In today’s financial landscape, mutual funds have emerged as a popular investment vehicle, offering individuals an opportunity to diversify their portfolios and gain exposure to various asset classes. These funds pool money from multiple investors to purchase a wide range of securities, including stocks, bonds, and other instruments, ultimately aiming to achieve capital appreciation and income generation. For anyone looking to enhance their financial literacy and invest in mutual funds, it is essential to understand the fundamentals of how these funds operate, their advantages, and the methodologies for investing in them.

Introduction to Mutual Funds

Mutual funds are essentially investment programs funded by shareholders that trade in diversified holdings and are professionally managed. Each mutual fund has a specific investment objective that dictates the types of investments it will make. Investors can choose among several categories based on their financial goals, risk tolerance, and investment horizon.

How Are Mutual Funds Structured?

The structure of mutual funds typically consists of three main components: the investors, the fund itself, and the asset management company (AMC). Investors contribute funds to purchase shares in the mutual fund. The value of these shares fluctuates based on the performance of the underlying assets within the fund. The AMC manages the funds, making investment decisions in accordance with the fund’s stated objectives. This professional management aspect is one of the many advantages that attract investors to mutual funds, especially those who may not have the time or expertise to manage their portfolios personally.

Types of Mutual Funds

Mutual funds can be broadly categorized into several types. Understanding these categories helps in making informed investment decisions. Here are the primary types of mutual funds:

- Equity Mutual Funds: These funds primarily invest in stocks and aim for high returns over the long term. They are suitable for risk-tolerant investors seeking capital growth.

- Debt Mutual Funds: Investing in fixed-income securities, these funds are designed for providing regular income with relatively lower risk, making them popular among conservative investors.

- Hybrid Mutual Funds: These funds invest in a mix of equities and fixed-income securities, providing a balance of risk and return.

- Index Funds: These funds aim to replicate the performance of a specific market index, offering a relatively passive investment strategy.

- Sectoral and Thematic Funds: These funds focus on specific sectors of the economy, allowing investors to gain exposure to particular industries.

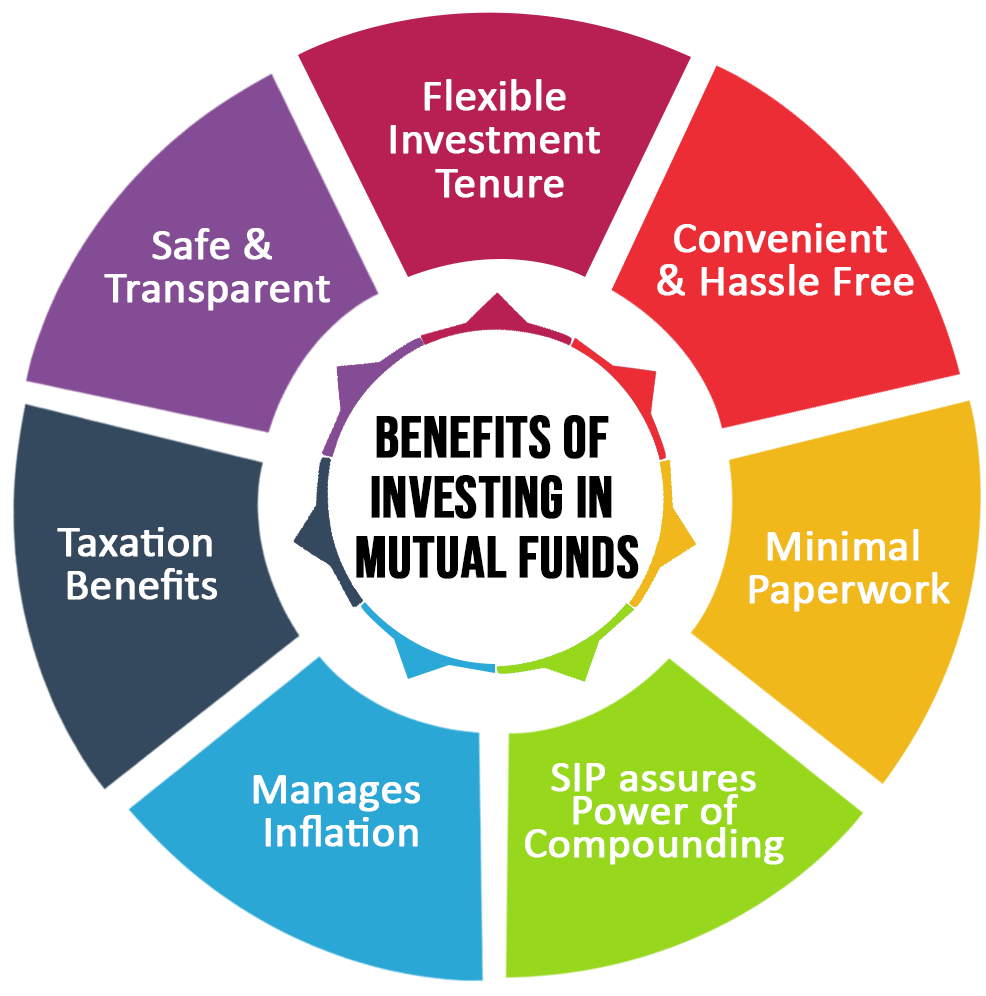

Benefits of Investing in Mutual Funds

Investing in mutual funds comes with several advantages that make them an attractive option for investors of all levels. Some of the key benefits include:

- Diversification: By pooling resources, mutual funds enable investors to achieve a diversified portfolio with a relatively small amount of money, reducing the risk associated with individual stocks or bonds.

- Professional Management: Fund managers, equipped with expertise and resources, actively manage the investments, which is especially beneficial for those who lack the time or knowledge to invest individually.

- Liquidity: Most mutual funds allow investors to buy and sell their shares at the end of each trading day, making it easier to access funds when needed.

- Affordability: Many mutual funds have low minimum investment requirements, making them accessible to a wide range of investors.

- Regulatory Oversight: Mutual funds are regulated by financial authorities, ensuring transparency and protecting investor interests.

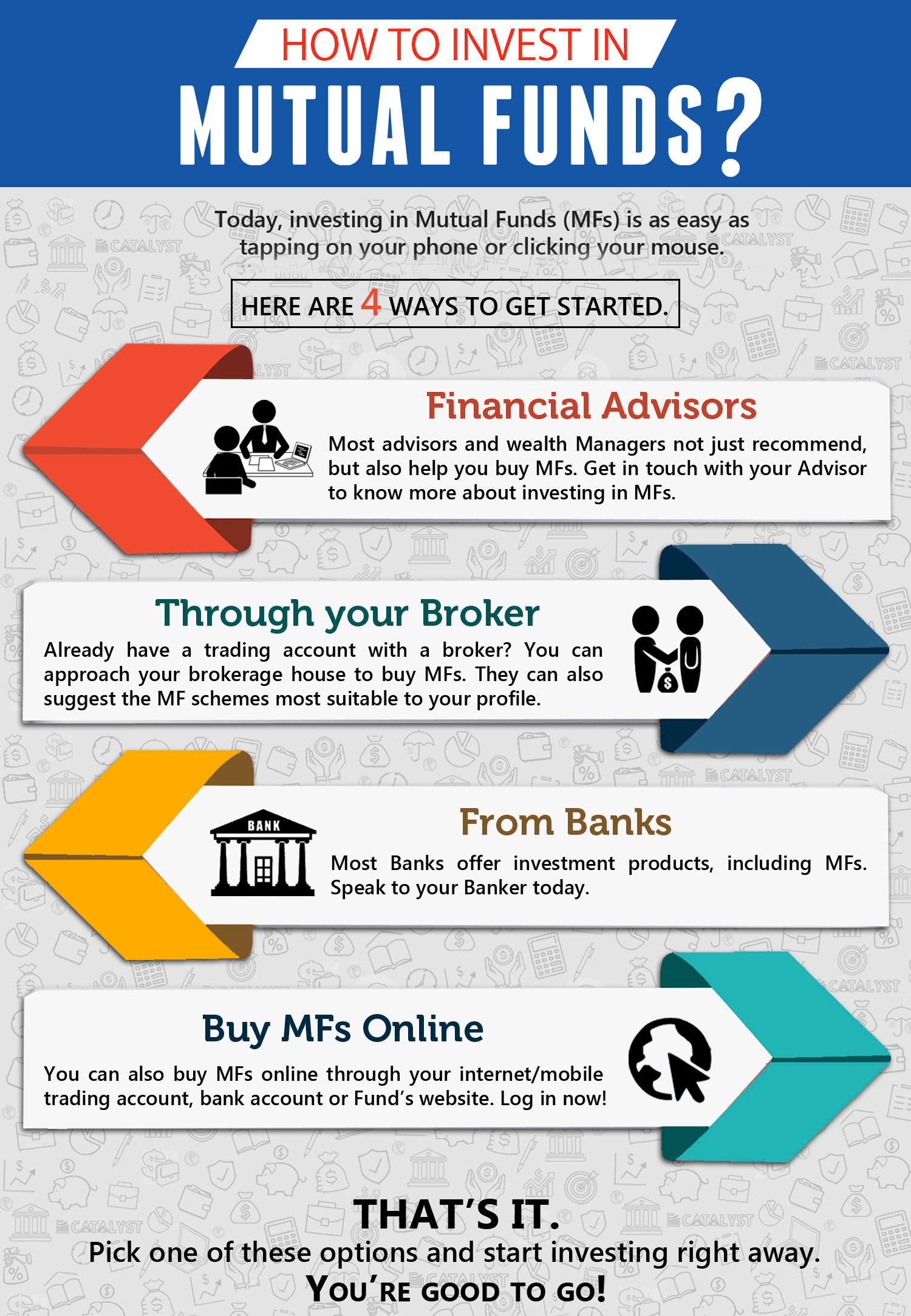

How to Invest in Mutual Funds

Investing in mutual funds is a straightforward process, but potential investors should follow a few key steps to ensure a successful investment experience:

- Assess Your Financial Goals: Before investing, it’s essential to determine your investment objectives, risk tolerance, and time horizon.

- Research Funds: Conduct thorough research on various mutual funds, considering their past performance, expense ratios, and investment strategies. Tools like fund comparison websites can be beneficial.

- Choose a Suitable Fund: Based on your research, select a mutual fund that aligns with your goals and risk appetite.

- Open an Account: To invest in mutual funds, you will typically need to open an investment account with an AMC or a financial advisor.

- Complete the Application Process: Fill out the necessary paperwork, provide identification, and deposit funds into your investment account.

- Monitor Your Investments: Regularly review the performance of your mutual fund investments and make adjustments as necessary based on your changing financial situation and market conditions.

Understanding Costs and Fees

While mutual funds offer many benefits, it is crucial to understand the costs and fees associated with investing in these funds. Common fees include:

- Expense Ratios: The annual fee that all funds or ETFs charge their shareholders, expressed as a percentage of assets under management. A lower expense ratio can enhance overall investment returns over time.

- Sales Loads: Some funds charge a fee when you buy (front-end load) or sell (back-end load) shares. These fees can reduce your overall investment return.

- Redemption Fees: If you sell your shares within a specific time frame, some funds impose a redemption fee to discourage short-term trading.

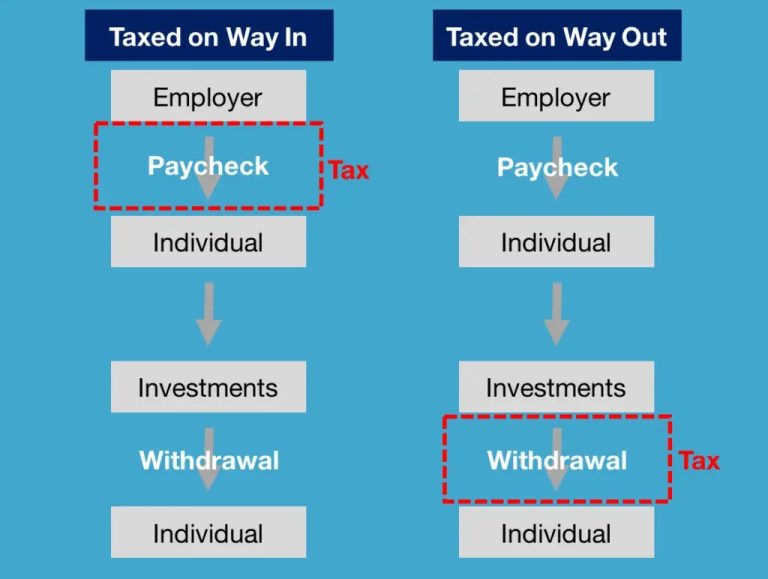

Tax Implications of Mutual Fund Investments

Understanding the tax implications of mutual fund investments is vital for effective tax planning. Mutual funds can generate capital gains, which are typically taxable events. Capital gains distributions may occur when the fund manager sells securities within the fund for a profit, and these gains are passed on to shareholders. Additionally, income generated from dividends may also be subject to taxes. Investors should consult with a tax professional to understand how mutual fund investments may affect their tax obligations.

Conclusion

In summary, mutual funds serve as a practical investment choice for individuals seeking to build wealth over time while balancing risk and return effectively. By understanding the structure of mutual funds, their various types, advantages, and the process of investing, individuals can make informed decisions that align with their financial goals. Moreover, awareness of costs, fees, and tax implications further empowers investors to navigate the complex world of mutual fund investments confidently.