In today’s fast-paced world, personal finance has become a vital skill for everyone. Understanding how to manage your money can set you on the path to financial stability and even wealth. Whether you’re just starting out on your financial journey or looking to refine your existing strategies, learning about personal finance is essential. One of the best resources that provide a solid framework for this topic is Khan University’s personal finance program, which offers a wealth of information to help you navigate this complex field.

Khan University Personal Finance: An Introduction

Khan University’s personal finance curriculum covers a wide range of subjects that are crucial for anyone looking to take control of their financial life. From budgeting to understanding credit and saving for retirement, this program can help you develop the skills necessary to build a secure financial future.

The Importance of Budgeting

One of the pillars of personal finance is budgeting. Learning to create and stick to a budget can help prevent overspending and ensure you are making the best decisions with your resources. Budgeting involves tracking your income and expenses to get a clearer picture of your financial situation. With the right tools and strategies, you can master the art of budgeting, which is a significant focus within the Khan University personal finance curriculum.

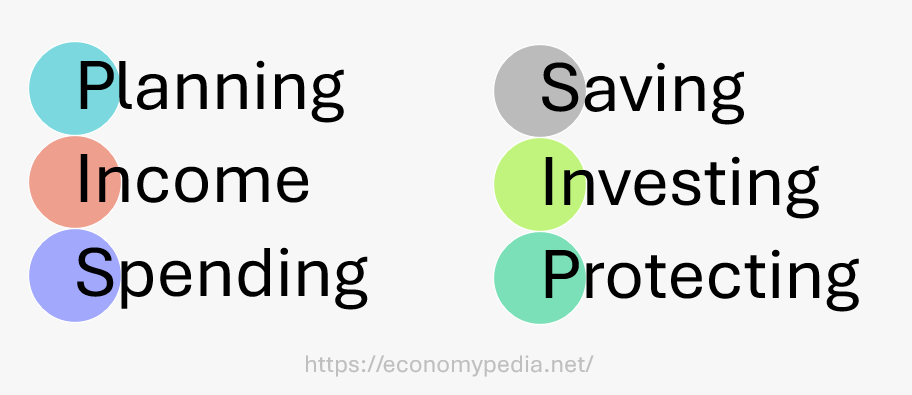

Visualizing Your Financial Health

This graphic illustrates key components of personal finance, highlighting essential strategies for managing your finances. Incorporating visual aids into your financial education can be an effective way to grasp the concepts presented in Khan University’s personal finance lessons.

Credit plays a defining role in personal finance. Knowing how to manage credit intelligently can save you thousands over your lifetime. Khan University’s personal finance courses delve into credit scores, how to maintain a good credit profile, and strategies for managing debt responsibly. Whether you are considering a loan or just trying to optimize your credit card use, understanding these elements is vital.

Saving for the Future: Khan University Personal Finance Insights

Saving is another crucial aspect of personal finance. Khan University stresses the importance of setting aside money for emergencies, future purchases, and long-term goals like retirement. An unexpected expense can derail even the best financial plans, but with a solid saving strategy, you can cushion the blow and maintain peace of mind.

Retirement Savings: Planning Ahead

It’s never too early to start planning for retirement. Khan University’s personal finance program emphasizes the power of compound interest and the benefits of early investing. There are various ways to save for retirement, such as 401(k) plans and IRAs. Understanding these options can help you make informed decisions about your future financial needs.

Moreover, setting specific goals for your retirement savings can motivate you to stay on track. Whether you dream of traveling, starting a business, or simply enjoying a comfortable lifestyle, having a clear picture of your retirement goals can significantly influence how you save today.

Investing: Putting Your Money to Work

Investment is often a daunting term for many, yet it’s a necessary part of building wealth. The Khan University personal finance curriculum breaks down the basics of investing, explaining how various assets can grow your wealth over time. From stocks to bonds, understanding the fundamentals of investing can empower you to make informed choices with your money.

Types of Investments: What You Need to Know

Investments come in various forms, and each has its risk and return profile. Khan University touches on key asset classes, including stocks, bonds, real estate, and mutual funds. By diversifying your investment portfolio, you can mitigate risks while optimizing potential returns. It’s essential to educate yourself on these options to create a balanced investment strategy.

Common Mistakes in Personal Finance

Even with the best intentions, it’s easy to make mistakes in managing your personal finances. Learning about common pitfalls is one of the best ways to avoid them. Khan University provides insights into errors like failing to budget properly, neglecting to save, and accumulating debt without a repayment plan. Being aware of these missteps can help you steer clear of financial traps.

Budgeting, saving, and conscious spending should become habits rather than one-time actions. Change takes time, but with persistence and education, you can create a financial lifestyle that supports your aspirations.

Finding Additional Resources

While Khan University’s personal finance program provides an excellent starting point, there’s a wealth of other resources available for further learning. Websites, books, podcasts, and apps can supplement your education, providing new perspectives and strategies that can enhance your understanding of personal finance.

Connecting with financial advisers or attending workshops can also provide additional support in your journey. Embracing a community focused on financial literacy can inspire you to reach your goals and encourage smart money management practices.

Making Personal Finance a Priority

The journey to financial literacy is not a sprint; it’s a marathon. Adopting the principles and lessons from Khan University’s personal finance offerings can help you pave the way to a financially secure future. Start small by implementing budgeting techniques, setting savings goals, and educating yourself about investment options. Remember, the more informed you become, the better equipped you’ll be to manage your financial life.

Ultimately, personal finance is about making conscious choices that align with your life goals and values. From the initial lessons of budgeting at Khan University to advanced investing techniques, there is a wealth of information available that can guide your financial decisions. Empower yourself with knowledge and watch as your confidence in managing your money grows.

As you embark on your personal finance journey, remember that it’s never too late to start charting your path to financial independence. With the right resources and a commitment to learning, you can gain control over your finances, preparing yourself for an abundant and secure future.