Maxing out your Roth IRA is a significant achievement in your investment journey, and it opens up a wealth of opportunities for further growth of your wealth. Many individuals find themselves asking, “Where can I invest after maxing out my Roth IRA?” The answer lies in various investment options available that can complement the benefits of your Roth IRA. This article will explore several strategies and avenues you might consider to continue building your investment portfolio.

Exploring Investment Options for Roth IRA

Once you have fully funded your Roth IRA with the maximum contribution allowed, it is essential to think strategically about your next steps. While the Roth IRA is an excellent vehicle for tax-free growth, there are additional investment avenues that can enhance your financial position.

Diversifying Beyond the Roth IRA: Investment Options for Roth IRA

Diversification is crucial to mitigate risk and enhance returns. Here are some avenues to consider:

- Taxable Brokerage Accounts: A taxable brokerage account allows you to invest in stocks, bonds, mutual funds, and ETFs without the contribution limits enforced on retirement accounts. It provides flexibility in terms of investment choices and withdrawal rules.

- Real Estate Investments: Investing in real estate can offer cash flow, appreciation, and tax advantages. You might consider purchasing rental properties or engaging in real estate crowdfunding platforms.

- Investing in Index Funds or ETFs: If you enjoy a hands-off approach, consider low-cost index funds or ETFs. They offer broad market exposure and can be a great addition for anyone looking for passive investment strategies.

Maximizing Returns with Investment Options for Roth IRA

To maximize your overall returns, consider focusing on investments with growth potential. This section will delve into options that can yield high returns over time.

Stocks: A Core Component of Your Investment Strategy

Investing in individual stocks provides the opportunity for substantial growth. By researching companies with solid financials and growth trajectories, you can build a portfolio that may outpace the market.

Sector-Focused ETFs: Capitalizing on Trends

Sector-focused ETFs allow you to capitalize on industry trends while diversifying your investment. If you recognize growth in the technology sector, for instance, investing in a technology-focused ETF can provide the exposure needed without the risks associated with purchasing individual stocks.

Alternative Investment Options for Roth IRA

Beyond traditional stocks and bonds, alternative investments can provide unique opportunities and potentially non-correlated returns.

Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate. Investing in REITs allows you to gain exposure to the real estate market without the complications of property management. Additionally, REITs often pay dividends, which can be reinvested for exponential growth.

Integrating Investment Options for Roth IRA with Your Overall Portfolio

Your investment philosophy should include a variety of asset classes that align with your financial goals. The following strategies can help integrate your investment options effectively.

Asset Allocation Strategies

Proper asset allocation is vital. This approach involves balancing your investments among different classes such as stocks, bonds, and alternative investments. The purpose is to optimize your risk-to-reward ratio and protect your investments during market volatility.

Regular Review and Rebalancing

As your investments grow, their proportions relative to each other may shift. Periodically reviewing and rebalancing your portfolio ensures that you stay aligned with your investment strategy and goals.

The Role of Education in Investment Options for Roth IRA

Investing successfully requires ongoing education. Understanding market trends, new financial products, and different investment strategies can make a significant difference in your investment outcomes.

Resources for Continued Learning

Take advantage of workshops, webinars, and financial seminars to expand your knowledge. Additionally, consider insights from reputable financial books and podcasts to deepen your understanding of investment strategies.

Setting Financial Goals with Consideration for Investment Options for Roth IRA

Establishing clear financial goals is fundamental to effectively managing your investments. By knowing what you’re aiming for, you can better align your investment options with your aspirations.

Short-Term vs. Long-Term Investments

Different goals require different investment strategies. If you plan to purchase a home or a vehicle within a few years, a more conservative investment option may be necessary. In contrast, if you’re investing for retirement or other long-term goals, you may prefer higher-risk, higher-reward options.

Understanding Tax Implications of Investment Options

While your Roth IRA allows for tax-free growth, it’s important to understand how taxes affect your other investments. This knowledge will help you choose the right accounts and investment vehicles to minimize your tax burden.

Capital Gains Tax Considerations

Gains realized from investments in taxable accounts can incur capital gains taxes. Understanding the difference between short- and long-term capital gains rates can inform your investment choices to optimize your tax situation.

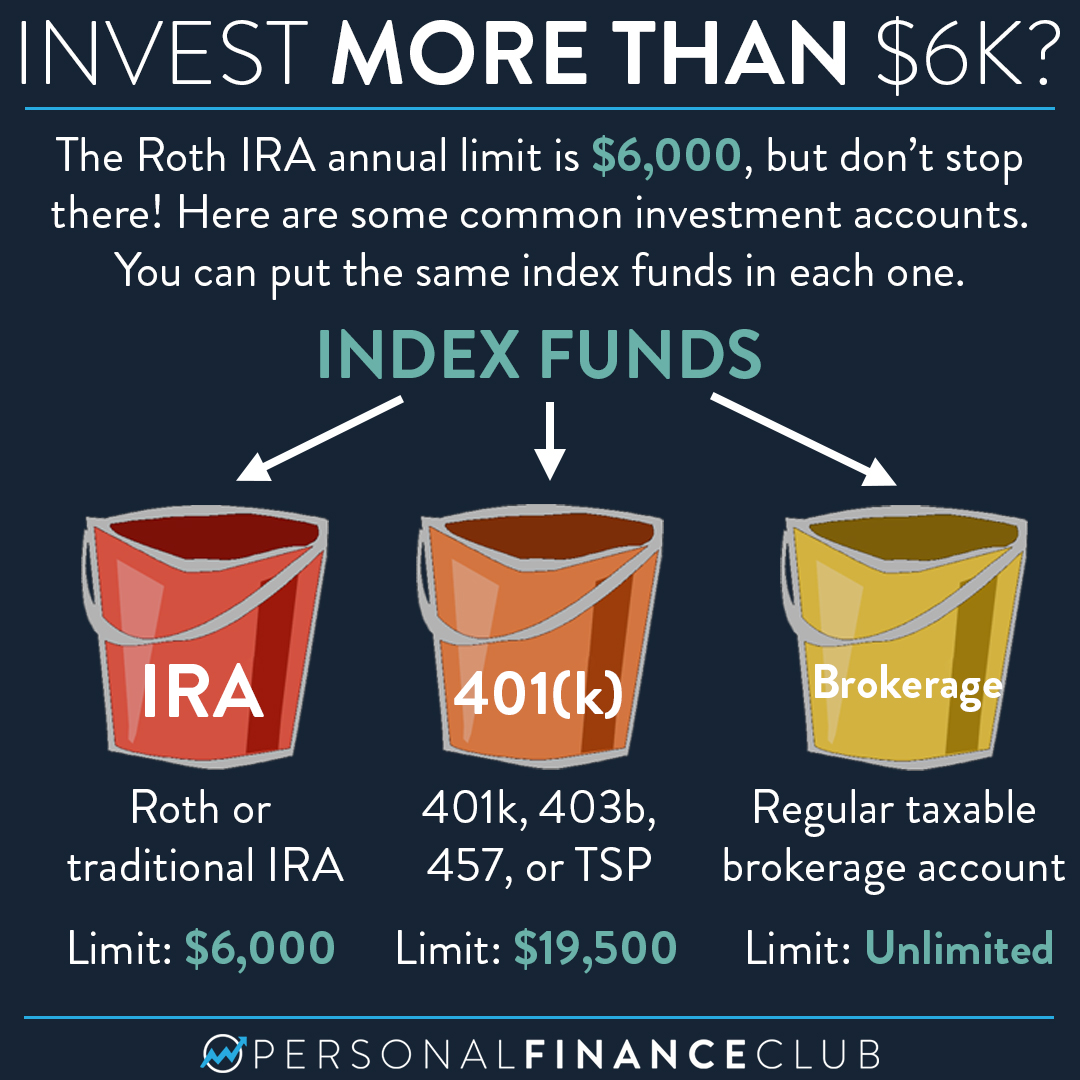

Image Representation of Investment Options for Roth IRA

Visualizing Investment Strategies

This image highlights various investment strategies you might consider after maxing out your Roth IRA.

Final Thoughts on Investment Options for Roth IRA

Maxing out your Roth IRA is only the beginning of your investment journey. Numerous investment options can complement the retirement account, each providing unique benefits and risks. By understanding these avenues and continuously educating yourself, you can develop a robust investment strategy that propels you toward your financial goals. Whether through taxable brokerage accounts, real estate, or alternative investments, remain vigilant and flexible to adapt to changing market conditions and personal circumstances. Always remember to align your investment choices with your long-term objectives, which is key to achieving lasting financial success.