your dashboard regularly. Whether you do this weekly or monthly, keeping your data fresh will ensure you have an accurate picture of your finances.

2. **Review Your Goals**: Periodically revisit your financial goals. Are they still relevant? Are you progressing toward them? If not, see what adjustments you can make.

3. **Seek Help When Needed**: If you find maintaining your dashboard overwhelming, don’t hesitate to seek guidance or assistance. Financial coaches and advisors can provide priceless insights.

Incorporating Technology with Your Personal Finance Excel Dashboard

While a personal finance excel dashboard is an excellent manual tool for tracking your finances, there are numerous software and apps available that can streamline this process even further. Some individuals prefer using online tools or apps that automatically sync with their bank accounts, providing real-time data and updates. However, the beauty of an Excel dashboard lies in its customization. You can tailor it exactly to your needs, allowing for the unique categories and metrics that matter most to you.

Personal Finance Dashboard: A Lifestyle Change

Implementing a personal finance excel dashboard can be more than just a budgeting tool; it can lead to a complete lifestyle shift towards financial awareness and responsibility. As you begin to track your spending and monitor your habits, you’ll likely find that your spending patterns and priorities begin to shift. You may choose to cut back on impulsive purchases or invest more in your savings goals, ultimately leading to improved financial security and peace of mind.

Celebrating Your Financial Success

As you work through the process of managing your finances with a personal finance excel dashboard, remember to celebrate your successes, no matter how small. Each step toward better financial health is a victory. Whether you’ve successfully reduced your spending in a particular category or reached a savings milestone, taking the time to acknowledge your progress can motivate you to continue on your financial journey.

Conclusion: Embrace the Personal Finance Excel Dashboard

Embracing a personal finance excel dashboard can be a game-changer for anyone looking to enhance their financial management strategies. Whether you’re just starting out on your financial journey or are looking to refine your current practices, this tool can provide invaluable insights into your financial health. By staying organized, setting clear goals, and regularly updating your dashboard, you’ll be well on your way to achieving financial peace.

So, are you ready to take control of your finances? Start utilizing a personal finance excel dashboard today and watch how it transforms your financial landscape!

Visual Representation of Your Finances

This visual representation is a simple yet effective way of understanding how your finances are laid out within your personal finance excel dashboard. A clear dashboard can guide you toward more informed financial decisions, better budgeting practices, and ultimately lead to the achievement of your financial aspirations.