In today’s fast-paced world, financial stability is a crucial element of our lives. Whether you’re looking to save for retirement, manage day-to-day expenses, or invest wisely, having a robust financial planning strategy checklist can steer you in the right direction. This guide aims to dive into the essential components of a financial planning strategy checklist, providing you with the tools necessary to achieve your monetary goals.

Understanding Your Financial Planning Strategy Checklist

Before we delve into the specifics of your checklist, it’s important to understand what a financial planning strategy checklist encompasses. Essentially, it’s a detailed roadmap that provides you guidance on what steps to take in managing your finances effectively. It can include various aspects like budgeting, investment planning, personal financial goals, and risk management. Having a clear structure helps ensure you don’t miss critical financial tasks.

Key Components of Your Financial Planning Strategy Checklist

The financial planning strategy checklist will differ based on individual needs, but there are universal elements that are beneficial to everyone. Here’s a deeper look at the components that every financial planning strategy checklist should include:

1. Set Clear Financial Goals

Your journey begins with establishing what you aim to achieve financially. This can range from short-term goals, such as saving for a vacation, to long-term aspirations like buying a home or preparing for retirement. Making your goals specific, measurable, achievable, realistic, and time-bound (SMART) will guide your financial planning journey.

2. Create a Comprehensive Budget

A budget is a fundamental tool in your financial planning strategy checklist. It’s essential to keep track of your earnings and expenses. Include all of your income sources and itemize your expenditures to understand where your money goes. Regularly updating your budget ensures that you can adjust as needed to meet financial goals.

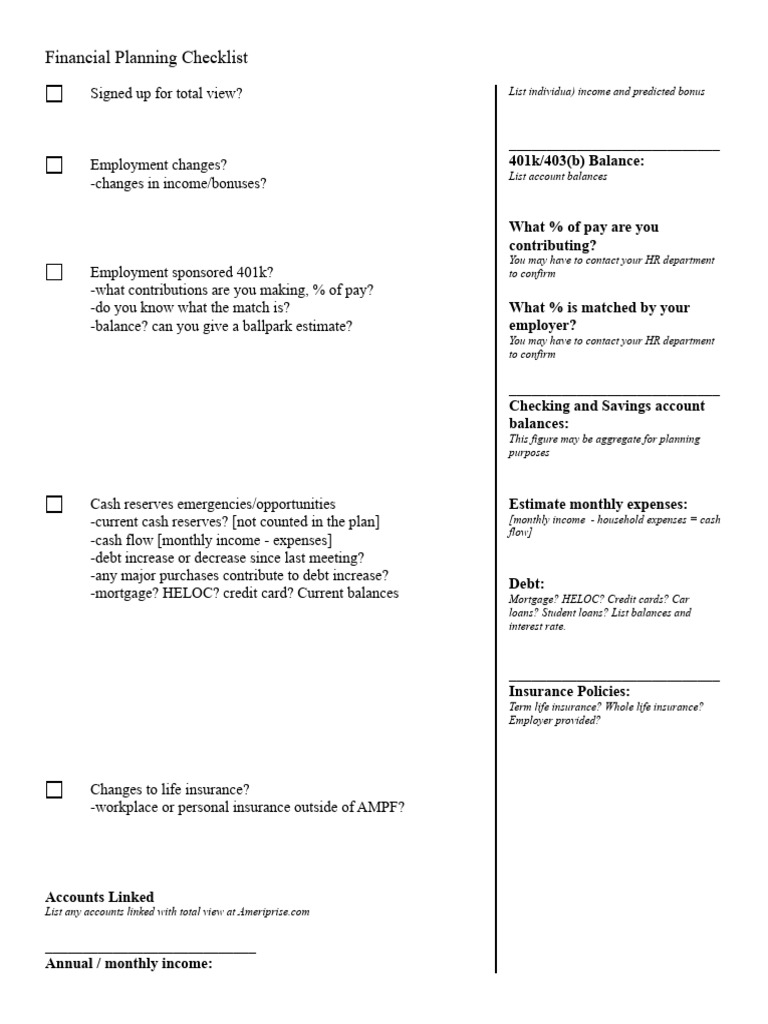

Visualizing Your Financial Planning Strategy Checklist

This image represents a financial planning checklist, serving as a visual aid to help you outline your personalized strategy. Refer to this as a resource to meticulously track your financial goals and maintain adherence to your financial planning strategy checklist.

3. Review and Manage Your Debt

Debt can be a major hurdle in achieving financial stability. It’s crucial to assess your current debts and create a plan to manage or eliminate them. List all debts, including interest rates and minimum payments, and prioritize them based on factors such as urgency and payoff amounts. This element is essential to the financial planning strategy checklist, as managing debt effectively is a key to financial freedom.

4. Build an Emergency Fund

Life is unpredictable, and having an emergency fund ensures you are prepared for unexpected expenses. Aim to save at least three to six months’ worth of living expenses. This financial cushion will provide peace of mind and prevent you from relying on credit during emergencies.

Utilizing Investment Opportunities

Part of your financial planning strategy checklist should highlight investment opportunities. Allocate a portion of your income towards investments that align with your financial goals. Understand different investment vehicles such as stocks, bonds, mutual funds, or real estate to diversify your portfolio and mitigate risk.

5. Insurance and Risk Management

Your financial strategy isn’t complete without considering the unexpected events that could impact your finances. Evaluate your insurance needs including health, auto, home, and life insurance policies. Ensure you have adequate coverage to safeguard your assets. This consideration is a vital addition to your financial planning strategy checklist.

6. Retirement Planning

It’s never too early to start planning for retirement. Assess your current retirement savings and explore options, such as 401(k) plans or IRAs. Your financial planning strategy checklist should emphasize the importance of maximizing contributions to retirement accounts and taking advantage of employer matches if available.

Keep Your Financial Planning Strategy Checklist Updated

Your financial situation is dynamic and can change due to various factors like salary raises, life events, or changing investment opportunities. Regularly revisiting and updating your financial planning strategy checklist is essential to ensure it remains relevant. Set aside time each year to review your financial status, accomplishments, and remaining goals.

7. Seek Professional Financial Advice

If you feel overwhelmed or uncertain about your financial planning journey, do not hesitate to seek professional advice. Financial planners can provide personalized guidance tailored to your situation. They can assist you in refining your financial planning strategy checklist and help you stay on track towards achieving your financial goals.

Common Mistakes to Avoid in Your Financial Planning Strategy Checklist

While striving towards your financial goals, it’s easy to slip into common traps. Ensure your financial planning strategy checklist doesn’t fall victim to these mistakes:

1. Neglecting to Track Progress

Merely having a checklist is not enough; you must actively track your progress. Regularly review and adjust your goals and strategies as necessary.

2. Setting Unrealistic Goals

It’s admirable to dream big, but setting unattainable goals can lead to frustration. Break larger goals into manageable parts and celebrate small victories.

3. Ignoring Additional Income Streams

Consider ways to create additional income streams — freelance work, side businesses, or passive income opportunities can significantly accelerate your financial growth. Your financial planning strategy checklist should incorporate exploring and implementing these additional revenue sources.

Conclusion: Why a Financial Planning Strategy Checklist Matters

A financial planning strategy checklist is more than just a list of tasks; it’s a comprehensive tool that equips you with the knowledge and direction necessary to navigate your financial landscape effectively. Be proactive about your financial future. Regular evaluations, adjustments, and education about your finances will empower you to create a solid foundation for long-term fiscal well-being.

Total financial freedom is not merely a dream; with a well-structured financial planning strategy checklist, it can be your reality. Start implementing these components today and take control of your financial future.