In today’s fast-paced world, managing your finances has never been more critical. With a plethora of expenses vying for our attention, having a clear strategy can make all the difference. One effective tool that has gained popularity recently is the money management sheet xlsx. This template enables users to visualize their finances, making it easier to track spending, budgeting, and financial goals. In this article, we’ll explore various aspects of money management and how using a dedicated sheet can elevate your financial management strategy.

Why You Need a Money Management Sheet XLSX

In the realm of financial literacy, having a structured plan is crucial. Without a dedicated money management sheet xlsx, many individuals find themselves overwhelmed by their financial activities. Here are a few reasons why incorporating this spreadsheet in your financial planning is a smart choice:

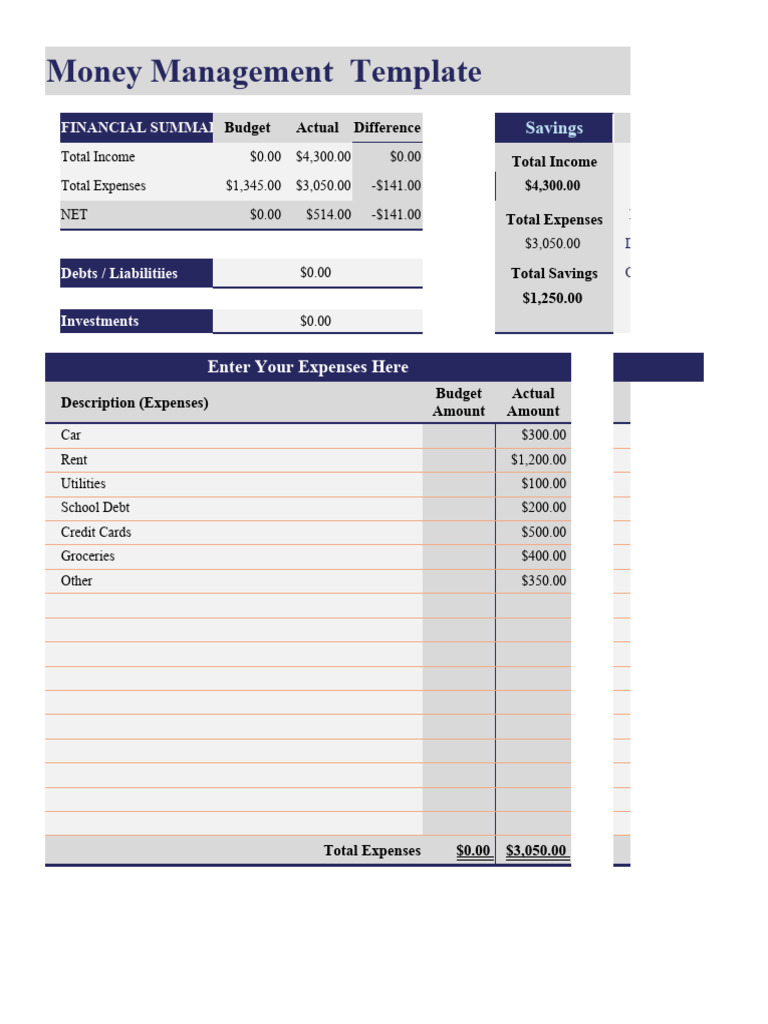

– **Visual Representation of Finances**: A money management sheet xlsx allows you to, quite literally, see where your money goes. This visual representation can bring clarity and help identify areas where you might be overspending.

– **Budget Planning**: One of the significant benefits of using these templates is the ability to set a budget and stick to it. By allocating funds to various categories (like food, rent, entertainment, etc.), you are more likely to adhere to your financial limits.

– **Goal Setting**: Do you have specific financial goals in mind? Whether saving for a vacation, a new gadget, or building an emergency fund, a money management sheet xlsx can help you track your progress.

Creating Your Own Money Management Sheet XLSX

Developing a personalized money management sheet xlsx might seem daunting, but it can be relatively straightforward. Here’s how to get started:

1. **Open Excel**: If you have Microsoft Excel, this will be your primary tool. Alternatively, feel free to use Google Sheets or any other similar software.

2. **Define Categories**: Create a column for your income and separate columns for various expenses. Common categories include Housing, Food, Transportation, and Entertainment.

3. **Input Data Regularly**: Each time you spend or earn money, input that data into your excel sheet. Consistency is the key here!

4. **Analyze**: At the end of each month, analyze how well you adhered to your budget. What categories did you overspend in? Where can you cut back?

Where to Find Useful Money Management Templates

If you’re not inclined to create your own from scratch, there are countless resources available to download premade money management sheets. Many sites offer free templates, including:

– **Excel Templates and Articles**: Websites focused on finance often publish blog posts that not only explain the importance of budgeting but also provide downloadable sheets.

– **Community Contributions**: Check out forums and online communities where financial literacy is discussed. Members frequently share their custom templates that you can use or adapt.

Implementing the Money Management Sheet XLSX into Your Routine

After setting up your money management sheet xlsx, the next step is integrating it into your everyday life. Here are practical steps to help with that:

– **Set a Weekly Review**: Dedicate a specific time every week to review your finances. Updating your money management sheet xlsx during this session ensures that you remain aware of your financial situation.

– **Adjust Categories as Needed**: Life changes, and so will your financial habits. If you find specific categories consistently exceed your budget, adjust accordingly to reflect your needs.

– **Seek Accountability**: Share your goals with a trusted friend or family member. They can help keep you accountable and might even join the journey with their own money management sheet xlsx.

Tips for Maximizing Your Money Management Sheet XLSX

To fully utilize your money management sheet xlsx, apply the following tips:

1. **Always Be Honest**: Ensure that you input data accurately. If you overspend, don’t shy away from noting it down; this data is essential for understanding your habits.

2. **Utilize Formulas**: Excel’s built-in formulas can perform calculations for you! Automatically total your expenses and see how you measure up against your budget.

3. **Stay Adaptable**: As mentioned, your financial situation isn’t static. Whether it’s a new job or a family addition, be ready to tweak your sheet to suit your current needs.

Examples of Money Management Sheet XLSX Layouts

Different layouts can serve various purposes. Here are some options to consider:

1. **Basic Layout**: A simple row and column matrix where you track monthly income against expenses.

2. **Detailed Layout**: If you’d like to dive deeper, consider a detailed approach where you track daily expenditures against planned categories.

3. **Visual Charts**: Once you get the hang of data entries, you can create visual aids within your spreadsheet, such as pie charts to represent spending proportions.

The Importance of Data Backup and Security

With all these tips and templates in play, remember that your financial data is sensitive. Here are a few ways to ensure its security:

– **Cloud Backups**: Use cloud services like Google Drive to store your sheet securely and access it from any location.

– **Regular Backups**: Backing up your document frequently ensures that no data will be lost.

– **Password Protection**: If you’re worried about prying eyes, consider password-protecting your document.

Final Thoughts on Money Management Using a Sheet XLSX

Managing your finances doesn’t have to be an uphill battle. By utilizing a money management sheet xlsx, you can ease your stress, gain insight into your spending habits, and set yourself up for financial success. The journey toward better financial health starts with that first entry into your sheet.

For those eager to jump-start their financial journey, consider downloading comprehensive templates that can facilitate the process. An excellent resource for templates can be found at this [link](https://finsage.tech/wp-content/uploads/2025/02/1720476866) – these Excel money management templates offer user-friendly layouts and flexibility to adapt to your financial goals.

Remember, achieving financial stability is a gradual process, and every small step taken today will lead to more significant successes tomorrow!