Investing can often feel overwhelming, especially when trying to understand the distinction between short-term and long-term goals. As we navigate the waters of financial growth, it’s crucial to focus on what we want to achieve in the near future. This guide will provide a comprehensive look at how to invest for short-term goals, ensuring that you have the necessary tools and knowledge to make informed decisions. Whether you’re saving for a major purchase, planning a vacation, or preparing for an upcoming event, understanding the time-frame, scope, and planning behind your investments is paramount.

Understanding Short-Term Goals

Before diving into the specifics of investment strategies, let’s clarify what constitutes short-term goals. Typically, these are objectives you aim to accomplish within one to three years. The nature of these goals often requires a unique approach to investing, differing significantly from long-term strategies which might involve stocks or retirement accounts. Knowing how to invest for short-term goals means selecting reliable options that provide liquidity and low risk while still allowing for some growth.

Setting Clear Financial Objectives

To effectively determine how to invest for short term goals, you must first identify your precise objectives. Ask yourself what you want to achieve and when. For instance, if you’re planning a wedding in two years, you need to know how much money you’ll require and when you need it. This clarity will guide your investment choices. Additionally, consider factors such as your risk tolerance and the time you can devote to managing your investments. Each of these elements plays a vital role in the success of your financial plan.

Investment Vehicles for Short-Term Goals

When thinking about how to invest for short-term goals, it’s important to explore various investment vehicles that align with your needs. Here are some popular options:

1. High-Yield Savings Accounts

One of the safest places to park your cash for short-term goals is a high-yield savings account. These accounts not only provide the security of traditional savings but often come with higher interest rates. This allows your money to grow without taking on substantial risks. It’s an excellent choice if you anticipate needing access to your funds within a couple of years.

2. Certificates of Deposit (CDs)

Certificates of Deposit are time-bound deposits offered by banks that typically offer higher interest rates than regular savings accounts. Investing in a CD requires you to lock your money away for a set period, which can range from a few months to several years. CDs are ideal for short-term goals, particularly if you are certain that you won’t need to withdraw the funds during the term. Understanding how to invest for short-term goals should include evaluating how much you can commit and for how long.

The Importance of Diversification

While focusing on how to invest for short-term goals, it’s essential to consider the importance of diversification. Just as with any investment strategy, spreading your risk across different assets is crucial. This means you shouldn’t put all your funds into a single high-yield savings account or a single CD. Instead, consider allocating your resources into a mix of these safe options, while perhaps adding a small percentage to low-risk stocks or mutual funds that have a history of stability.

3. Money Market Accounts

Money market accounts offer a higher interest rate than traditional savings accounts, along with check-writing privileges and debit cards for easy access to your funds. They are often fluid, allowing for quick withdrawals without penalties. This makes them an attractive option for those who need more immediate access to their funds while still aiming to earn a better return than what a standard savings account offers.

Creative Alternatives

There are also more creative alternatives to traditional savings vehicles when contemplating how to invest for short-term goals. Peer-to-peer lending, for example, allows you to earn interest by lending money directly to individuals or businesses through online platforms. While this approach carries some risk, the potential returns can be higher than conventional saving methods. Another option might be investing in short-term bond funds that tend to be less volatile than the stock market.

Preparing for Market Volatility

One crucial aspect of managing your investments, particularly in the short term, is being prepared for market volatility. Economic fluctuations can occur without warning, impacting your investment’s performance. Knowing how to invest for short-term goals means you must regularly review your portfolio and be ready to make adjustments as needed. Monitor your investments closely, and stay informed about market trends that might influence your planned objectives.

Visualizing Your Investment Strategy

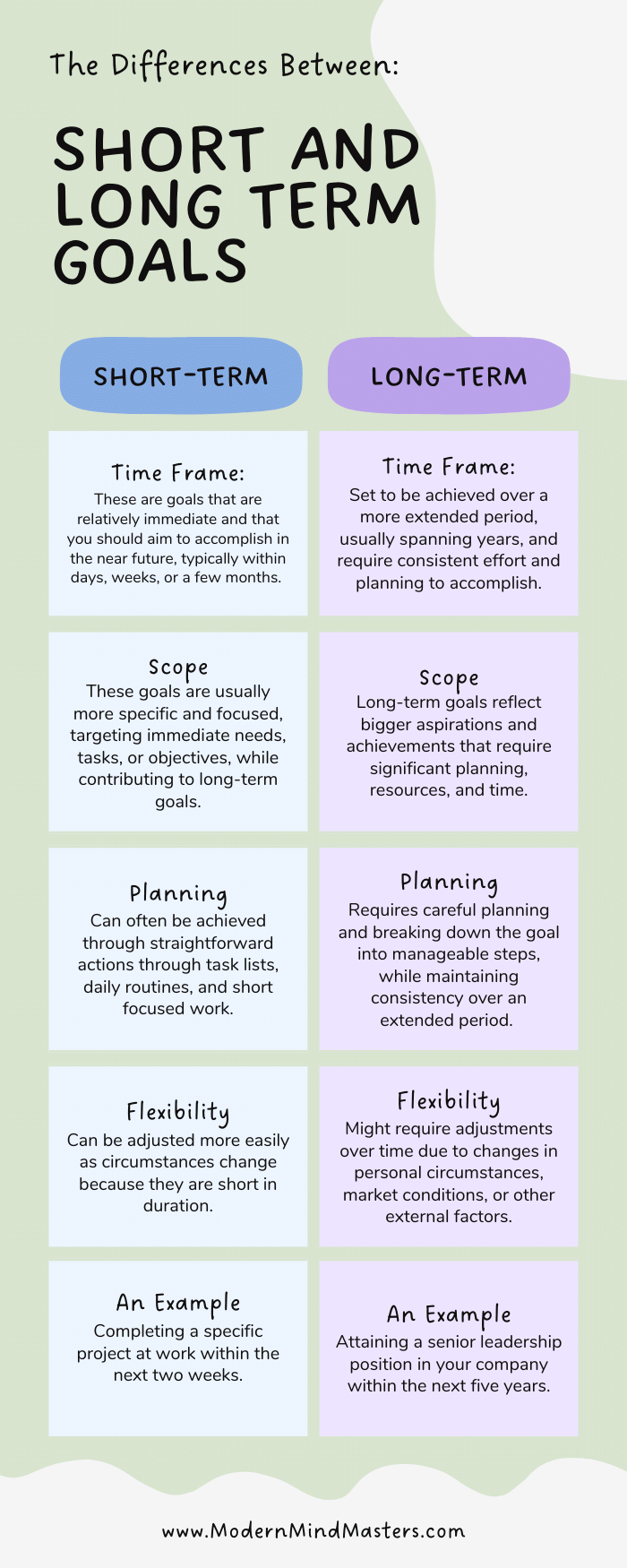

This image helps illustrate the crucial differences between short-term and long-term investment strategies, allowing investors to visualize their financial planning more effectively.

4. Stock Market for Short-Term Goals

While the stock market is typically associated with long-term investing, it can also play a role in your short-term strategy with adequate precautions. Identifying stable and low-volatility stocks can allow for short-term capital growth. However, it’s imperative to understand the risks involved as the stock market can fluctuates significantly. If you’re new to investing and unsure of how to invest for short-term goals, consider starting small and using tools like stop-loss orders to limit potential losses.

Conclusion: Aligning Investments with Goals

In conclusion, mastering how to invest for short-term goals entails a keen understanding of your personal objectives, a solid grasp of the various investment avenues available, and a willingness to adapt as market conditions change. With thoughtful planning, risk management, and diversification, you can successfully align your investments with your financial goals. Remember, the key to successful investing is not just to choose the right avenues but also to stay disciplined and committed to your plan. Whatever your short-term objectives might be, the power to achieve them lies within your ability to strategically manage your investments.

Take the time to educate yourself further, consult with financial advisors if needed, and adjust your strategy as your circumstances evolve. The sooner you begin investing for your short-term goals, the faster you’ll find yourself approaching those milestones.