In today’s fast-paced world, understanding how to manage personal finance is essential for achieving financial stability and independence. Many individuals find themselves overwhelmed by debt, unsure of how to budget effectively, or struggling to save for future goals. This article aims to provide you with a comprehensive guide on how to manage personal finance, offering practical tips, strategies, and resources to improve your financial situation.

Understanding the Basics of Personal Finance

To effectively manage personal finance, it is crucial to understand the fundamental concepts that underpin financial management. These include budgeting, saving, investing, and planning for retirement. By grasping these concepts, you can create a strong foundation upon which to build and enhance your financial wellbeing.

Budgeting: The Cornerstone of Financial Management

One of the first steps on how to manage personal finance is to establish a solid budget. A budget serves as a roadmap for your spending and saving habits, ensuring that you live within your means while still allocating funds for your goals.

- Track Your Income: Determine your total monthly income, including salary, side hustles, and any other sources of revenue.

- List Your Expenses: Categorize your expenses into fixed (like rent) and variable (like groceries), allowing you to see where your money goes.

- Set Financial Goals: Identify short-term and long-term financial goals to prioritize your spending and saving efforts.

Creating a budget may involve some trial and error, but refining it over time will lead to a more robust understanding of how to manage personal finance effectively.

Saving: Building Your Financial Safety Net

Another critical component of how to manage personal finance is establishing a savings plan. Savings provide a financial cushion for emergencies and enable you to work toward larger financial objectives. Here are some strategies to bolster your savings:

Create an Emergency Fund

An emergency fund is vital for financial security. Aim to save at least three to six months’ worth of living expenses in a separate account. This fund can help you handle unexpected expenses without resorting to debt.

Automate Your Savings

Consider setting up automatic transfers from your checking account to your savings account. This strategy ensures that you pay yourself first and helps to foster a saving habit without requiring ongoing effort.

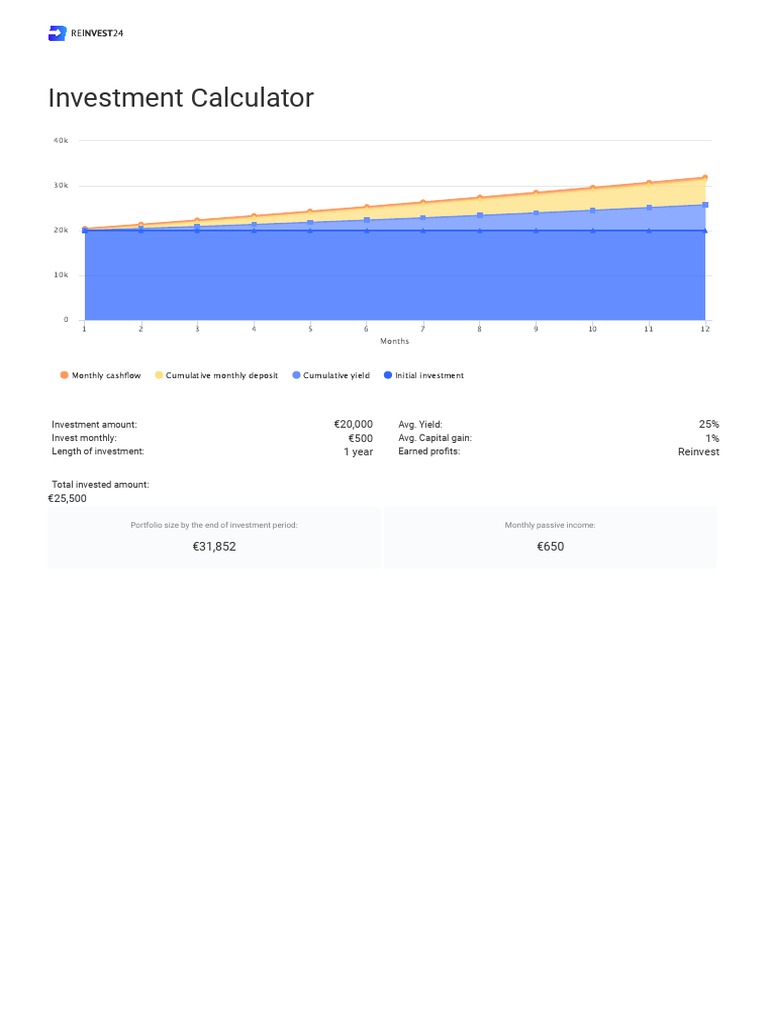

Investing: Making Your Money Work for You

Understanding how to manage personal finance also involves learning about investing. While saving is essential, investing can help you grow your wealth over time. Here are some basic principles to consider:

Diversification

Diversifying your investment portfolio—spreading your investments across different asset classes—can help reduce risk. By investing in a mix of stocks, bonds, and other investment vehicles, you can cushion the impact of market volatility.

Long-term Mindset

Investing should be viewed as a long-term endeavor. As a rule of thumb, avoid making impulsive decisions based on market fluctuations. A steady, well-researched approach typically yields better results over time.

Retirement Planning: Securing Your Future

Part of knowing how to manage personal finance is planning for your retirement. Start by contributing to retirement accounts such as a 401(k) or an IRA. Many companies offer matching contributions, which can significantly increase your savings over time.

Understanding Retirement Accounts

Familiarize yourself with different retirement accounts, their benefits, and how compound interest works. The sooner you begin saving for retirement, the more your money can grow, thanks to the power of compounding.

Educating Yourself and Seeking Help

Education is a continuous journey in personal finance management. Whether you are a financial novice or an experienced individual, staying updated on best practices is crucial.

The Role of Financial Advisors

Consider consulting a financial advisor if you feel overwhelmed. An advisor can provide personalized guidance on how to manage personal finance, helping you create a sustainable financial plan tailored to your unique circumstances.

Image: Personal Finance Management Tools

This image represents various tools and resources available for managing personal finance effectively. Explore the link for more insights.

Common Mistakes to Avoid

While learning how to manage personal finance, be aware of common pitfalls that people often encounter:

- Ignoring Debt: Failing to address accumulating debt can lead to severe financial strain. Prioritize paying off high-interest debts first.

- Living Beyond Your Means: It’s essential to stick to your budget and avoid lifestyle inflation, particularly as your income increases.

- Neglecting Financial Goals: Without clear goals, it’s challenging to measure progress and make necessary adjustments to your financial plan.

Conclusion: Taking Control of Your Financial Destiny

Ultimately, understanding how to manage personal finance is key to achieving financial independence and security. By adopting the strategies outlined in this article, such as effective budgeting, disciplined saving, prudent investing, and comprehensive retirement planning, you set yourself up for a healthier financial future. Remember, the journey may be challenging at times, but with diligence and a commitment to learning, you can take control of your financial destiny.

For further insights and resources on managing your personal finances, consider exploring additional literature and online courses that specialize in this vital area of expertise.