The ability to manage personal finances can often feel overwhelming, especially in today’s rapidly changing economic landscape. Technology has gifted us with tools that can ease this stress and provide clarity. Among these tools, Microsoft’s ‘Money in Excel’ stands out as a marvelous solution for those looking to manage personal finances in a more structured way. This powerful template, incorporated into Excel, helps users track spending, budgets, and financial goals effectively. Let’s dive deeper into how you can utilize Money in Excel to streamline your personal finance management.

Getting Started: Manage Personal Finances in Excel

Before we explore the extensive features of Money in Excel, let’s discuss why managing personal finances is crucial. Having a well-defined budget not only provides insight into your spending habits but also helps to prepare for financial emergencies, future investments, and retirement planning. By investing time upfront into understanding your financial status and setting up proper budgeting, you pave the way for a more secure financial future.

Money in Excel: A Game Changer for Managing Personal Finances

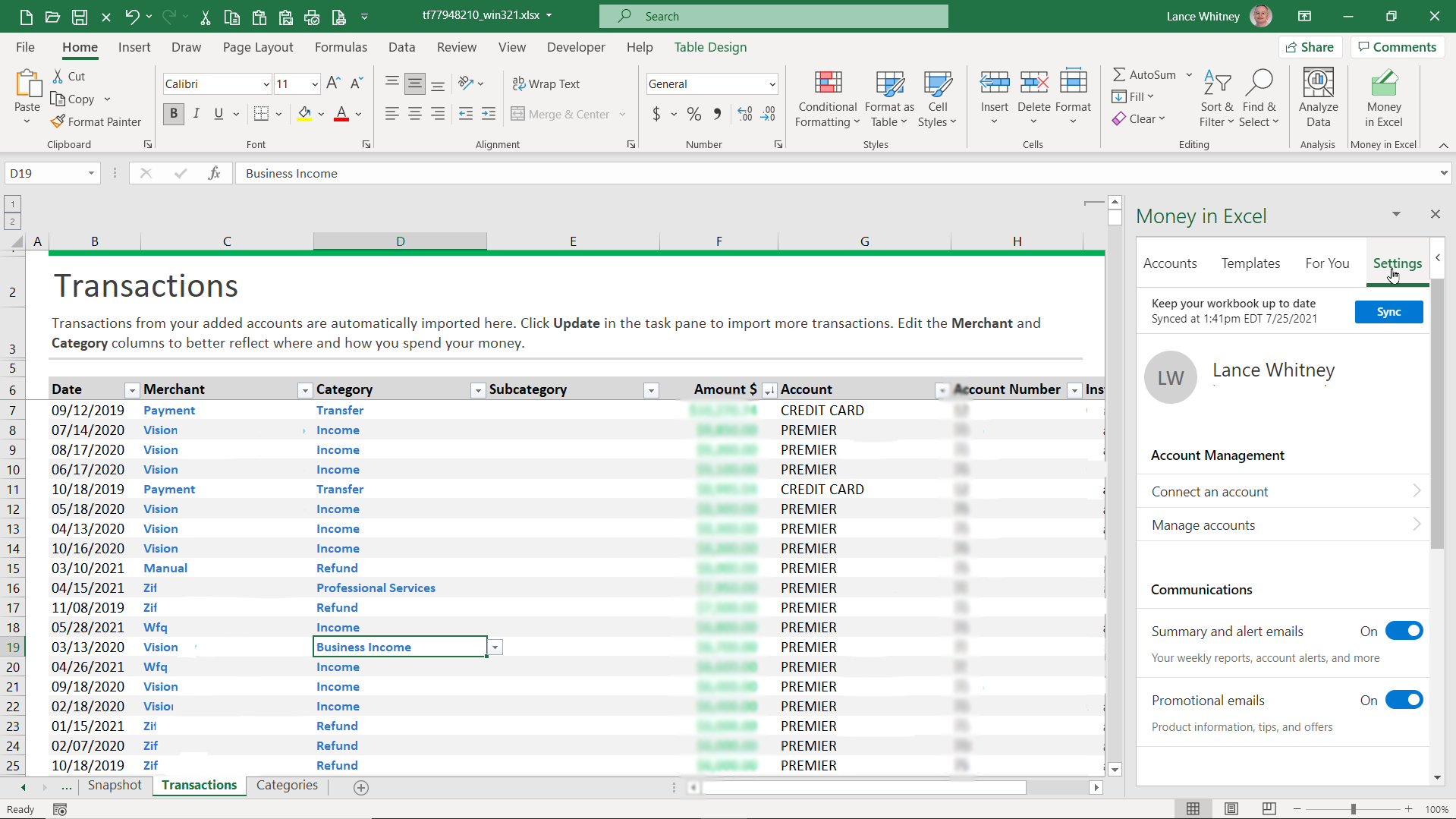

This image illustrates how Money in Excel can help you visually manage personal finances more effectively. It showcases the dynamic environment of Excel filled with robust functionalities designed to enhance your financial clarity.

Understanding the Features of Money in Excel

Money in Excel is integrated with all the necessary tools to help you manage your personal finances seamlessly. From its ability to enter transactions manually to its capability to import bank transactions automatically, it’s easily customizable to fit your unique financial needs. Below are some notable features of Money in Excel:

- Automatic Bank Sync: Effortlessly pull in transactions from your bank accounts, allowing you to have a real-time understanding of your spending.

- Budgeting Capabilities: Set up budgets for different categories, which helps in controlling overspending.

- Spending Analysis: Detailed reports and visual representation of your expenditures, giving you insights into where your money goes each month.

- Goal Tracking: Define financial goals, be it saving for a vacation, purchasing a home, or building an emergency fund. Money in Excel helps track your progress over time.

Why You Should Manage Personal Finances Using Excel

Excel has long been a stalwart in the realm of personal finance due to its versatility. It doesn’t just stop at numbers; it offers powerful data analysis tools that make managing personal finances an engaging experience.

Real-Time Updates for Better Financial Decisions

One of the primary advantages of managing personal finances in Excel is the real-time updates provided by Money in Excel. By syncing your bank accounts, you can witness immediate changes to your financial status. This real-time flow of data ensures that you’re never left in the dark about your spending and can take corrective actions promptly if you notice runaway expenditures in particular areas.

How to Set Up Money in Excel for Financial Success

The setup process for Money in Excel is straightforward. Here’s a step-by-step guide that will assist you in getting your personal finance management up and running quickly:

- Download Money in Excel: Ensure that you have a subscription to Microsoft 365, then download the Money in Excel template from the Microsoft website.

- Link Your Bank Accounts: Open the Money in Excel template, navigate to the ‘Accounts’ section, and follow the prompts to securely link your bank accounts.

- Customize Your Budget: Edit the budget categories to reflect your unique financial situation. Allocate amounts that are realistic based on your income.

- Input Transactions: You can now start entering transactions either manually or by allowing the template to pull them directly from your bank.

- Analyze Your Finances: Use the provided dashboards to review your financial health transparently and make necessary adjustments.

Continuously Managing Personal Finances with Excel

Managing personal finances doesn’t end with setup; it requires ongoing commitment and adaptation. Regular review of your financial dashboard ensures that you stay on top of your budget and goals, encouraging disciplines such as savings and investments. Here’s how continual use of the tool can benefit you:

- Accountability: By consistently logging your finances, you create a habit and accountability system that keeps you dedicated to your financial health.

- Informed Decisions: The ability to see your financial pattern over time helps you make informed spending decisions, adjusting your lifestyle to meet your financial goals.

- Proactive Management: Spot trends that may need immediate attention—like recurring expenses—that could signify necessary adjustments in your budgeting approach.

Common Mistakes When Managing Personal Finances in Excel

While Money in Excel is a powerful tool, the effectiveness largely depends on how you utilize it. There are some common pitfalls that users should avoid:

- Neglecting to Update Regularly: Allowing transactions to pile up without timely entries undermines the tool’s purpose.

- Setting Unrealistic Budgets: While ambition is essential, setting budgets that are too strict can lead to frustration and failure in adhering to them.

- Skipping Financial Reviews: Regular reviews are essential to recognize successes, make adjustments, and stay motivated.

By being aware of these potential mistakes, you can navigate your financial journey with greater confidence and success.

Final Thoughts: Making the Most of Money in Excel

To truly manage personal finances with ease, Money in Excel is an exceptional resource that integrates effortlessly into your financial lifestyle. By harnessing its features and continuously engaging with your data, you can set yourself on a path to financial literacy and empowerment.

As your comfort with the platform grows, explore additional functionalities that allow you to take deeper dives into your fiscal landscape. For instance, consider integrating charts and advanced formulas to get even more granular data about spending habits. Remember, personal finance is a personal journey, so find the strategies that resonate with you and adjust them as you evolve.

Overall, by embedding money management within your day-to-day activities using Excel, you can foster a healthier financial outlook—proactive rather than reactive. Embrace the journey, and make it yours!