When it comes to achieving financial freedom, passive income is a game changer. Whether you’re hustling day in and day out or just looking to create some extra income streams, understanding how to make your money work for you can be a real blessing. In this post, we’re diving deep into the world of passive income with a focus on real estate investments, specifically through Real Estate Investment Trusts (REITs), and some essential rules to snag that money-making opportunity while you sleep. Let’s get into it!

Perfect Passive Income Real Estate Investment – REITs

First up, let’s talk about REITs. Now, if you’re wondering what REITs are, allow me to break it down for you. Real Estate Investment Trusts are companies that own, operate, or finance income-producing real estate across a range of property sectors. Just think of it as a way for you to invest in real estate without needing to buy the property directly. This means you can earn passive income through rental properties without dealing with the hassle of property management.

With REITs, you’re essentially buying shares in a portfolio of real estate ventures. This strategy is especially great for those who want to diversify their investments but may not have the capital to invest in physical properties themselves. It’s like joining a community where everyone chips in together to own a piece of something much bigger than themselves.

One of the best parts about investing in REITs is that they have a legal obligation to distribute a majority of their taxable income to shareholders in the form of dividends. So, not only do you get the potential for appreciation in your investment, but you also receive regular payouts. That’s what we call a win-win situation!

However, like any investment, it’s crucial to do your homework. Look for reputable REITs with a solid track record, and make sure they’re aligned with your financial goals. Some may focus on commercial properties, while others might specialize in residential ones. Understanding the market trends and the specific REIT’s portfolio will give you a clearer picture of what to expect.

8 Rules to Consider While Planning to Earn Passive Income From Real

Alright, let’s break down some essential rules you should keep in mind when planning to earn that passive income. Following these guidelines can set you on the right path to creating a steady revenue stream.

1. Start with Your Why:

Before you dive in, clarify your motivations for wanting passive income. Whether it’s to retire comfortably, fund your child’s education, or take that dream vacation, knowing why you’re investing will help keep you focused and motivated.

2. Diversify Your Investments:

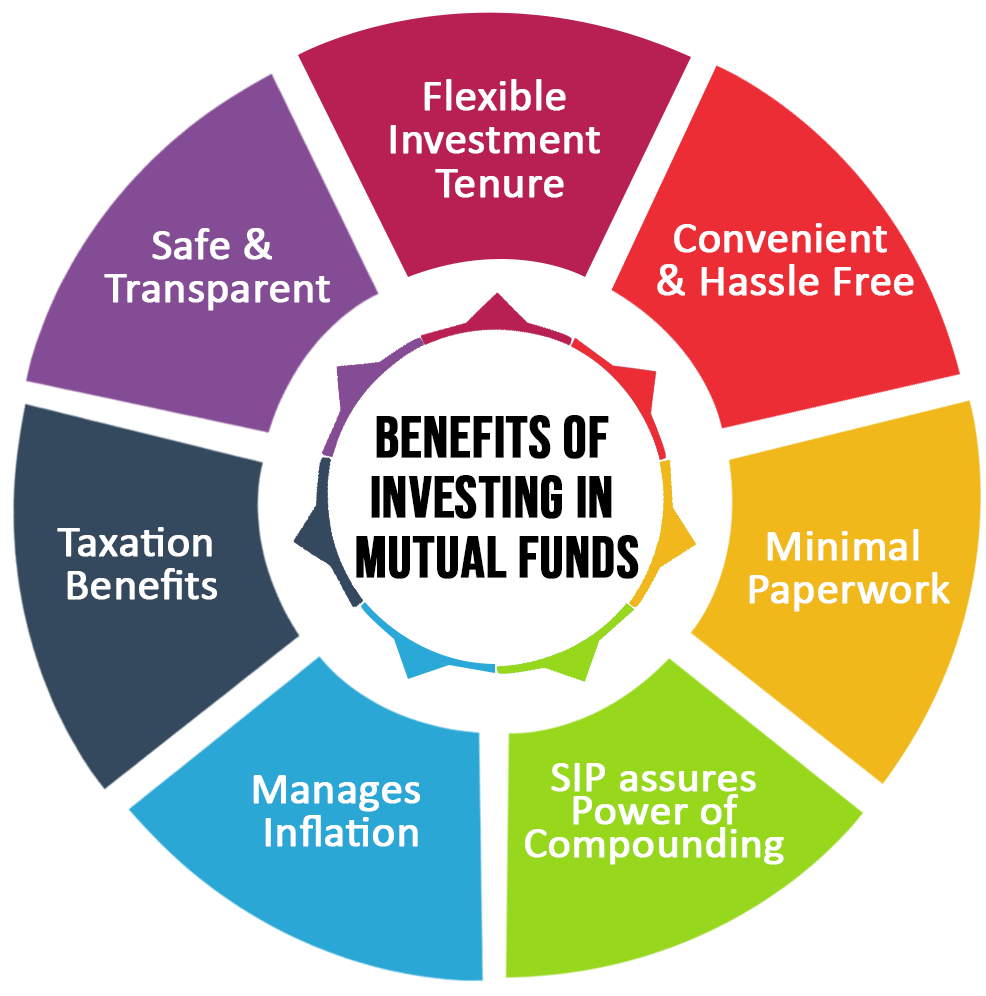

Don’t put all your eggs in one basket! Spread your investments across different types of assets, whether it’s REITs, stocks, bonds, or even starting a side hustle. Diversifying helps minimize risk and increases your chances of generating stable income.

3. Choose Wisely:

When choosing your REITs or any investment, do your research. Look at the performance history, the management team, and the underlying assets. A solid investment likely means solid returns.

4. Monitor Your Progress:

Once you’ve invested, keep an eye on your investments. Review them periodically to assess their performance and make adjustments as necessary. This proactive approach will help you stay on track to reach your financial goals.

5. Reinvest Your Earnings:

One of the best strategies for building long-term wealth is to reinvest the dividends or earnings you receive. Many people overlook this step, but it can significantly amplify your returns over time.

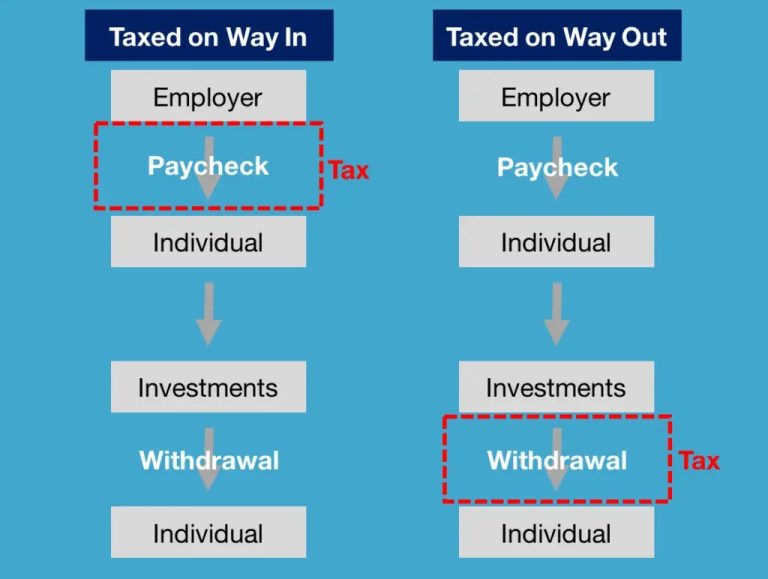

6. Understand the Tax Implications:

Different investments come with different tax obligations. Be sure you’re aware of how your earnings will be taxed and explore potential tax-saving strategies available to you.

7. Patience is Key:

Creating streams of passive income takes time. Don’t get discouraged if you don’t see immediate results. Stick with your strategy, and be patient. Over time, your perseverance will likely pay off.

8. Keep Learning:

The world of investing is always changing. Stay informed and continue to educate yourself about new opportunities and best practices. Knowledge is power, and the more you learn, the better decisions you’ll make.

In conclusion, passive income through real estate investments, especially via REITs, offers an incredible opportunity to build wealth over time. Following the key principles and guidelines can set you on the right path to generating that extra income while freeing up your time to focus on what truly matters in life. Whether you’re looking to buy your first REIT or are already on your journey to financial independence, remember that every step counts. Keep pushing forward!

Remember, the road to financial success isn’t a sprint; it’s a marathon. Stay committed, keep learning, and enjoy the journey toward building that passive income stream. You got this!