In today’s fast-paced world, understanding how to manage personal finance notes effectively is crucial for anyone looking to secure their financial future. As inflation rises and the investment landscape becomes increasingly complex, having a structured approach to personal finance is more important than ever. This article will guide you through the best practices for managing personal finance notes, provide clarity on complex concepts, and help you make informed decisions.

Why Managing Personal Finance Notes is Essential

Managing personal finance notes begins with a clear understanding of your financial situation. Knowing where your money is going and where it comes from sets the foundation for all future budgeting and investment strategies. Without this foundation, it is easy to overspend, lose track of savings goals, and miss out on investment opportunities. One of the pivotal elements in this journey is to maintain accurate records of your expenses, income, and investments.

Creating Effective Personal Finance Notes

To manage personal finance notes effectively, consider using various tools that suit your lifestyle and preferences. Some individuals may prefer digital spreadsheets, while others may find traditional pen-and-paper methods more effective. Here are a few strategies to enhance your note-taking:

- Budget Tracking: Keep detailed records of all your income and expenses. Categorize your spending to gain insights into where cuts can be made.

- Saving Goals: Clearly document your short-term and long-term savings goals. Make notes regarding when you plan to save and how much, monitoring your progress regularly.

- Investment Planning: Maintain records of your investments, including performance, dividends, and market trends. This will help you assess your strategies and make informed decisions.

Visualizing Your Financial Journey

Managing Personal Finance Notes with Visual Aids

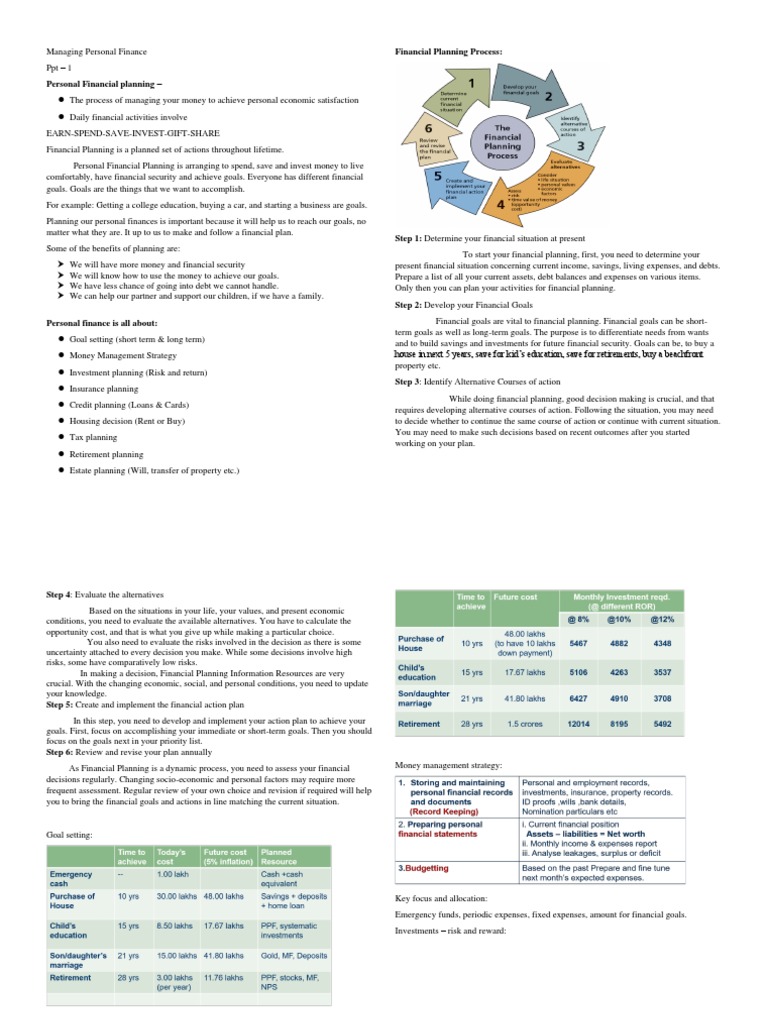

Incorporating visual elements into your personal finance notes can significantly improve your understanding of your financial health. Charts and graphs are excellent for visualizing cash flow, savings growth, and investment performance.

Using tools like pie charts to illustrate how much of your income goes towards various expenses, and line graphs to forecast how your investments may grow over time, can enhance clarity. You might also consider utilizing apps that offer visual representations, allowing for quick assessments of your financial status.

Tips for Maintaining Your Personal Finance Notes

While creating notes is essential, maintaining these notes over time is where many people falter. Here are some tips to keep your personal finance notes relevant and useful:

- Regular Updates: Set aside time weekly or monthly to update your financial notes. This ritual can prevent information overload and ensure accuracy.

- Review and Reflect: Periodically review your notes. Ask yourself what strategies are working, what isn’t, and how to best adapt moving forward.

- Seek Feedback: If you’re unsure about your financial strategies, don’t hesitate to seek advice from trusted friends or financial advisors. They may offer valuable insights that you hadn’t considered.

Understanding Inflation Through Your Personal Finance Notes

Inflation can have a tremendous impact on personal finance. As the prices of goods and services rise, the purchasing power of your money decreases, making it vital to manage personal finance notes that account for this change. For instance, include sections in your notes dedicated to observing inflation rates and how they affect your monthly expenses and saving plans.

Adapting Your Financial Strategy with Inflation in Mind

As inflation continues to fluctuate, adjusting your financial strategy is imperative. Here are some considerations to mitigate the effects of inflation:

- Increase Income Streams: Explore opportunities for side jobs or investments that can help supplement your income, potentially offsetting the effects of inflation.

- Invest Wisely: Diversify your investment portfolio with assets that historically perform well during inflationary periods, such as real estate or commodities.

- Smart Budgeting: Adjust your budget to account for rising costs, ensuring you accurately allocate funds for essential expenses without compromising your savings.

Leveraging Technology for Managing Personal Finance Notes

In our digital age, streamlining the process of managing personal finance notes is incredibly convenient thanks to various apps and software. Embracing tech tools can transform how you approach financial management:

- Budgeting Apps: Consider apps like Mint or You Need a Budget (YNAB) that automatically categorize expenses and visualize your financial health in real time.

- Investment Trackers: Tools such as Personal Capital allow you to track your investments and assess your progress towards your financial goals.

- Reminders and Alerts: Set automatic alerts for bill payments and savings milestones, ensuring you never miss a critical deadline.

Reviewing Your Personal Finance Notes Regularly

Regular reviews of your personal finance notes can lead to invaluable insights. By assessing your financial health routinely, you can make proactive changes rather than reactive ones when it comes to your finances. Some key areas to focus on during reviews include:

- Spending Patterns: Identify areas where spending may have crept up unexpectedly and develop strategies to reign it in.

- Goal Progress: Measure your progress towards savings and investment goals, adjusting your plans as necessary.

- Emergency Funds: Assess the adequacy of your emergency fund and determine if it needs to be increased to match living expenses.

The Long-Term Impact of Managing Personal Finance Notes

The habits you form around managing personal finance notes will have long-term repercussions on your financial wellbeing. The more diligent you are about tracking, reviewing, and adjusting your financial strategies, the more robust your financial standing will become. Over time, effective note management can lead to:

- Increased Savings: By being aware of your spending habits, you can identify opportunities to save more effectively.

- Enhanced Knowledge: Regularly engaging with your finances increases your understanding, empowering you to make better financial choices.

- Greater Financial Confidence: As you gain control over your finances, you’ll find renewed confidence in your ability to navigate challenges.

In conclusion, managing personal finance notes is not just an organizational task; it is a vital strategy for achieving long-term financial goals. By prioritizing effective note-taking, utilizing available technology, and staying informed about financial trends such as inflation, you can empower yourself to make sound financial decisions. Remember, the earlier and more consistently you engage in managing personal finance notes, the closer you will be to securing a financially stable future.