Investing in stocks can be a rewarding endeavor, offering opportunities to grow wealth and secure financial futures. If you’ve ever wondered how to start making money with stocks, you’re not alone. Many individuals are exploring the stock market as a means to increase their income. In this comprehensive guide, we will delve into effective strategies, tips, and the fundamental principles of investing to successfully navigate the stock market and start earning through stocks.

Understanding the Basics of Stock Market Investment

Before we explore how to start making money with stocks, it’s essential to understand what stocks are. Stocks represent ownership in a company, and when you purchase a share, you become a part-owner of that company. This ownership can yield various financial benefits as the company grows and profits increase. However, it’s crucial to remember that investing in stocks also comes with risks, and market fluctuations can impact your investments significantly.

Learn How to Start Making Money with Stocks

Now that we have a foundational understanding of stocks, let’s delve into practical steps you can take. Here are some strategies to consider when embarking on your journey:

1. Educate Yourself

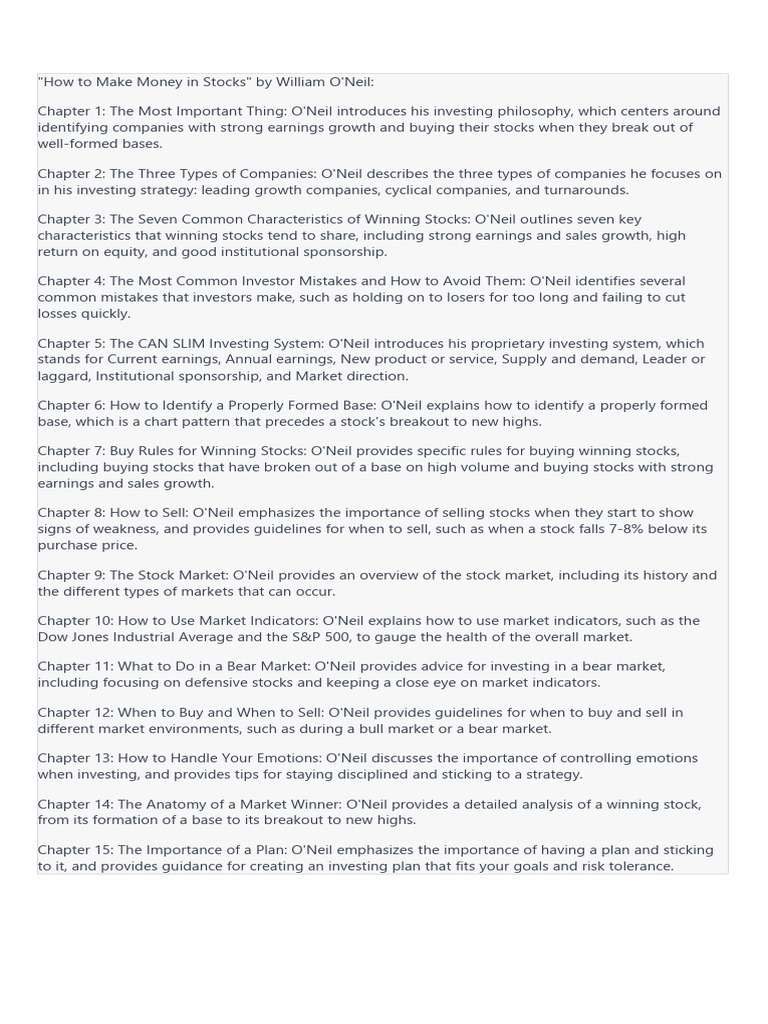

To truly understand how to start making money with stocks, you must educate yourself. Numerous resources are available, including books, online courses, and forums dedicated to stock trading. One highly regarded resource is the book titled How To Make Money in Stocks. This book provides insights and methodologies for successful investing, making it a great starting point for novices and experienced investors alike.

Essential Concepts in Stock Investment

Here are some critical concepts to grasp to facilitate your understanding and execution of how to start making money with stocks:

2. Diversification

Diversifying your stock portfolio is one of the most effective strategies for minimizing risk. By spreading your investments across various sectors, you can protect yourself against significant losses. If one industry suffers, your others may still perform well, balancing out your overall portfolio. Many investors recommend holding a mix of stocks from different market sectors including technology, healthcare, and finance.

3. Long-Term Perspective

Another crucial aspect of learning how to start making money with stocks is maintaining a long-term perspective. The stock market can be volatile in the short term, and prices may fluctuate drastically due to various factors. However, history has shown that markets tend to increase in value over time. By investing with a long-term mindset, you can avoid the pitfalls of reactionary trading based on short-term market movements.

The Role of Research in Successful Stock Investment

4. Perform Due Diligence

In your quest to learn how to start making money with stocks, it’s essential to conduct thorough research before making any investments. Analyze a company’s financial statements, earnings reports, and industry conditions. Understanding the health of a company and its potential for growth can provide insights that guide your investment decisions.

5. Follow Market Trends

Keeping an eye on current market trends can also aid your ability to make informed decisions about stock purchases. Awareness of economic indicators, changes in interest rates, and market sentiment can provide context for the stocks you are considering. By understanding these factors, you may identify potential investment opportunities that align with your financial goals.

Building Your Stock Portfolio

As you embark on your journey to learn how to start making money with stocks, building a solid stock portfolio is vital. Here are some guidelines to help you construct a portfolio that aligns with your risk tolerance and investment objectives:

6. Initial Investment

Your initial investment can pave the way for future success. Start by investing an amount you feel comfortable with, ensuring that you have a solid financial foundation. Ramping up gradually allows you to learn and adapt without exposing yourself to undue risk.

7. Monitor Your Investments

Once your portfolio is established, continuous monitoring is crucial. Regularly check the performance of your stocks and review your investment strategies. If certain stocks are consistently underperforming, it may be time to reassess or sell that investment. The market is dynamic, and being proactive will help you stay ahead.

Psychological Aspects of Investing

8. Manage Your Emotions

Investing can be an emotional rollercoaster given the unpredictable nature of the stock market. It is essential to manage your emotions, especially during market downturns. Learning how to start making money with stocks involves staying calm, sticking to your strategy, and resisting the urge to make impulsive decisions based on fear.

9. Seek Professional Guidance

If you feel overwhelmed, consider seeking advice from financial advisors who specialize in stock investments. A professional can provide tailored strategies based on your financial position and goals, making the road to investing easier and more informed.

Utilizing Technology for Stock Investing

In today’s digital age, technology provides numerous tools and platforms that can assist you in your investment journey:

10. Investment Apps

Various investment apps allow you to track the stock market in real time, buy and sell shares with ease, and analyze market statistics. These tools can simplify the process and provide immediate access to important market data, enabling you to make informed decisions more conveniently.

11. Online Brokerages

Engaging with online brokerages can significantly reduce the cost associated with stock trading. Many platforms offer commission-free trading, making it cheaper to buy and sell stocks as you learn how to start making money with stocks. Research different brokerages to find one that aligns with your needs.

Conclusion: Your Path to Successful Stock Investment

Understanding how to start making money with stocks is challenging yet incredibly rewarding. The journey involves continuous learning, strategic planning, and emotional resilience. By applying the strategies discussed in this guide, conducting thorough research, and utilizing available resources, you can take confident steps toward achieving your investment goals.

Remember, the stock market is not just a place for trading; it’s an avenue for wealth creation and financial independence. Embrace the learning process, stay informed, and keep your long-term objectives in mind as you navigate this exciting journey.