In today’s rapidly evolving financial landscape, finding the right investment options for cash is crucial for both individuals and businesses. With numerous choices available, it is essential to identify options that not only provide liquidity but also enhance your return on investment. An informed approach will better position you to make financially sound decisions that align with your financial goals. This article delves into various investment options for cash, covering safety, yield potential, and suitability for different financial situations.

Understanding Investment Options for Cash

When it comes to managing cash, investors must carefully consider their goals, risk tolerance, and time horizon. Different investment options cater to varying needs; thus, understanding the intricacies of each will enable wise decision-making. Below, we discuss several of the most prevalent investment options for cash available in the market today.

High-Yield Savings Accounts

High-yield savings accounts are a popular choice among savers seeking to earn interest on their cash while retaining easy access to their funds. These accounts, typically offered by online banks, provide significantly higher interest rates compared to traditional savings accounts. While interest rates can fluctuate, these accounts generally provide a safe harbor for funds, protected by FDIC insurance up to $250,000 per depositor.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another solid investment option for cash. CDs require you to lock in your money for a specified term, ranging from a few months to several years. In return, you generally receive a higher interest rate compared to standard savings accounts. While your funds are inaccessible during the term without a penalty, the predictability of returns makes CDs an attractive choice for conservative investors looking for stability.

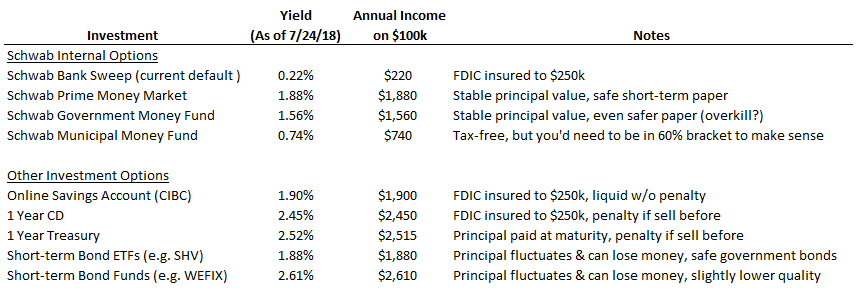

An Image of Different Investment Options for Cash

This image illustrates a range of investment options for cash, helping investors visualize the landscape of potential choices they can make. As we analyze further options, it’s essential to consider the requirements and returns from these various avenues.

Money Market Accounts

Money market accounts combine features of checking and savings accounts, offering higher interest rates while maintaining liquidity. These accounts typically require a higher minimum balance and may limit the number of transactions you can execute each month. However, the trade-off can be worthwhile, as they provide competitive rates along with the convenience of easy access to cash for everyday needs.

Investment Options for Cash with Bonds

For those looking for stability with higher yields, bonds are a suitable option. Bonds represent a loan made by an investor to a borrower, typically a corporation or government. When you purchase bonds, you are essentially lending your money in exchange for regular interest payments over the life of the bond, culminating in the return of the principal amount upon maturity. While bonds are generally considered less risky than stocks, they are still subject to interest rate fluctuations and credit risk, and thus must be chosen wisely.

Treasury Securities

Treasury securities, including Treasury bills, notes, and bonds, are backed by the U.S. government and are considered among the safest investment options for cash. These securities offer various maturities and typically provide interest that is exempt from state and local taxes. Investors can purchase these assets directly from the U.S. Treasury or through reputable brokers.

Corporate Bonds

Corporate bonds can be an advantageous investment option for cash for those willing to take on slightly more risk for potentially higher returns. These bonds are issued by companies to fund their operations or projects. When selecting corporate bonds, it’s crucial to conduct due diligence on the issuing company’s financial stability to evaluate risks appropriately. High-yield or “junk” bonds offer higher interest rates but come with increased risk, thereby requiring careful risk assessment before commitment.

Investment Options for Cash in Stocks

For those comfortable with higher risk, the stock market presents opportunities for significant returns. Although stocks can be more volatile, investing in dividend-paying stocks or exchange-traded funds (ETFs) can provide a source of income while allowing for capital appreciation. Stocks can be a great long-term investment option for cash to grow wealth, especially for younger investors with a longer time horizon.

Dividend Stocks

Dividend stocks offer investors a combination of growth and regular income. Companies that consistently pay dividends typically possess strong cash flow and are likely to continue doing so for the foreseeable future. Investors can reinvest dividends to purchase additional shares, thus benefiting from compound growth.

Exchange-Traded Funds (ETFs)

ETFs are another viable investment option for cash, providing exposure to various asset classes or market sectors. Unlike mutual funds, ETFs trade on stock exchanges like individual stocks and offer flexibility and liquidity, making them an attractive choice for investors. For those looking to diversify without excessive cash outlay, ETFs can be a wise choice, as they allow investors to spread risk across numerous assets.

Alternative Investment Options for Cash

Aside from the traditional investments, alternative investment options for cash, such as real estate investment trusts (REITs) and peer-to-peer lending, have gained traction among savvy investors. While these options may carry different risk profiles, they can yield significant returns, especially in a well-structured portfolio.

Real Estate Investment Trusts (REITs)

REITs provide a way for investors to invest in real estate without needing to buy, manage, or finance properties directly. They typically generate income through renting and leasing properties, distributing dividends to shareholders. For those seeking a tangible asset for diversification, REITs can be a compelling investment option for cash.

Peer-to-Peer Lending

Peer-to-peer lending platforms allow individuals to lend money directly to borrowers, bypassing traditional financial institutions. This model provides investors with the potential for high returns, though it comes with significant risk as the borrower may default. Diligent risk assessment is vital when considering peer-to-peer lending as an investment option for cash.

Conclusion

In conclusion, the landscape of investment options for cash is vast and varied. From traditional savings accounts and CDs to stocks and alternative investments like REITs, understanding the pros and cons of each option is essential for making informed financial decisions. Investors should consider their unique financial circumstances, goals, and risk tolerance when selecting the most suitable options for their cash. By diversifying their investments across various asset classes, individuals and businesses can maximize their cash’s potential while effectively managing risk.