Money management is an essential skill that every young person should master. In today’s fast-paced world, the ability to manage finances effectively can set the foundation for a successful future. From budgeting to saving, understanding the principles of money management can equip youth with the tools they need to make informed financial decisions. Whether they are preparing for college, starting a job, or considering their long-term financial goals, young people can greatly benefit from learning money management strategies.

Why Money Management for Young People is Crucial

In an era where financial literacy is more important than ever, young people need to understand the significance of money management. By learning these vital skills early, they lay the groundwork for a secure financial future. Budgeting, saving, and investing are just a few of the concepts that can help transform their approach to money.

Foundational Skills in Money Management for Young People

Before diving into specific strategies, it’s important to establish some foundational skills that young people should focus on when it comes to money management. Here are a few key areas:

- Budgeting: Understanding how to create and stick to a budget is essential. Young people should learn how to track their income versus expenses to ensure they live within their means.

- Saving: The habit of saving money from an early age can lead to financial security later in life. Setting specific savings goals can make this process more manageable and rewarding.

- Understanding Credit: It’s never too early to learn about credit scores, interest rates, and how to maintain good credit. These factors play a significant role in future financial opportunities, such as loans and mortgages.

Engaging with Money Management for Young People

It’s important to make the learning process engaging and relevant for young people. Here are a few methods that can help make money management lessons fun and applicable to their lives:

Interactive Workshops and Seminars

Participating in workshops or seminars that focus on money management can provide young people with hands-on experience and real-world examples. Educators can incorporate role-playing scenarios that help participants practice budgeting for events or planning for spending while on a trip.

Games and Competitions

Gamifying financial education can encourage young people to learn more about money management while having fun. Establish competitions to see who can create the best budget or who can save the most money in a month. These activities not only teach skills but also foster a sense of community among participants.

Visual Learning Aids for Money Management for Young People

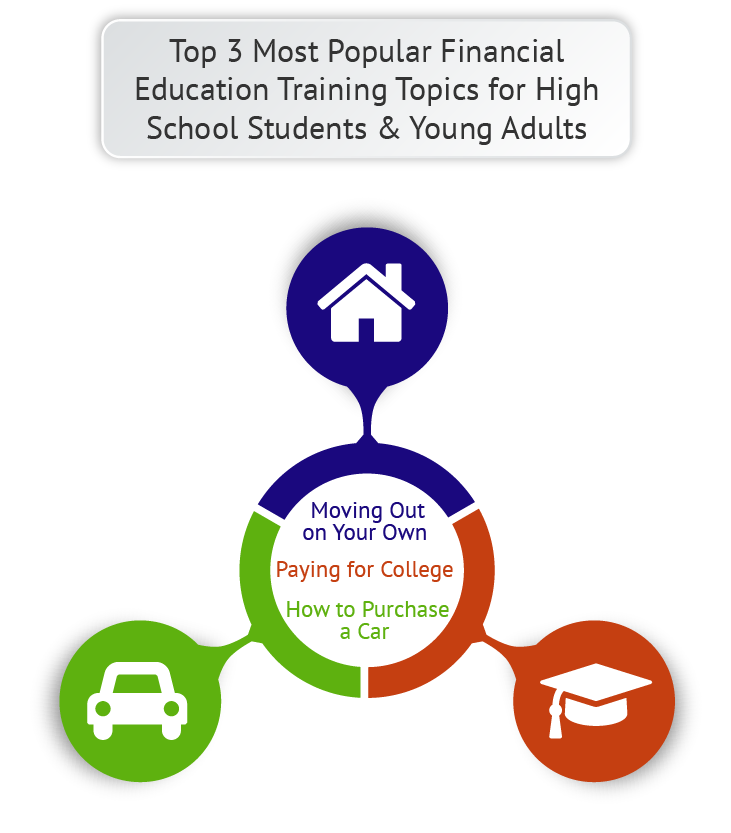

Visual aids play a vital role in understanding complex concepts. Utilizing engaging graphics can make the lesson more memorable. One such example is illustrated below:

Illustration of Money Management Strategies

This infographic outlines best practices for youth money management and serves as a great conversation starter in any educational setting. Utilizing visual tools can help young individuals remember key takeaways and apply them in real life.

Goal Setting: The Path to Financial Success for Young People

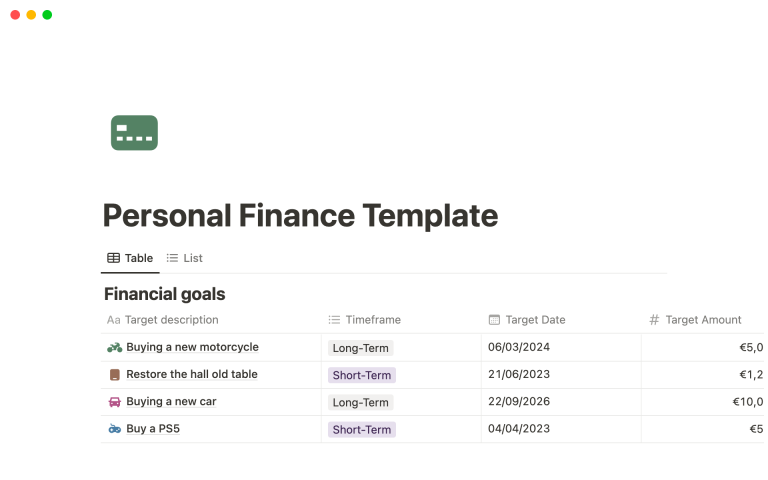

Goal setting is pivotal in managing money wisely. By setting clear and measurable goals, young people can better focus their efforts towards achieving financial milestones. These goals can range from saving for a new phone to understanding the importance of investing for the long-term.

Creating SMART Goals

Encouraging young people to create SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals can help them stay on track with their financial plans. For example, a young person might set a goal to save $500 for a laptop in one year by putting away a certain amount each month.

Accountability and Support Systems

Creating an environment where young people can hold each other accountable for their financial goals can also be beneficial. Mentorship programs or peer support groups can provide additional resources and encouragement, making the journey of learning about money management much less daunting.

Practical Tips for Money Management for Young People

To further enrich their understanding, here are some practical tips that young people can implement right away:

- Create a Monthly Budget: Start by tracking all income sources and expenditures to understand spending patterns better. Adjust the budget based on needs and goals.

- Open a Savings Account: Encourage young people to open a savings account if they haven’t already. This simple action can help them manage money more effectively and encourage savings habits.

- Educate About Responsible Spending: Discuss the importance of making informed purchasing decisions and discerning needs versus wants.

- Explore Investment Basics: Introduce concepts like stocks, bonds, and mutual funds. Understanding these topics at a young age will better prepare young individuals for future financial endeavors.

The Role of Technology in Money Management for Young People

In this digital age, technology plays a significant role in enhancing financial literacy among young people. There are numerous apps and online tools designed to assist individuals in tracking their spending, setting budgets, and even learning about investing. Here are a few examples:

- Budgeting Apps: Applications like Mint or YNAB (You Need A Budget) can provide young individuals with an easy-to-use platform to manage their finances.

- Financial Education Games: Several interactive platforms gamify the learning of financial concepts, making it relatable and interesting for young users.

- Investment Simulators: These tools allow young people to simulate the stock market experience, providing them with a taste of real-world investing without any financial risk.

By exploring these tech-driven resources, young people can develop a more profound understanding of money management that combines traditional principles with modern approaches.

Conclusion: Building a Bright Financial Future for Young People

In conclusion, the earlier young people acquire money management skills, the better prepared they will be for the financial challenges that lie ahead. Through engaging educational techniques, practical advice, and the integration of technology, we can ignite their interest in finance and empower them to make informed economic choices. With the right guidance, the youth of today are set to become the financially savvy leaders of tomorrow!