In today’s fast-paced world, self-employment offers incredible opportunities for individuals who value independence and control over their financial destinies. However, with this freedom comes the responsibility of managing one’s finances smartly. This includes making informed decisions on various investment options for individuals. In this article, we will discuss the most effective investment strategies specifically tailored for self-employed professionals, ensuring you find the right fit for your unique circumstances.

Understanding Investment Options for Individuals

Before diving into specific investment options for individuals, it’s crucial to recognize why diversification is pivotal. With the myriad of choices available, understanding your risk tolerance, financial goals, and timelines can help in selecting the right investment avenues.

1. Individual Retirement Accounts (IRAs)

One of the best investment options for individuals, particularly for those who are self-employed, is setting up an Individual Retirement Account (IRA). IRAs provide an excellent tax-advantaged way to save for retirement. There are two main types: Traditional IRA and Roth IRA.

- Traditional IRA: Contributions may be tax-deductible, meaning you could lower your taxable income in the year of contribution, while taxes are deferred until withdrawal.

- Roth IRA: Although contributions are made with after-tax dollars, your withdrawals during retirement are tax-free, provided certain conditions are met.

Both options have different contribution limits and rules, so it’s essential to evaluate which one aligns better with your retirement planning strategy.

2. Health Savings Accounts (HSAs)

If you have a high-deductible health plan, an HSA can be an invaluable investment tool. Not only does it allow you to save for medical expenses tax-free, but it can also serve as an additional retirement account once you hit retirement age.

Investments within an HSA can be allocated similarly to an IRA, which means you can choose different investment vehicles like stocks, bonds, or mutual funds to grow your savings over time.

3. Stock Market Investments

Investing in the stock market can be one of the most lucrative options for individuals looking to grow their wealth. Whether you’re investing in individual stocks or index funds, the stock market offers tremendous potential for long-term gains. Here are a few points to consider:

- Risk assessment: Your risk tolerance will dictate your stock market investments. Higher-risk stocks might yield higher returns, but they can also result in substantial losses.

- Research is key: Always conduct thorough research before investing. Knowledge about the companies and industries can give you an edge.

- Diversification: Diversifying your portfolio can help mitigate risk while maximizing your returns.

Exploring More Investment Options for Individuals

4. Real Estate Investments

Real estate can be an excellent addition to your investment portfolio. Whether it’s purchasing rental properties, flipping houses, or investing in real estate investment trusts (REITs), real estate offers tangible assets that can provide steady cash flow and equity growth over time.

Real Estate Investment

Make sure to analyze the local market conditions, rental yields, and property management aspects before diving into any real estate investments.

5. Peer-to-Peer Lending

Peer-to-peer lending platforms allow you to lend money directly to individuals or small businesses in exchange for interest payments. This investment option for individuals, generally yields higher returns compared to traditional savings accounts or bonds.

However, it is essential to consider the risks involved, as borrowers may default on their loans. Always assess the platform’s credibility and the borrower’s creditworthiness before proceeding.

Investment Options for Individuals: Additional Considerations

6. Bonds and Fixed-Income Securities

Bonds often provide a steadier source of income compared to stocks. For self-employed individuals, incorporating bonds and fixed-income securities into your portfolio can help balance the potential volatility of stock investments. Here are some bond types to consider:

- Government Bonds: Generally, these are the safest forms and are backed by governments.

- Corporate Bonds: While higher in risk than government bonds, they also offer higher returns.

- Muni Bonds: These are issued by states and municipalities, often tax-exempt.

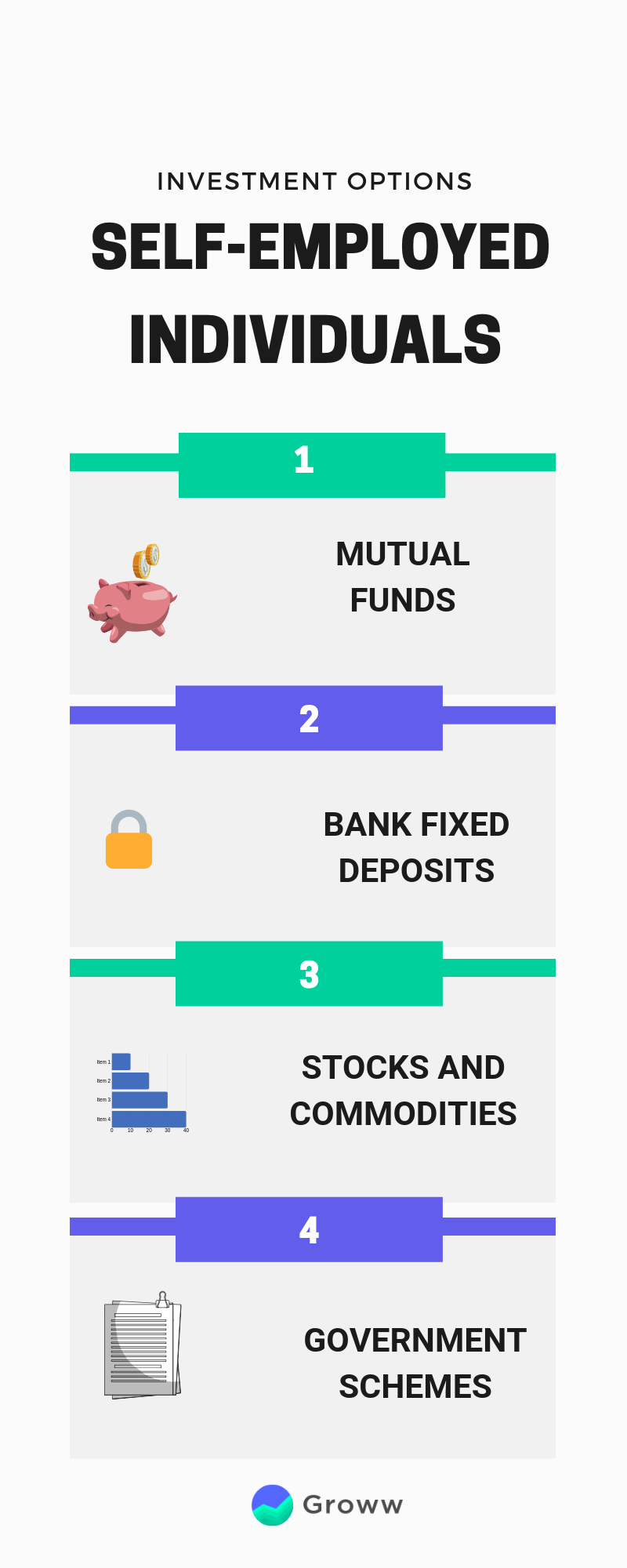

7. Mutual Funds and Exchange-Traded Funds (ETFs)

For individuals seeking a diversified investment approach without having to manage a large portfolio actively, mutual funds and ETFs might be the way to go. These funds pool money from many investors to purchase a diverse group of stocks, bonds, or other securities.

Both options come with management fees, but they provide a hands-off investment experience and professional management, which can be particularly beneficial for self-employed individuals with busy schedules.

The Importance of an Investment Strategy for Self-Employed Individuals

As a self-employed person, it’s vital to develop a comprehensive investment strategy that aligns with your financial goals. Take time to assess your income stability, potential growth, and risk tolerance. Collaborating with a financial advisor can provide tailored advice specifically designed for your unique situation.

8. Emergency Funds: A Necessary Safety Net

Before diving headfirst into complex investment options for individuals, it’s important to ensure you have a solid emergency fund. This fund should cover at least six months of expenses and allow you greater flexibility in your investment decisions.

Knowing that you have financial backing during uncertain economic times can alleviate pressure and allow for more long-term investment planning.

9. Continued Education and Adaptation

Finally, the investment landscape is always evolving. Self-employed individuals should prioritize continued education to stay abreast of changes in market conditions, tax laws, and alternative investment options. Utilize resources such as online courses, seminars, and webinars to enhance your knowledge, making informed decisions along the way.

Conclusion

In conclusion, self-employed individuals have access to a diverse range of investment options tailored to their unique needs and aspirations. From IRAs and HSAs to mutual funds and real estate, there are plenty of strategies to build a strong financial foundation. By understanding your financial goals, risk tolerance, and conducting proper research, you can create an investment portfolio that propels you toward success. Remember, the key is to start investing wisely today, as the earlier you begin, the greater your potential for growth in the future!