Managing finances can be particularly challenging for freelancers, who may face fluctuating income and irregular payment schedules. Therefore, having a robust financial strategy is essential for sustaining a freelance career. Below, we explore valuable freelancer financial planning advice designed to help you maintain control over your financial situation while maximizing opportunities.

Essential Freelancer Financial Planning Advice

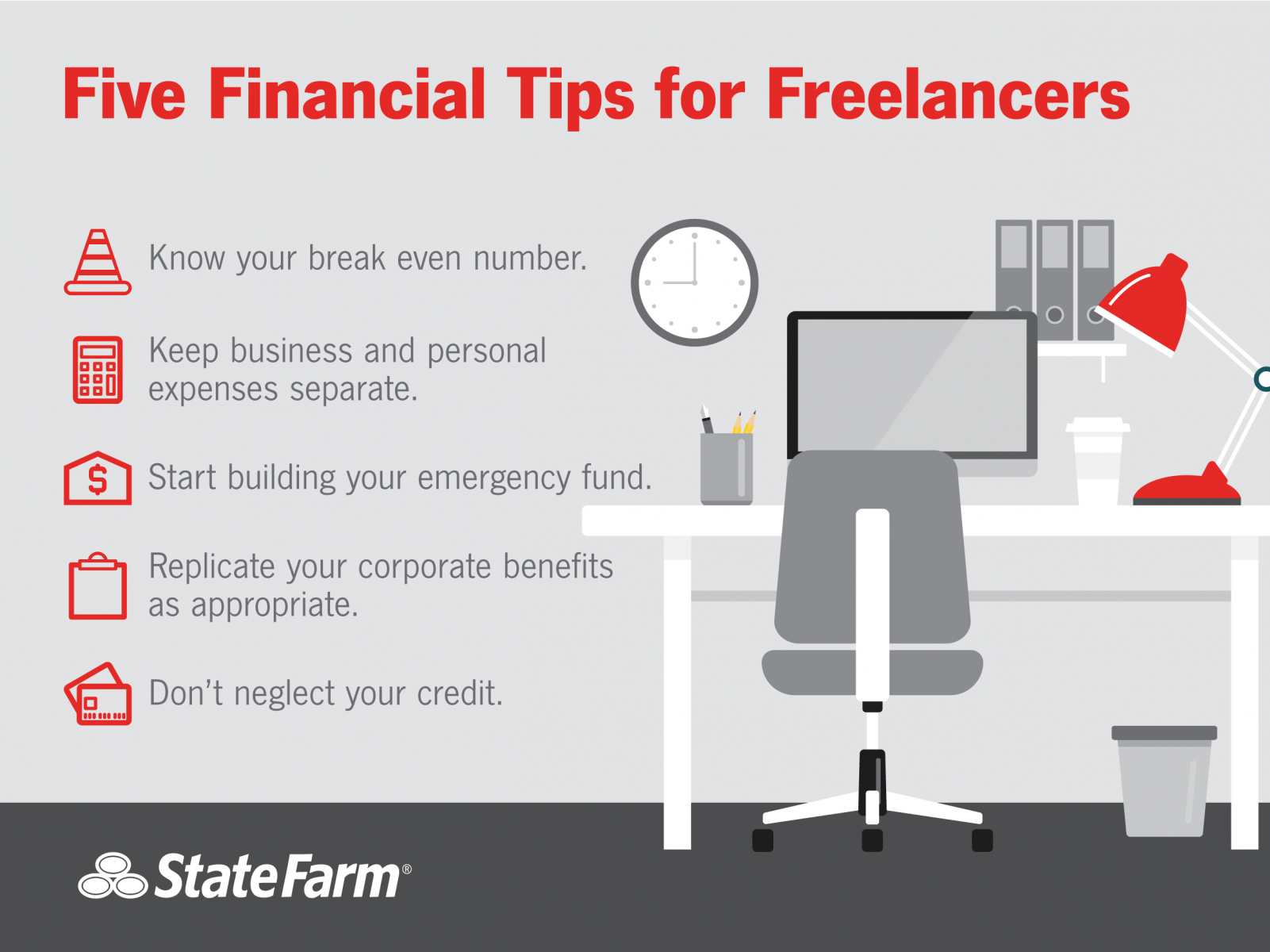

This image encapsulates some crucial financial tips that freelancers should consider. It serves as a visual guide highlighting the importance of budgeting and saving strategies tailored for those who work independently.

Understanding Your Income: A Fundamental Freelancer Financial Planning Advice

The first step in effective freelancer financial planning is to gain a thorough understanding of your income stream. Unlike traditional employees, many freelancers earn varying amounts each month. This variability can make budgeting challenging. It is advisable to track all incoming payments systematically. Consider using accounting software that can help keep track of invoices, payments received, and anticipated revenues. This practice not only aids in getting a clearer picture of your finances but also helps in planning future expenses efficiently.

In addition, freelancers should establish a minimum income requirement for essential living expenses. By knowing the bare minimum needed each month, you can more confidently plan your work schedule to meet your financial goals. Understanding your income will significantly inform your decision-making processes, making this an indispensable piece of freelancer financial planning advice.

Budgeting: The Cornerstone of Freelancer Financial Planning Advice

It’s easy for freelancers to overlook budgeting, especially during busy periods. However, effective budgeting is one of the cornerstones of sound financial planning. Start by categorizing your expenses into fixed costs (like utility bills and rent) and variable costs (such as groceries and entertainment). This will provide a clearer picture of your financial commitments and reveal areas where you can trim unnecessary spending.

Further, consider setting aside a specific percentage of your income for savings. A common recommendation is to allocate 20% of your earnings to savings or an emergency fund. This fund can act as a safety net during lean months and is invaluable for managing the unpredictability that often accompanies freelance work. Following disciplined budgeting is crucial in establishing a stable financial foundation, making it an essential piece of freelancer financial planning advice.

The Importance of an Emergency Fund in Freelancer Financial Planning Advice

An emergency fund serves as a financial buffer, which is especially critical for freelancers. In an industry where work can be sporadic, a well-stocked emergency fund can make all the difference between financial stability and crisis. Aim to save at least three to six months’ worth of living expenses in this fund.

Having an emergency reserve not only cushions you against unexpected expenses like medical emergencies or home repairs but also allows you to navigate slower business periods without significant stress. Whether it’s to cover basic living expenses or unexpected business costs, prioritizing an emergency fund is a vital tip for freelancer financial planning.

Taxes: Essential Freelancer Financial Planning Advice

Consider utilizing tax software or hiring an accountant who specializes in freelancer needs for accurate tax filing. This is an excellent preventive measure that can help minimize tax-related stress. Keeping detailed records of expenses is equally imperative, as many business-related costs can be deductible, effectively lowering your overall tax burden.

Tax season can certainly be a stressful time, but with the right preparations in place, it can become a manageable process, making this a crucial piece of freelancer financial planning advice.

Retirement Planning: A Strategic Angle of Freelancer Financial Planning Advice

Freelancers often overlook retirement planning, given the immediate concerns of creating income. However, setting aside funds for retirement is essential for long-term financial stability. Explore options like a Simplified Employee Pension (SEP) IRA or a Solo 401(k) which offer tax advantages and can help you save for the future.

Making regular contributions to these retirement accounts should be a top priority. Just as you would deduct tax payments each month, create a separate account dedicated to retirement savings, ensuring that you consistently allot some of your income to these funds.

Implementing an effective retirement strategy early on increases your financial literacy and sets a precedent for a healthier financial future, positioning this as an indispensable element of freelancer financial planning advice.

Insurance: Protecting Your Assets as Part of Freelancer Financial Planning Advice

Financial security also involves protecting what you’ve built through insurance. Freelancers should consider professional liability insurance, health insurance, and even life insurance depending on personal circumstances. These coverage plans provide both peace of mind and financial protection against potential income loss, legal actions, or health-related setbacks.

Having solid insurance coverage is an often-overlooked aspect of financial sustainability. Exploring various providers and understanding different insurance products can empower freelancers to make informed decisions. Therefore, understanding the significance of insurance is an essential part of freelancer financial planning advice.

Investing as Part of Luxury Freelancer Financial Planning Advice

While saving is crucial, investing can brew long-term benefits, making it an integral part of financial planning. Consider allocating a portion of your income towards investment accounts. Stocks, bonds, or even real estate investment trusts (REITs) are potential avenues through which freelancers can grow their wealth over time.

Start small if you’re new to investing and gradually increase your investments as your financial literacy improves. The earlier you begin, the more your investments can grow, so don’t overlook the importance of making investments and creating additional revenue streams as part of your freelancer financial planning advice.

Networking for Financial Growth: Additional Freelancer Financial Planning Advice

Networking can facilitate client referrals and collaborations, directly impacting your income potential. Join freelancer groups, attend industry events, and engage with others on social media platforms to build professional relationships. These connections not only open up avenues for work but also provide insights and experience that enhance your financial literacy and overall planning.

Networking plays a role in ensuring steady business streams and leads to stability, demonstrating its importance in the realm of freelancer financial planning advice.

Maintaining Work-Life Balance as Financial Planning Advice

Lastly, maintain a balanced approach to work and personal life. Overworking not only cumulatively leads to burnout but often affects your decision-making efficiency and financial planning. Ensure you’re allowing yourself time to recharge and evaluate your professional and financial trajectories regularly.

No financial plan can be effective without good mental and physical health. Remember that well-being should be prioritized alongside financial success. Thus, maintaining a balanced lifestyle is a component of holistic freelancer financial planning advice.

In conclusion, following these freelancer financial planning advice strategies can tremendously affect your long-term success as a freelancer. From managing income and taxes to prudent investments and insurance, each element holds significance. With a meticulous plan in place, you can navigate the unique challenges of freelance work while securing your financial future.