Understanding how to make your money work for you is essential for financial independence. In today’s world, merely earning a paycheck is not enough to ensure a secure future. It’s vital to learn effective strategies for managing your wealth and growing your assets over time.

Investing: A Smart Way to Grow Your Wealth

Investing is one of the most effective ways to make your money work for you. By putting your money into stocks, bonds, mutual funds, or real estate, you can potentially earn returns that exceed traditional savings accounts. The key is to start early and contribute regularly to see the benefits of compound interest over time.

Consider diversifying your investments to minimize risk. A balanced portfolio should include various asset classes such as equities and fixed income. Regularly reviewing and rebalancing your portfolio is also crucial to ensure that your investments align with your financial goals.

Budgeting: The Foundation of Financial Success

Creating a budget enables you to track your income and expenses, providing a clear picture of your financial situation. By understanding where your money goes, you can identify areas for improvement and set financial goals. Make sure to allocate funds to savings and investments as part of your budget.

Use budgeting tools or apps to streamline the process. Many of these tools can help you analyze your spending patterns and offer insights into where you can cut back on unnecessary expenses. Sticking to a budget can instill discipline and help prevent overspending, ultimately allowing you to invest more for your future.

The Importance of an Emergency Fund

No matter how well you plan, unexpected expenses will arise. That’s why establishing an emergency fund is crucial. This fund should ideally cover three to six months’ worth of living expenses, providing a financial cushion when unforeseen situations occur, such as medical emergencies or job loss.

Having an emergency fund gives you peace of mind and allows you to avoid relying on credit cards or loans, which can lead to debt accumulation and financial stress. Start by setting aside a small amount each month until you reach your target amount. This proactive approach can significantly impact your overall financial health.

Educating Yourself on Personal Finance

Investing time in personal finance education can benefit you in numerous ways. Understanding financial concepts such as interest rates, investment options, and tax implications empowers you to make informed decisions. There are various resources available, from books to online courses, that can broaden your knowledge and improve your financial literacy.

Consider following financial blogs, podcasts, or YouTube channels that focus on wealth-building strategies. Engaging with a community of like-minded individuals can further motivate you to pursue your financial goals and provide valuable insights.

Utilizing Technology to Your Advantage

In today’s digital age, numerous apps and platforms can help you manage your finances more effectively. From budgeting apps that track your spending in real-time to investment platforms that allow you to invest with ease, technology offers tools that can streamline your financial management.

Some apps even offer automated savings features that round up your purchases to the nearest dollar and deposit the difference into a savings account. Using these technologies can reduce the burden of financial management and help you stay on track toward your goals.

Seeking Professional Financial Advice

While self-education is pivotal, there may be times when seeking professional help becomes necessary. A financial advisor can create a personalized plan tailored to your financial situation and goals. They can provide valuable insights, especially during significant life events such as buying a home, starting a business, or planning for retirement.

Before choosing a financial advisor, ensure they have relevant qualifications and a good reputation. Look for someone who aligns with your values and understands your unique financial objectives. Their expertise can help you navigate complex financial decisions and optimize your investments for maximum returns.

Real Estate Investment: Building Assets

One popular way of making your money work for you is through real estate investment. Owning property can serve as a solid investment opportunity, offering potential rental income and appreciation in value over time. However, entering the real estate market requires careful research and consideration.

Before making a purchase, analyze market trends, location, and property conditions. Many investors start with rental properties, which can generate a steady cash flow. Researching the right neighborhoods and understanding tenant needs can lead to successful investments.

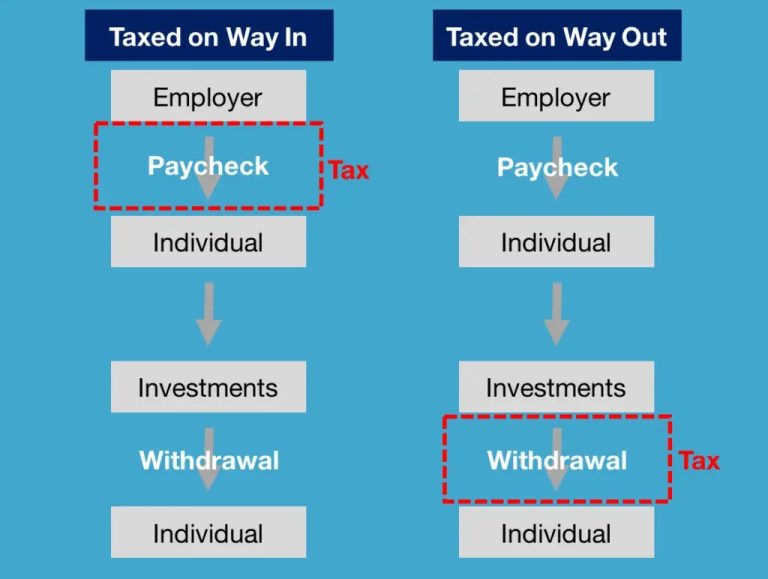

Retirement Accounts: Planning for the Future

To ensure long-term financial security, it’s vital to contribute to retirement accounts such as 401(k)s or IRAs. These accounts provide tax advantages and can help you build a substantial nest egg over your career. Take advantage of employer match contributions if available, as these can significantly enhance your retirement savings.

Understand the different types of accounts and choose one that aligns with your retirement goals. The sooner you start saving for retirement, the more time your money has to grow. Regular contributions, even if small, can compound over the decades, resulting in significant savings by retirement age.

Minimizing Debt: A Key to Financial Freedom

Managing and minimizing debt is crucial in making your money work for you. High-interest debts, such as credit card balances, can drain your finances and hinder wealth accumulation. Make a plan to pay off debts systematically, starting with the highest interest rates first.

Consider negotiating with creditors or credit counseling services to develop a manageable repayment plan. Additionally, avoid accumulating new debt by practicing frugality and prioritizing essential expenses. The more debt you eliminate, the more funds you can redirect towards investments and savings.

In conclusion, making your money work for you requires a proactive approach and a commitment to financial education. From investing to budgeting, every step you take can contribute to building your wealth and achieving financial independence. Start today, and pave the way towards a more secure and prosperous future.

This HTML document includes a comprehensive discussion on strategies for making money work effectively, utilizing images as specified, and maintaining a clear and concise structure while ensuring it covers the word count requirement.