So, you’ve decided to take the plunge into the world of investments, and let me tell you, it’s a wild rodeo out there! Now, you might be wondering where to start, and that’s perfectly okay. Buckle up, because we’re diving into the investment options for Fidelity Roth IRA—a place where your money can grow while you sip your morning coffee and contemplate your future as a million-dollar barista.

Getting Started on Your Investment Options for Fidelity Roth IRA

First things first, what even is a Roth IRA? It sounds fancy, like a secret club that only the savvy investors get to join. Well, think of it as a delightful garden where you plant seeds today; with a bit of patience, you’ll reap a bountiful harvest later on—without having to deal with pesky taxes when you finally decide to enjoy those fruits! And trust me, those seeds (a.k.a your contributions) are the key to the investment options for your Fidelity Roth IRA.

Why Choose Fidelity for Your Roth IRA Investment Options?

Picture this: You’re lounging at home, flipping through your investment options for Fidelity Roth IRA, and you notice a familiar face among the crowd—the good ol’ Fidelity Investments. They’re like your favorite aunt who always knows what to give you for your birthday; reliable and well-stocked with useful gifts, aka investment strategies. Their tools and platforms can make your financial journey feel a little less like navigating a labyrinth and more like enjoying a leisurely stroll through the park. Who wouldn’t want that?

Examining Your Investment Options for Fidelity Roth IRA: Stock Up!

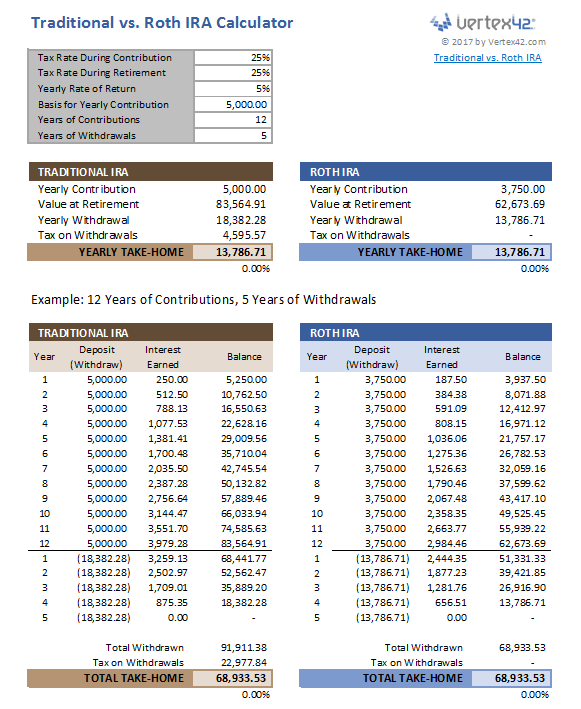

Check Out This Fancy Calculator!

Now that we have our calculator, let’s talk about stocks, the wild cards of the investment options for Fidelity Roth IRA! Stocks can be like that unpredictable friend who sometimes shows up to the party in a tuxedo and other times in pajama pants. They can soar high or drop faster than a piñata at a birthday party. But when you choose the right ones, they can be the life of the investment party! Building a stock portfolio is sort of like crafting the ultimate playlist. You want a mix of classic hits, underground gems, and maybe a guilty pleasure or two. Diversification is key here! And never underestimate the power of a great recommendation—especially from your dependable Fidelity Investments!

Bonding Over Investment Options for Fidelity Roth IRA

If stocks make you a bit anxious, then bonds may be your cozy blanket on a rainy day. Think of them as the steady, reliable tortoise in the race against the unpredictable hares (a.k.a stocks). They can provide stability and help you weather some financial storms. However, make sure not to go all in on the bonds, as too much of a good thing can get a little… snoozy! Remember, you want a balance to optimize those investment options for Fidelity Roth IRA.

Fun with Funds—Mutual Fund Mania!

Speaking of balancing acts, we can’t forget about mutual funds. These little beauties are like a buffet for your investment options for Fidelity Roth IRA! With one swoop, you can grab a plate filled with stocks, bonds, and other financial goodies. It saves you from the hassle of picking individual investments while ensuring you have a bit of everything on your plate. Plus, with Fidelity’s reputation, you can be assured that the chefs are top-notch!

ETFs: Your Fastpass to the Investment Amusement Park

If mutual funds are a buffet, then ETFs (Exchange-Traded Funds) are like those handy fast passes at theme parks. You can jump on the ride without waiting in line forever. They’re traded like stocks, which means you can buy and sell them throughout the day but still enjoy the diversified fun like mutual funds. Just be sure to keep an eye out for those whimsical market movements!

Setting Up Automatic Contributions: Invest and Forget!

Now that you’ve got your investment options for Fidelity Roth IRA lined up, here’s a brilliant idea: set up automatic contributions. Picture it like a monthly subscription to your coffee bean of choice. You’ll wake up one day, and your money will be steadily brewing in your account without you having to remember to hit the ‘submit’ button each month. It’s like hitting the snooze button on your financial worries! Want to know the best part? You could even get brave and increase the amount each year, resulting in a delightful surprise party for your wealth!

Do the Math—Roth vs. Traditional IRA

Before we wrap things up, let’s talk about the infamous battle between Roth and Traditional IRAs. Picture it like the superhero vs. villain showdown. On one side, you have the Roth IRA with tax-free withdrawals in retirement, standing tall and confident. On the other side, the Traditional IRA, with its catchy “tax-deferred until retirement” game plan, making things a bit more mysterious. The choice ultimately boils down to whether you want to pay taxes now or later. Weighing your investment options for Fidelity Roth IRA against various scenarios will help you make the best choice for your future!

Staying Informed: News and Updates for Your Investment Options

The financial world is a constantly evolving landscape, and staying informed is crucial. Fidelity offers a variety of resources to keep you in the loop! Webinars, articles, and newsletters are at your disposal to help you navigate the various streets and alleyways of your investment options for Fidelity Roth IRA. Regularly checking in with the latest trends could be the difference between being a savvy investor and a lost tourist in a strange city.

Final Thoughts on Investment Options for Fidelity Roth IRA

So, dear reader, as you dip your toes into the investment waters with Fidelity Roth IRA, remember to keep your options open, have a mix of fun and stability, and never forget to enjoy the ride. Your financial future is like a blank canvas waiting for your vibrant brushstrokes. Whether you’re more of a stocks or bonds person or you just want to dabble in mutual funds, let the investment options for your Fidelity Roth IRA be your playground! Here’s to making financial gains as delightful as biting into a slice of cake—sweet, rewarding, and satisfying!