Oh, the wonderful world of investment! It’s like a buffet where you can pile your plate high with various dishes, but instead of sushi and mashed potatoes, you’re loading up on stocks, bonds, and real estate. But wait! If you actually want to make a profit without heartburn, you might want to diversify your investment portfolio. Let’s dive into this ultimate guide with a few mouthwatering examples!

Diversify Investment Portfolio: Top 5 Ways to Consider

Why put all your eggs in one basket when you could have a whole chicken coop? That’s the essence of diversification! It’s all about spreading your investments to reduce risk. Consider your options carefully: stocks, bonds, commodities, real estate, and that mystical land of mutual funds.

How to Diversify Your Investment Portfolio for Maximum Returns

Ready to embark on this thrilling investment adventure? Here are a few strategies to consider: Imagine diversifying your portfolio as a social gathering where everyone brings a dish to share. If someone accidentally burns their casserole, you’ve still got plenty of delicious options! Similarly, if your stocks tumble, you’ll have bonds and other investments to cushion the fall.

First on the menu: stocks. These little pieces of companies are great, but don’t forget to mix in some growth stocks and dividends-paying stocks. A blend of both can potentially bring you stunning returns while sprinkling a bit of stability on your plate. Then there’s the classic combo of gold and silver—seriously, you can’t underestimate the power of precious metals!

Next, let’s toss in a little real estate. Owning property can be a fantastic way to generate passive income, plus you have the added benefit of appreciating value over time. It’s like planting a money tree that keeps growing! Consider Real Estate Investment Trusts (REITs) if you’re not ready to become a landlord.

And oh boy, how could we forget about those delightful bonds? They may not be as exciting as stocks, but they sure know how to send steady income your way. Think of them as your steady but boring uncle who always brings you cookies for the holidays. They may not create extravagant memories, but will provide a warm, comforting presence!

Of course, you might be asking yourself, “Is that all there is?” Fear not, adventurous investor! Alternatives such as commodities, hedge funds, and cryptocurrencies are also on the menu. Sure, they might be a bit spicy and unpredictable, but they can add some zest to your financial plate.

Remember, the key is balance! Diversifying your portfolio isn’t just about adding as many items as possible. It’s like creating a band; each instrument plays its part in harmony. Too much of one thing can lead to discord, while the right mix can create a beautiful symphony of growth.

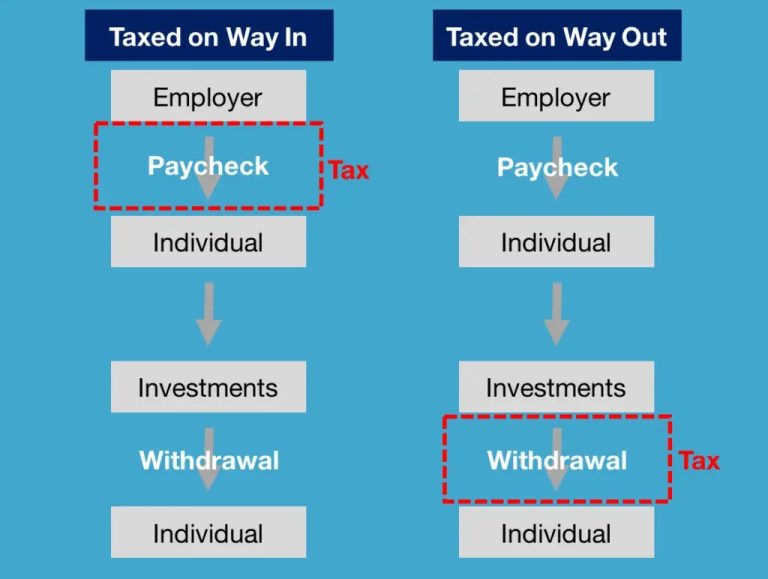

Now that we’ve filled our plate, let’s dig into the tricky waters of risk management! Just like you wouldn’t go kayaking without a life jacket, don’t dive into investments without a solid plan to manage risk. Know your risk tolerance, understand market volatility, and keep an eye on asset allocation! You want a mix that’s right for your personal taste and your financial goals.

Taking action is the next step. It’s easy to read about diversification, but it takes guts to actually do it. Start small, perhaps with fractional shares or low-cost index funds, to test the waters. And remember, investing isn’t a sprint; it’s more like a leisurely Sunday drive through the countryside. Enjoy the scenery, but make sure your car’s running smoothly!

Ah, but let’s not forget the importance of staying educated. The investment landscape is constantly changing, just like trends in avocado toast. Stay informed, read up on market news, and adapt your strategy as needed. It’s like being the DJ at a party—one moment you’re spinning a bop, and the next, you need to switch it up to keep the dance floor moving.

So, there you have it! A rundown of why and how to diversify your investment portfolio. Just like a great recipe, you’ll want to continually tweak and adjust based on your taste. And don’t hesitate to get a little creative while you’re at it! After all, every good investment deserves a sprinkle of innovation and a dash of courage.

To wrap things up, remember that diversification is your friend. There’s no one-size-fits-all, so find the mix that aligns with your financial goals, risk tolerance, and investment timeframe. Happy investing!