In today’s digital age, seamless banking experiences are paramount. For users of the Capitec Bank app, reversing transactions and saving money can be easily managed right at your fingertips. Understanding the functionalities of this app not only enhances your banking experience but also empowers you with the knowledge of how to save money effectively. In this article, we will guide you on how to reverse money using the Capitec app while also emphasizing how you can save money through various strategies.

How to Reverse Money Using Capitec App

The Capitec app provides a straightforward interface to manage your finances, including reversing transactions. This capability is crucial for those times when mistakes happen. Let’s delve into how you can reverse money using the Capitec app while keeping in mind strategies on how to save money as you navigate your banking experience.

Understanding the Capitec App Features

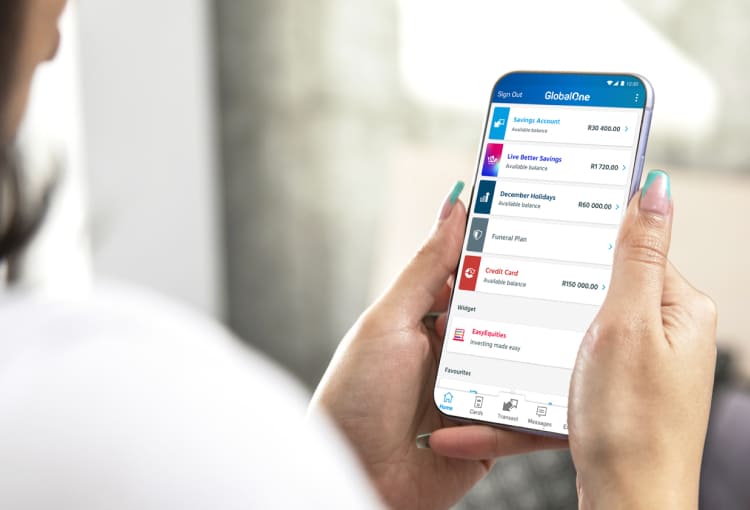

First, familiarize yourself with the features of the Capitec app. It serves as a comprehensive tool to manage your finances, enabling customers to perform a wide range of transactions. From account management to instant notifications about your spending, each feature helps you stay on top of your finances. Knowing how to leverage these features efficiently is where the real savings begin. For instance, the budgeting tool within the app assists you in monitoring your spending habits, making it easier to identify areas where you can trim expenses — a perfect step on your path to understanding how to save money via Capitec.

Steps to Reverse Transactions

Reversing a transaction in the Capitec app is a process designed for simplicity. Here’s a step-by-step guide to ensure that you can do this effortlessly:

- Open the Capitec app on your mobile device and log in to your account.

- Navigate to the “Transactions” section where all your recent transactions will be listed.

- Select the transaction you wish to reverse.

- Follow the on-screen prompts to complete the reversal process. You will likely need to confirm this action.

This feature is not just about correcting mistakes — it’s an opportunity to refine your approach towards managing your money, particularly with regards to how to save money via Capitec’s offerings.

How to Save Money with Capitec: Practical Strategies

Now that you know how to reverse transactions, let’s explore some practical strategies on how to save money with Capitec. With the right approach, users can make the most of their banking experience and enhance their financial health.

Utilize the Budgeting Tool

The Capitec app includes a budgeting tool that assists you in setting financial goals and monitoring your expenses. By inputting your income and outlining your fixed and variable expenses, you can get a clear picture of your financial situation. This clarity allows you to identify areas where you might be overspending and adjust your budget accordingly. As you learn to manage your expenses, you will naturally find ways on how to save money via Capitec.

Set Up Notifications

Another excellent feature of the Capitec app is the ability to set up notifications. By receiving alerts regarding your spending, you can immediately see how your transaction patterns affect your savings goals. Whether it’s a daily spending limit exceeded notification or a reminder for upcoming payments, these alerts evoke responsible spending habits, leading to better money management that aligns with your goal of saving money.

Take Advantage of Savings Accounts

Capitec also offers various savings account options that can help your money grow over time. By understanding the differences between these accounts and choosing the right one for your needs, you can maximize your savings. Consider setting up automatic transfers to your savings account after each pay period. This practice can help you avoid the temptation to spend what you should be saving, thereby illustrating another aspect of how to save money via Capitec effectively.

Leveraging Capitec for Daily Savings

Your everyday banking choices also play a significant role in your ability to save money. Every penny counts, and with Capitec, even your day-to-day spending can contribute to your financial growth.

Use Cards Wisely

Capitec provides both debit and credit options. Understanding when to use each can influence your savings dramatically. For regular purchases, utilizing a debit card might help keep your spending within budget. In contrast, for larger expenses where cash flow management is critical, strategically using credit can offer benefits, as long as you are disciplined about repayments. This balanced approach indicates a proactive way on how to save money via Capitec.

Regular Review of Transactions

A habit that supports effective saving is the routine examination of your transactions. By regularly reviewing your spending via the Capitec app, you can identify unnecessary purchases. This reflects not just good financial management but supports your overarching goal of saving — after all, the key to saving money lies in recognizing what you don’t need to spend.

Explore Promotions and Offers

Capitec often has promotions and offers that might help you save on interest or earn cashback on certain transactions. Staying informed about these can result in significant savings over time. Additionally, leveraging these offers will instill a habit of seeking value in your transactions — crucial for anyone focused on learning how to save money via Capitec.

Planning for Future Goals

Ultimately, effective money management and saving lead to the achievement of future goals. Whether it’s a dream vacation, a new car, or simply a comfortable retirement, having financial goals will give your saving efforts direction.

Set Short- and Long-Term Goals

Define short-term goals, like saving for a holiday, alongside long-term goals such as retirement savings. Using the Capitec app’s budgeting tool can help you align your monthly savings with these goals. By continuously monitoring your progress, you’ll find yourself on a more disciplined saving path.

Consult with Financial Advisors

If navigating savings and investments feels overwhelming, don’t hesitate to consult with a financial advisor. Many banks, including Capitec, offer resources to guide you through your financial journey. They can provide insights on effective ways on how to save money by aligning your investment strategies with your financial goals.

In conclusion, the Capitec app is more than just a banking tool; it embodies a philosophy of financial wellness and effective money management. By understanding how to reverse transactions, utilizing the bank’s array of tools, and implementing sound saving practices, you can take significant strides toward your financial aspirations. Remember, every small step you take with these strategies contributes to your overall goal — to save money wisely and enhance your financial literacy.