Imagine waking up each day without the obligation to clock in to a job. Sounds dreamy, right? The concept of FIRE (Financial Independence, Retire Early) offers a roadmap to achieving just that. It’s a lifestyle that combines aggressive saving and investment strategies aimed at reaching financial independence and retiring much earlier than the traditional retirement age. Let’s dive into some critical components of the FIRE movement that promise to help you live your life on your own terms.

Visualizing Your Path to Early Retirement

This image encapsulates the essence of the FIRE movement. It isn’t just about saving; it’s about crafting a life filled with intention and purpose. The foundational goal of FIRE is to build a sustainable financial portfolio that allows you the freedom to walk away from the traditional workforce. By cutting down on unnecessary expenses and saving a massive percentage of your income, you can invest in assets that continue to grow even without your active involvement. The best part? This strategy isn’t about deprivation; it’s about making conscious choices that align with your values and goals.

Diving Deeper into Financial Independence

Understanding financial independence is crucial for anyone considering the FIRE approach. It’s more than just accumulating wealth; it’s about managing your finances in a way that you can choose to work or not work based on your preferences. The journey begins with creating a budget and understanding where your money is going. You need to identify your essential expenses and see where you can cut back.

To begin your path towards FIRE, consider the following steps: First, evaluate your current financial situation. This includes understanding your income, expenses, debt levels, and savings. Next, set clear financial goals. This could be saving a certain amount for retirement, paying off all debt, or accumulating a specific investment portfolio.

Building the Foundation: Saving Aggressively

To achieve financial independence, one method is to save aggressively. This often means aiming to save at least 50% or more of your income. While this may sound impossible, many FIRE adherents achieve this by adopting a frugal lifestyle. Reducing your living expenses significantly can make a world of difference.

Consider where you can cut costs. Are you spending unnecessarily on subscriptions? Can you cook at home more often instead of dining out? Every penny saved is a penny that can be invested. Investing those savings in a diversified portfolio can significantly increase your wealth over time as compound interest works its magic.

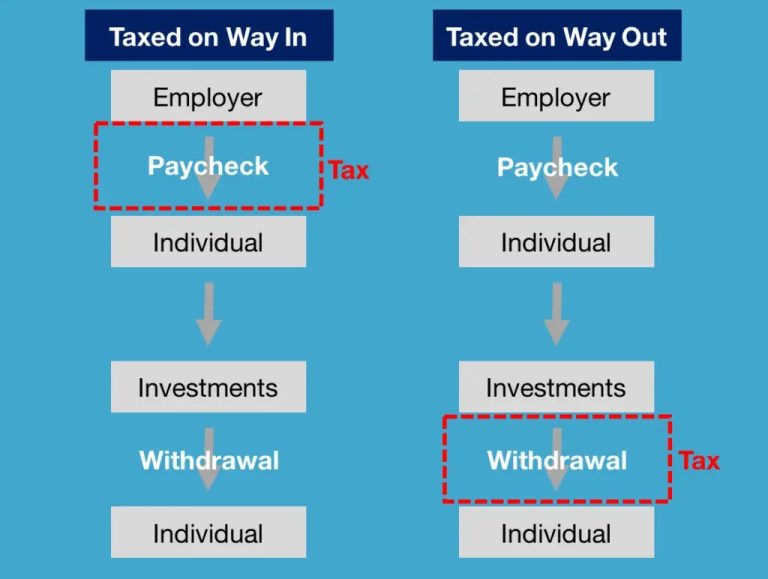

Investing Wisely: Making Your Money Work for You

Once you have a solid saving strategy, it’s essential to make informed investment decisions. Investing isn’t about gambling; it’s about strategically placing your money into assets that have the potential to grow over time. Consider stocks, bonds, real estate, or mutual funds. Each investment avenue comes with its own risk and reward, so it’s paramount to educate yourself on each and find a balance that works for your risk tolerance.

Many people enter the FIRE movement with a 4% rule in mind. This rule suggests that you can withdraw 4% of your investments each year during retirement without depleting your funds. The goal is to accumulate enough savings that investing allows you to live off this annual withdrawal seamlessly.

Creating a Life of Purpose Beyond Work

One of the most rewarding moments in the FIRE journey is the ability to carve out an existence that’s rich and fulfilling, all without the confines of a traditional job. Early retirement does not mean sitting idly; it opens the door to pursue passions and interests that may have been relegated to the sidelines during your working years.

Whether it means traveling, volunteering, starting a new business, or spending more time with family, having the freedom to choose how to spend your days can be incredibly fulfilling. The FIRE movement emphasizes aligning your financial decisions with your life goals, creating a holistic approach to living well.

Additionally, many individuals in the FIRE community build side hustles or part-time endeavors that not only provide additional income but also keep them engaged and passionate about what they do. This approach can be a great way to maintain a sense of purpose while gradually easing into retirement.

The Importance of Community and Education

As you embark on your FIRE journey, connecting with like-minded individuals can be a huge asset. There are numerous resources available, from books and podcasts to online forums and social media groups. By engaging with these communities, you can share experiences, seek advice, and learn from others who have taken similar paths.

Continuous education is key. The financial landscape is always changing, making it crucial to stay informed on investment strategies, market trends, and economic conditions. The more you know, the better equipped you will be to navigate your financial journey successfully.

In closing, the journey to financial independence and early retirement through the FIRE movement is undoubtedly challenging but profoundly rewarding. By saving aggressively, investing wisely, and aligning your financial goals with your passions, the dream of waking up each day on your terms can become a reality. So, take that first step, start building your roadmap, and embrace the empowering journey towards financial freedom!