Managing your personal finances is an essential skill that can impact every aspect of your life. Whether you are a student just starting to gain independence or someone looking to restructure your financial habits, understanding the importance of having control over your finances cannot be overstated. This guide will provide comprehensive insights into developing your proficiency in managing your personal finances. It will specifically focus on the managing your personal finances student activity guide answers to further your understanding and provide clarity when it comes to handling financial tasks and decisions.

Understanding the Basics of Personal Finance

Before exploring the details of the managing your personal finances student activity guide answers, it’s crucial to lay a foundational understanding of personal finance principles. Personal finance encompasses the methods and strategies you employ to budget, save, invest, and spend your money. Understanding these basics will allow you to apply the knowledge you gain from various resources effectively.

The Importance of Budgeting

Budgeting is one of the cornerstones of personal finance. It allows you to plan how to allocate your income and expenses wisely. By setting up a budget, you can track your spending habits and identify areas where you can reduce unnecessary expenses, leading to more savings or investments. Keeping a close eye on your budget will prepare you for unexpected expenses and help you achieve long-term financial goals.

Implementing Savings Strategies

A key component often discussed in the managing your personal finances student activity guide answers includes effective savings strategies. It’s advisable to establish an automatic savings plan where a fixed amount from your income is set aside for savings before addressing any expenses. This approach not only encourages disciplined saving but also nurtures a reserve for emergencies, wants, and future investments.

Exploring Managing Your Personal Finances Student Activity Guide Answers

The managing your personal finances student activity guide answers provide essential insights into practical financial management. By incorporating the responses from these activities into your everyday financial dealings, you can make informed choices that align with your financial goals. The guide also stresses the significance of responsibilities, such as repaying loans and maintaining a good credit score, which can significantly affect your financial journey.

Credit Management

Understanding how to manage credit accounts responsibly is vital. The guide emphasizes the need for reviewing credit reports regularly and understanding the factors that contribute to a good credit score. Maintaining a good credit history can lead to lower interest rates on loans, which can save you significant amounts in the long term. As you go through the managing your personal finances student activity guide answers, pay special attention to how your credit utilization ratio impacts financial health.

Practical Applications of Financial Skills

It is one thing to understand theoretical principles; however, applying these principles to real-life situations is where the true learning happens. Engage with various scenarios outlined in the managing your personal finances student activity guide answers to solidify your understanding. This engagement will empower you to develop practical solutions to common financial dilemmas.

Utilizing Financial Tools

In today’s digital age, there are countless financial management tools available that can assist you in keeping track of your finances. Many of these tools can sync with your bank accounts to provide real-time updates on spending and budgeting. Incorporating these into your financial strategy will complement the teachings in the managing your personal finances student activity guide answers, making it easier to achieve financial stability.

Building an Investment Foundation

Investing is an essential aspect that many overlook in their financial planning. The managing your personal finances student activity guide answers suggest that learning about different investment options is crucial for building wealth over time. Whether you choose to invest in stocks, bonds, or real estate, understanding how these avenues work will position you for success in the long run.

Long-term vs. Short-term Investments

The guide discusses the importance of distinguishing between long-term and short-term investments, emphasizing a mixed approach that aligns with your financial goals. Long-term investments often provide greater returns but require patience, while short-term investments can give quick access to your money. This aspect of managing your finances underscores the need for strategic planning and foresight.

Introducing Financial Literacy Resources

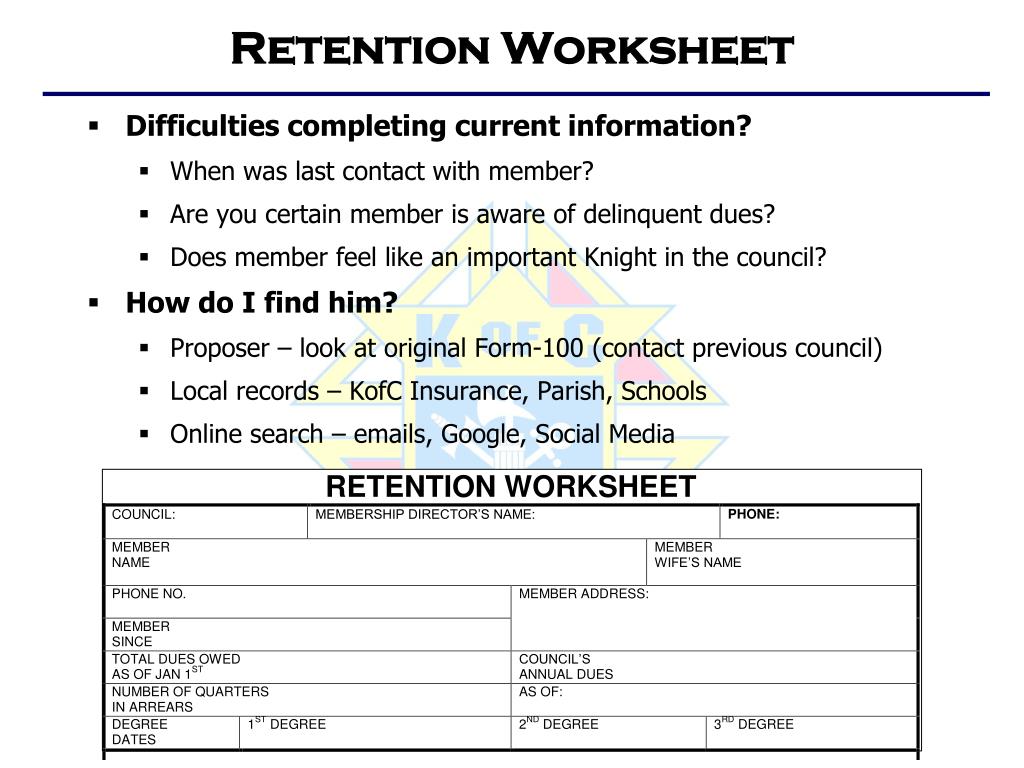

Discovering the Visuals Behind Financial Topics

Visual aids, such as the financial activity worksheet shown in the image above, can be incredibly beneficial to students. They often summarize complex concepts and make learning about personal finance more engaging. The worksheets might include budgeting exercises, savings challenges, and investment simulations designed to bolster practical knowledge acquisition—information relevant to the managing your personal finances student activity guide answers.

The Role of Financial Advisors

At times, navigating financial situations might seem daunting. It’s important to recognize when to seek professional advice. Financial advisors can offer personalized assistance tailored to your situation, guiding you in understanding intricate aspects of personal finance highlighted in the managing your personal finances student activity guide answers.

Developing a Financial Action Plan

With the knowledge and skills gained from studying the managing your personal finances student activity guide answers, you can develop an actionable financial plan. Outline your financial objectives, the steps needed to achieve them, and a timeline for completion. This plan should include budgeting, saving, investing, and strategies for managing debts, allowing you to take control of your finances.

Review and Adjust Your Financial Plan Regularly

Just as life circumstances change, so do financial needs and goals. Regularly reviewing and adjusting your financial plan ensures that you remain aligned with your objectives and can navigate any unforeseen circumstances. Whether it’s a sudden expense or a change in income, staying flexible in your approach is crucial for long-lasting financial health.

Conclusion: Your Journey in Managing Personal Finances

In conclusion, gaining knowledge about personal finance and applying it through the managing your personal finances student activity guide answers can be transformative. By embracing budgeting, savings strategies, and investment opportunities, you pave the way for a secure financial future. It may require effort and discipline, but the rewards of understanding and managing your personal finances are profound. Start today, engage with resources, seek help when necessary, and take charge of your financial destiny.