Managing personal finances can often feel overwhelming. However, with the right tools and resources, you can simplify the process and regain control over your financial situation. One such tool that can be incredibly beneficial is the managing personal finances excel template. This template allows you to organize your income, expenses, and savings effectively, ensuring you can plan for the future. In this article, we will explore the features of this template, share tips on how to utilize it effectively, and outline its benefits in managing your financial goals.

Introducing the Managing Personal Finances Excel Template

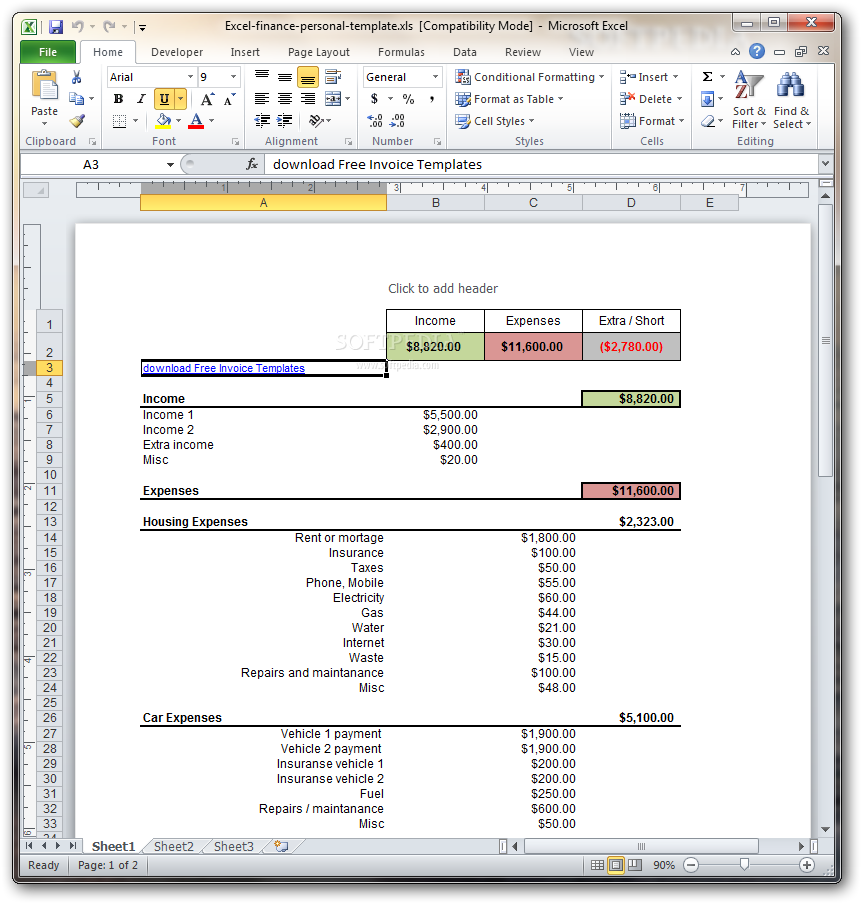

The managing personal finances excel template is designed to help individuals easily track their financial activities and make informed decisions. Whether you’re saving for a vacation, paying off debt, or simply trying to keep within your budget, this template is an invaluable resource. Its user-friendly interface and customizable features allow you to deeply engage with your financial data and adapt to your unique situation. Let’s delve deeper into its functionality and explore how it can streamline your financial management process.

Features of the Managing Personal Finances Excel Template

One of the primary reasons why individuals turn to the managing personal finances excel template is its comprehensive features. Here are some key functionalities that set it apart:

- Budget Tracking: The template allows you to create monthly budgets, categorize expenses, and monitor your progress to ensure you stay on track.

- Income Tracking: Record all sources of income to have a clear picture of your financial inflow, which helps in budgeting and planning.

- Expense Categorization: Categorize your expenses into fixed and variable expenses to identify spending patterns and areas where reductions can be made.

- Savings Goals: Set and track savings goals, ensuring that you allocate portions of your budget towards achieving these objectives.

- Visual Reports: Generate charts and graphs that provide visual representation of your finances, making it easier to understand trends and make decisions.

Why Use a Managing Personal Finances Excel Template?

Leveraging the managing personal finances excel template can lead to significant improvements in your financial health. Here are some of the top reasons to consider using this template:

Enhanced Clarity and Control

By using the managing personal finances excel template, you’ll gain enhanced clarity over your finances. The process of entering your income and expenses, followed by analyzing the data, provides a clear view of where your money is going. This level of visibility helps you exercise control over your financial choices, making it easier to adjust spending habits as necessary.

Informed Financial Decision-Making

Financial decisions can often lead to anxiety, especially when you don’t have a firm grasp of your financial situation. With the managing personal finances excel template, you’ll have the information at your fingertips to make informed decisions. Rather than relying on estimates or hunches, you can use concrete data to guide your spending, saving, and investing choices.

Decreased Financial Anxiety

For many, managing finances is synonymous with stress. However, using the managing personal finances excel template can diminish this anxiety. By developing a structured approach to tracking your finances, the template promotes a sense of security and control over financial pressures. The knowledge that you are actively monitoring and managing your money can relieve a considerable amount of stress.

Steps to Utilize the Managing Personal Finances Excel Template Effectively

To unlock the full potential of the managing personal finances excel template, it’s crucial to approach it systematically. Below are practical steps to ensure you get the most out of this tool:

1. Download the Template

Start by downloading the managing personal finances excel template from a reputable source. Ensure you choose a version that is easy to use and compatible with your version of Microsoft Excel.

2. Input Initial Financial Data

Enter your current financial details, including your income sources, fixed expenses, and any outstanding debts. This initial input creates a baseline for tracking your financial progress.

3. Set Financial Goals

Identify your short-term and long-term financial goals, such as debt repayment, saving for a major purchase, or retirement planning. Input these goals into the template to track your progress over time.

4. Regularly Update the Template

To glean meaningful insights from your managing personal finances excel template, it’s essential to update it regularly. Schedule a time each week or month to input recent expenses and income changes, ensuring the data is accurate and up-to-date.

5. Review and Analyze Your Finances

Set aside time to review your finances periodically. Use the visual reports generated by the template to analyze trends and patterns. This review process is integral to understanding your spending habits and making informed adjustments.

Conclusion: Take Charge of Your Financial Future

The managing personal finances excel template is a powerful tool that can transform how you view and engage with your finances. By organizing and visualizing your financial data, you can make confident decisions that align with your financial goals. Whether you are seasoned in financial management or embarking on this journey for the first time, this template provides the structure and clarity needed to take control of your finances.

Don’t let financial confusion hold you back. Embrace the managing personal finances excel template and start your journey toward improved financial wellbeing today. With diligent use and regular updates, you’ll find that managing your personal finances becomes a streamlined and empowering experience. Begin today and take the first step toward a brighter financial future!