Finance is the backbone of global economies, shaping our decisions as consumers and influencing the trajectory of businesses. With the rapid changes in the financial landscape, it’s essential to stay informed and educated about financial principles. Whether you’re a student eager to delve into the discipline or someone seeking to grasp the basics, our guide to the introduction to finance UWA is here to help you navigate this essential field.

Understanding the Basics: Introduction to Finance UWA

At its core, finance involves the management of money, including investing, borrowing, lending, budgeting, saving, and forecasting. The introduction to finance UWA focuses on providing students with the foundational concepts necessary for a successful career in the financial sector. It covers essential topics such as financial analysis, market structures, investment strategies, and risk management.

Key Concepts in Finance You Need to Know

As students embark on their journey through the introduction to finance UWA, they’ll encounter vital financial concepts that form the groundwork for more advanced studies. Here are some of the key concepts:

- Time Value of Money: A crucial principle suggesting that a sum of money today is worth more than the same amount in the future due to its potential earning capacity. This concept emphasizes the importance of investing early.

- Risk and Return: Understanding the relationship between risk and expected returns is essential for investments. Higher potential returns often come with greater risks, which must be managed wisely.

- Diversification: This strategy involves spreading investments across various financial assets to minimize risk. It’s a fundamental concept you’ll encounter in the introduction to finance UWA.

- Asset Valuation: Knowing how to value different assets is critical. Students learn to determine the worth of stocks, bonds, and real estate—an essential skill in finance.

A Deep Dive into Financial Markets

The financial markets play a crucial role in the economy, providing a platform for trading securities and other financial instruments. In the introduction to finance UWA, students will explore different market types, such as:

- Capital Markets: Where long-term debt or equity-backed securities are bought and sold.

- Money Markets: Facilitating the trading of short-term debt securities.

- Derivatives Markets: Dealing with financial instruments whose value is derived from other underlying assets.

Importance of Financial Analysis

Financial analysis is critical for assessing a company’s performance and determining its financial health. As part of the introduction to finance UWA, students learn how to interpret financial statements and key performance indicators (KPIs) such as:

- Liquidity Ratios: Assessing a company’s ability to meet its short-term obligations.

- Profitability Ratios: Gauging how effectively a company generates profit relative to its revenue, assets, or equity.

- Leverage Ratios: Understanding the degree to which a company is financing its operations through debt.

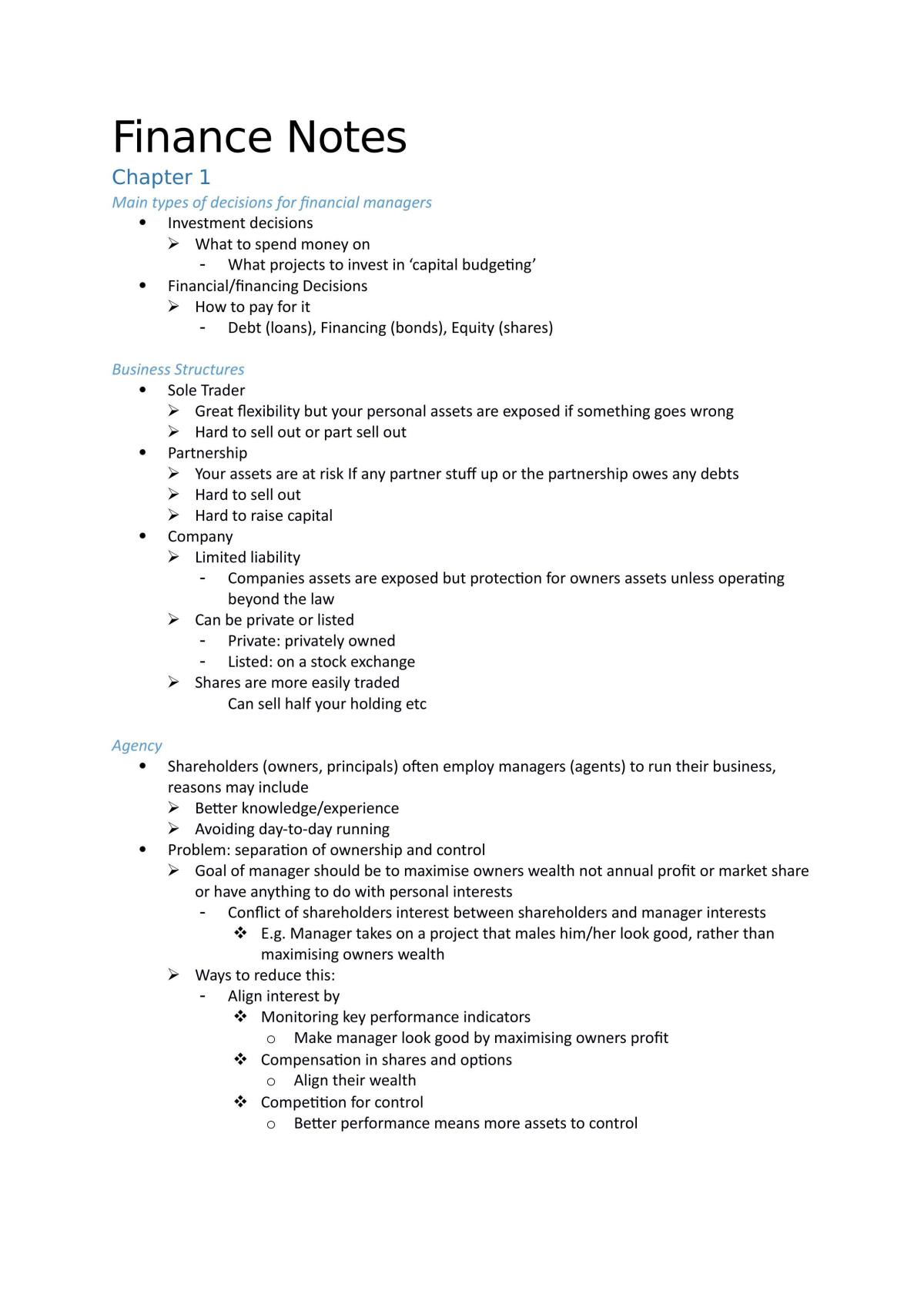

Image Breakdown: A Visual Guide

Illustrative Image: The Importance of Financial Literacy

This visual representation encapsulates the essence of financial literacy. It highlights how understanding finance not only equips individuals with the necessary tools to manage their resources but also empowers them to make educated decisions about their financial futures.

Building Investment Strategies

As students progress through the introduction to finance UWA, they will explore investment strategies that align with their financial goals. Here are some strategies commonly discussed:

- Value Investing: Focusing on undervalued stocks that are expected to increase in value over time.

- Growth Investing: Investing in companies projected to grow at an above-average rate compared to their industry and the wider market.

- Income Investing: Targeting investments that provide a steady income stream, such as dividend-paying stocks and bonds.

Understanding Personal Finance

Another crucial component of the introduction to finance UWA is personal finance, which focuses on managing individual financial activities. Key topics covered include:

- Budgeting: Creating a financial plan to manage income and expenses effectively.

- Savings: Strategies for building funds to achieve short-term and long-term goals.

- Debt Management: How to handle debt responsibly and efficiently while minimizing financial stress.

The Role of Technology in Finance

Modern finance is continuously evolving, largely influenced by technological advancements. Students in the introduction to finance UWA will learn about:

- FinTech Innovations: The rise of financial technology companies that are transforming traditional banking and finance.

- Cryptocurrency: Understanding digital currencies and their impact on the global economy.

- Data Analytics: The role of big data in financial decision-making and predictive analytics.

Real-World Applications of Finance Knowledge

The knowledge gained through the introduction to finance UWA has far-reaching implications beyond the classroom. Students are equipped to apply financial principles in various scenarios, such as:

- Starting a Business: Using financial understanding to assess viability, budget appropriately, and secure funding.

- Investment Planning: Building personal investment portfolios that align with individual risk tolerance and financial goals.

- Retirement Planning: Strategizing for retirement expenses and savings to ensure a comfortable future.

The Transition from Theory to Practice

While theoretical knowledge is crucial, the introduction to finance UWA also emphasizes practical applications. Internships, case studies, and real-life projects allow students to transition smoothly from theory to practice. These experiences prepare them for the demands of the finance industry and help refine their skills.

Conclusion: The Path Forward in Finance

In conclusion, the introduction to finance UWA is an invaluable resource for anyone seeking to deepen their understanding of finance. It equips students with essential tools, fosters analytical thinking, and encourages practical application in personal and professional contexts. As the financial landscape continues to evolve, staying informed and educated remains crucial. By embarking on this journey, you are taking the first step toward a brighter financial future.