Are you feeling overwhelmed with your finances? You’re not alone. Managing money can be difficult, but it doesn’t have to be! By learning how to manage money on Excel, you can simplify your budgeting process, track your expenses, and set financial goals with ease. This guide will provide you with the tools and insights you need to harness the power of Excel for your personal finance management.

Understanding the Basics: How to Manage Money on Excel

In today’s fast-paced world, it’s essential to have a handle on your finances. Excel is a powerful tool that can help you organize your spending and savings effectively. First, you’ll want to familiarize yourself with the basic functions and features of Excel that are helpful for financial tracking. Creating a simple spreadsheet can be one of the first steps in learning how to manage money on Excel.

Creating Your First Budget Spreadsheet

Getting started with a budget spreadsheet is relatively easy. Open a new Excel worksheet and dedicate columns for different categories such as:

– Income

– Fixed Expenses (like rent or mortgage)

– Variable Expenses (like groceries or entertainment)

– Savings and Investments

For each category, enter your projected amounts at the beginning of the month and then track actual spending as the month progresses. Excel allows you to calculate totals using straightforward formulas. A key formula to know is the SUM function, which can help you quickly determine how much you’re spending in each category.

The Benefits of Using Excel for Managing Money

Learning how to manage money on Excel offers several advantages. Here are some reasons why Excel is an excellent choice for personal finance management:

- Customizability: You can create a spreadsheet tailored to your financial needs, whether it’s a strict budget or a simple overview of your investments.

- Easy updates: As your financial situation changes, adjusting your spreadsheet is a breeze.

- Data analysis tools: Excel offers features like charts and graphs that help visualize your spending habits and trends over time.

Once you dive in, you’ll find that managing your money becomes less of a chore and more of an insightful activity that can provide a clearer picture of your financial health.

Visualizing Your Finances: How to Manage Money on Excel with Charts

While tables of data are useful, visual representation can make it far easier to understand your financial situation. Excel charts and graphs can provide clarity when you’re trying to analyze where your money goes each month. You can create pie charts to illustrate spending categories or line graphs to track savings progress over time.

Customizing Graphs for Personal Use

To create a visual representation of your data:

- Select the data you want to include in your chart.

- Navigate to the “Insert” tab and choose the type of chart that best represents your data.

- Customize your chart with colors and labels to make it user-friendly.

By using these visual tools, you’ll more easily discover patterns in your finances and better understand how to manage money on Excel effectively.

Setting Financial Goals: How to Manage Money on Excel

Establishing financial goals is a vital part of managing your money. Whether you’re saving for a vacation, looking to pay off debt, or trying to create an emergency fund, Excel can assist you in tracking progress towards your goals.

Goal Tracking in Your Spreadsheet

Create a new section within your budget spreadsheet dedicated to financial goals. List out your goals alongside the amounts you need to save each month to achieve them. Tracking these figures on a regular basis helps you stay accountable and motivates you to reach your financial aspirations.

Consider setting SMART goals — Specific, Measurable, Achievable, Relevant, and Time-bound. This approach will clarify what you’re working towards and help maintain focus.

Utilizing Templates: How to Manage Money on Excel

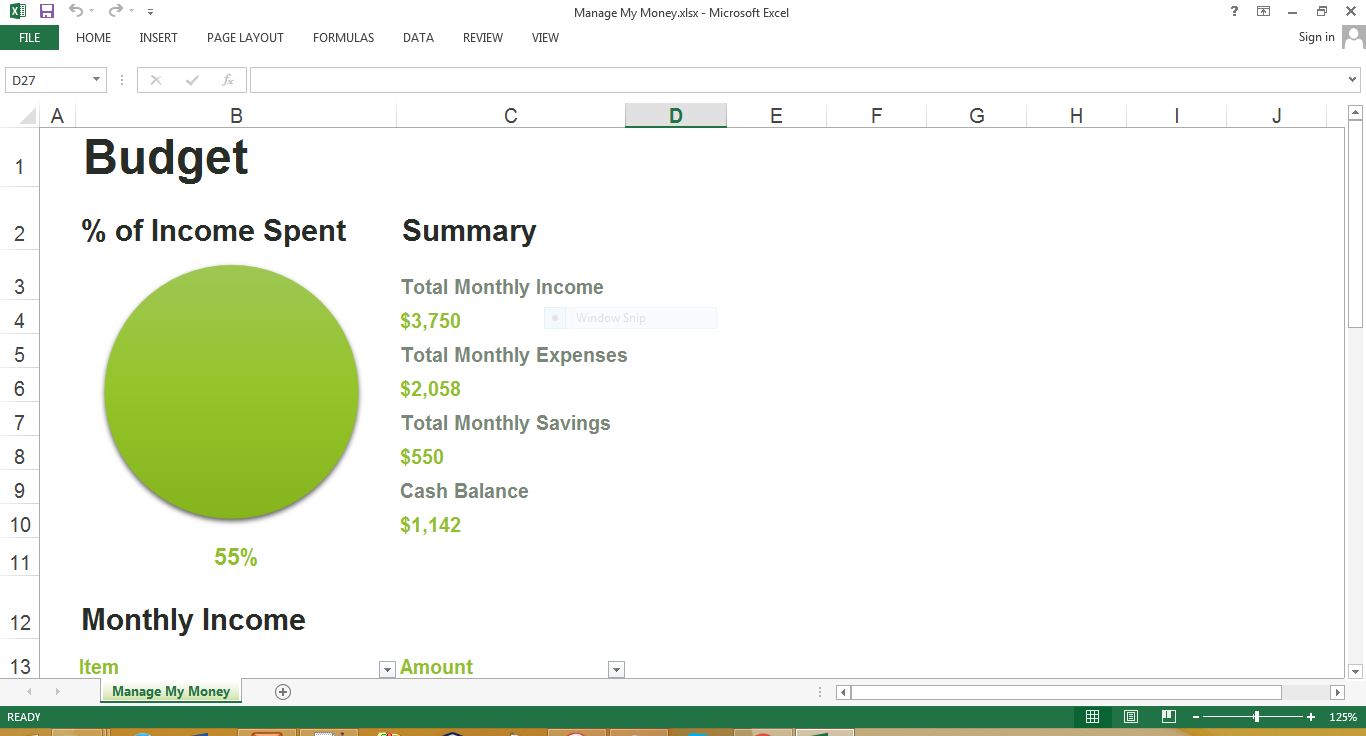

Manage My Money Excel Template

There’s no need to start from scratch; numerous pre-designed Excel templates are available that can jumpstart your budgeting efforts. These templates typically come equipped with formulas and formatting, allowing you to dive right into managing your finances.

To find templates, simply search online for “Excel budgeting templates”. Customize them according to your financial situation, and before you know it, you’ll be managing your money on Excel like a pro!

Examples of Useful Templates

- Monthly Budget Planner: A comprehensive template that includes income, expenses, and even a savings tracker.

- Expense Tracker: Perfect for those who want to gain a quick overview of monthly costs.

- Debt Payoff Tracker: Helps you stay motivated as you work towards eliminating debt.

The Power of Formulas in Excel for Managing Money

Mastering Excel means knowing how to utilize its formulas effectively. When you know how to manage money on Excel with formulas, you tap into a powerful way to make calculations automatic and reduce errors. Here are some essential formulas:

- SUM: Add up total expenses and income easily.

- AVERAGE: Calculate average spending in any given category.

- IF: Use conditional statements to track whether you are within budget or over in a certain category.

These formulas can significantly streamline your budgeting process and help you keep your financial information organized and accurate. Understanding these can be crucial for anyone serious about how to manage money on Excel.

Regularly Reviewing Your Finances

It’s essential to revisit your budget and goals regularly. Set aside time at the end of each month to compare your planned budget against your actual spending and adjust as needed. This practice not only fosters accountability but also keeps you aware of your financial status.

Creating an Action Plan

After analyzing your monthly performance, create an action plan for the next month. Set specific targets for spending and savings based on your past performance. Staying proactive will aid you in better managing your money and adjusting to fluctuations in your income or expenses.

Conclusion: Empower Yourself by Learning How to Manage Money on Excel

Managing your finances can feel daunting, but with the help of Excel, you can take control of your financial health. From budget planning to setting and tracking financial goals, learning how to manage money on Excel opens up a world of possibilities. Dive in, utilize the tools available, and equip yourself with the knowledge needed to make informed financial decisions. Remember, the journey to financial security starts with understanding where your money goes!

By taking these steps, you’ll soon find that you’re not just managing your money—you’re mastering it. With a little practice, you’ll be more than prepared for whatever financial challenges come your way. Happy budgeting!