If you’re considering managing your finances more effectively and want to secure your savings, one of the best steps you can take is to open a Commonwealth Bank savings account. Despite the numerous banking options available, a savings account offers you the security and ease of access to your funds that other accounts may not provide. This guide will walk you through the advantages, eligibility criteria, application process, and tips for maximizing your new savings account. Let’s dive in!

Why You Should Open a Commonwealth Bank Savings Account

Every savvy saver knows the importance of picking the right bank to entrust their hard-earned money. Commonly, consumers are drawn to banks based on their interest rates and account features. When you choose to open a Commonwealth Bank savings account, you’re opting for convenience, safety, and competitive benefits that maximize your savings potential. With a well-established bank like Commonwealth Bank, you gain access to numerous financial services that support your savings goals.

Benefits of a Commonwealth Bank Savings Account

Opening a Commonwealth Bank savings account comes with a host of advantages that can significantly enhance your financial journey. Here are some highlights:

- High-Interest Rates: Unlike regular checking accounts, saving accounts from Commonwealth Bank generally offer higher interest rates, meaning you earn more on your deposits.

- Accessibility: With online and mobile banking, you can easily manage your account from anywhere, making it simpler to track your savings progress.

- Financial Security: Commonwealth Bank offers a secure banking environment to protect your funds against unauthorized access.

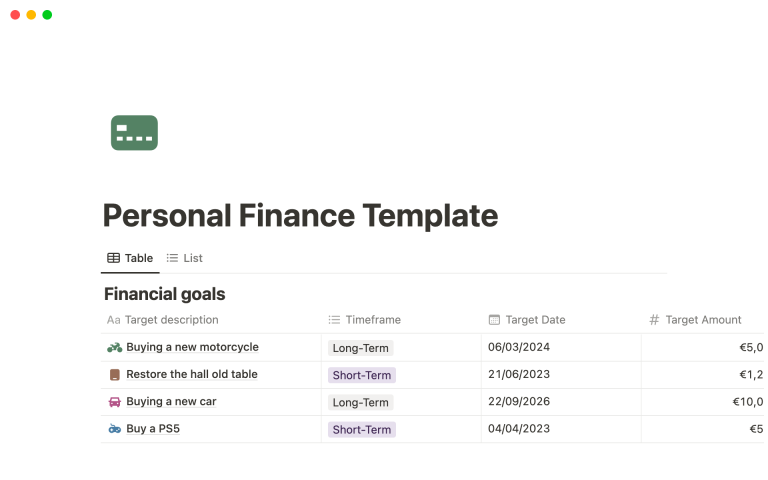

- Goal Setting: Integrated tools allow you to set and achieve your savings goals, prompting more intentional financial decisions.

How to Open a Commonwealth Bank Savings Account

Now that you’re aware of the benefits, let’s discuss how you can officially get started by opening a Commonwealth Bank savings account. The process is simple, straightforward, and can be completed online or in person.

Step 1: Check Your Eligibility

Before proceeding, it’s essential to ensure you meet the eligibility criteria. The standard requirements include:

- Being an Australian resident.

- At least 16 years of age; younger applicants may require a guardian.

- Proof of identity, often requiring a driver’s license or passport.

Step 2: Prepare Your Documents

To expedite the process, gather the relevant documents beforehand. This will typically include:

- Identification documents.

- Proof of address, such as a utility bill or lease agreement.

- Tax File Number (TFN) to avoid higher withholding tax on interest earned.

Application Process to Open a Commonwealth Bank Savings Account

With your eligibility confirmed and documents prepared, you’re now ready to proceed to the application stage. The Commonwealth Bank offers two methods to apply: online or over the counter.

Online Application

Applying online is quick and efficient. Here’s how:

- Visit the official Commonwealth Bank website.

- Select the specific type of savings account you wish to open.

- Fill out the online application form with your personal details and attach the necessary documents.

- Submit your application and wait for a confirmation email.

In-Person Application

If you prefer a personal touch, you can visit any Commonwealth Bank branch. Simply request assistance from a bank representative, who will guide you through the application process and help you with any questions you may have.

Your Guide to Setting Up a Savings Account

Once your application is successfully processed, you will receive your account details through email or via a personal interaction at the bank. Make sure to remember these details to manage your account effectively.

Tips for Maximizing Your Commonwealth Bank Savings Account

Opening a Commonwealth Bank savings account is just the first step; now, you’ll want to ensure you get the most out of your account. Here are some actionable tips:

1. Set Clear Savings Goals

Determine what you’re saving for—be it a vacation, emergency fund, or a future investment. This clarity can motivate you to save consistently.

2. Automate Your Savings

Consider setting up automatic transfers from your checking account to your savings account. This strategy makes saving effortless and ensures you consistently contribute to your savings goals.

3. Take Advantage of Promotions

Keep an eye out for promotional offers from Commonwealth Bank that may increase your interest rates or provide bonuses for reaching certain savings milestones.

Conclusion: Make the Most of Your Savings Journey

Now that you understand how to open a Commonwealth Bank savings account and the benefits of doing so, it’s time to take control of your financial future. By following the steps outlined above, you can better position yourself to grow your savings effectively. Remember, the sooner you start saving, the closer you’ll get to achieving your financial objectives.

Your financial journey begins today—take the plunge into a world of savvy savings! Be sure to revisit this guide often and maintain a proactive approach to managing your funds.