Embarking on a journey of financial security often leads one to consider various investment avenues. For many conservative investors, the appeal of government bonds and private equity funds presents a compelling option. This post explores these investment strategies, highlighting their benefits and what they entail, providing you with essential insights to help you make informed decisions.

Investing in Government Bonds

Government bonds, especially in stable economies, are often considered a safe investment. They provide a predictable return with minimal risk, making them an attractive choice for individuals who prefer a conservative approach. When you buy a government bond, you essentially lend money to the government in exchange for interest payments over a specified period. At the end of the term, the principal amount is returned to you.

The reliability of government bonds stems from their backing by the government, which typically has the power to raise taxes or print money to meet its obligations. For conservative investors, this security is crucial, especially during times of economic uncertainty. Additionally, bonds can offer a hedge against stock market volatility. By maintaining a portion of your portfolio in government bonds, you insulate yourself from the fluctuations that often come with equities.

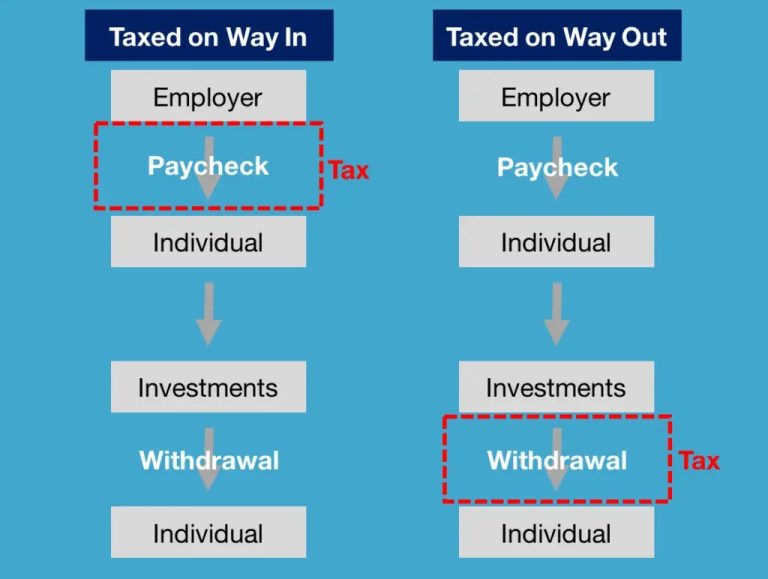

Another significant benefit of government bonds is their tax advantages. Many governments offer tax exemptions or favorable rates on interest earned from these bonds, enhancing the overall return on investment. Furthermore, bonds can be an effective way to diversify an investment portfolio, as they often react differently to economic changes than stocks. By having a balanced mix, you can achieve a more stable performance in your overall financial strategy.

Understanding Astrea PE Bonds

Astrea private equity (PE) bonds represent another appealing option for conservative investors looking for a unique blend of safety and growth potential. Unlike traditional government bonds, PE bonds provide access to a diversified portfolio of private equity funds. This strategy allows investors to partake in the lucrative world of private equity without requiring substantial capital or expertise in the field.

Investing in Astrea PE Bonds enables you to gain exposure to private equity investments that are typically not accessible to individual investors. This diversification can lead to higher returns compared to conventional fixed-income securities. As private equity funds generally invest in a range of businesses, they can capitalize on market inefficiencies and historical trends to generate significant profit. For conservative investors, this means that while there is some level of risk involved, the potential for greater rewards is present. The key here is to balance that risk with a solid understanding of the underlying assets.

Moreover, these bonds are designed with a clear investment strategy. The funds are carefully curated by experienced professionals who understand the market dynamics and identify opportunities that align with your risk tolerance. This aspect mitigates some of the anxiety that often accompanies investing in private equity, particularly for those who prefer to remain conservative in their investment philosophy.

Astrea PE Bonds also come with an additional layer of security often not seen in other investment vehicles. Many of these bonds are backed by a diversified pool of investments, providing a safety net that protects against the underperformance of a single asset. This feature is particularly attractive for conservative investors who want to keep their capital relatively intact while still reaping benefits from potentially higher returns.

It’s essential to note the liquidity aspect of these investments. While government bonds typically offer a straightforward pathway to cash with their set maturity dates, private equity investments, including Astrea PE Bonds, can be less liquid. Understanding your financial needs and possible investment horizon is crucial before diving in. Nevertheless, the long-term benefits can be substantial, making them a worthy consideration for those comfortable with some level of illiquidity.

Combining government bonds with private equity options like Astrea PE Bonds can create a robust investment strategy. This balance allows conservative investors to enjoy stability while also tapping into higher growth potential without exposing themselves to undue risk. It’s all about diversification and aligning your investments with your financial goals and risk appetite.

As you navigate the investment landscape, consider the following factors: your timeline, risk tolerance, and financial objectives. Have an open dialogue with financial advisors or investment professionals and seek their guidance to tailor an investment strategy that meets your specific needs. Overall, understanding both government bonds and private equity options will empower you to make confident decisions in your investment journey.

Ultimately, forging a financial future rooted in sound investment practices can lead to lasting wealth and stability. Whether you choose the guaranteed returns of government bonds or the growth potential of Astrea PE Bonds, it’s vital to remember the importance of informed decision-making and strategic planning in building your investment portfolio. With prudence and a clear strategy, you can successfully navigate the complexities of investing and work towards realizing your financial aspirations.