The role of a Financial Planning Manager is critical in any organization, especially those involved in financial services, corporate finance, or investment management. Understanding the nuances of a financial planning manager job description helps clarify expectations and can guide professionals in their career paths. This article delves into the key responsibilities, skills, and qualifications associated with this significant position in the finance sector.

Key Responsibilities of a Financial Planning Manager

A Financial Planning Manager is tasked with overseeing and enhancing the financial planning processes within an organization. Here are some of the vital responsibilities included in a financial planning manager job description:

- Developing Financial Plans: Creating both short-term and long-term financial plans tailored to meet organizational goals. This involves analyzing financial data and making accurate forecasts based on trends.

- Budget Management: Overseeing the company’s budget. This includes ensuring accurate budget creation, implementation, and ongoing monitoring to avoid discrepancies.

- Team Leadership: Leading a team of financial analysts to ensure effective communication and collaboration when executing financial plans and strategies.

- Financial Reporting: Regularly preparing detailed financial reports for upper management, revealing the financial status of the organization and guiding investment decisions.

- Risk Analysis: Identifying potential financial risks and developing risk mitigation strategies to safeguard the organization’s assets.

- Investment Strategy Development: Developing strategies to maximize company investments through thorough research and analysis.

Essential Skills for a Financial Planning Manager

A successful Financial Planning Manager must possess a specific skill set to excel in their role. The following skills are essential and often highlighted in a financial planning manager job description:

- Analytical Skills: The ability to assess financial data critically, spotting trends and making informed decisions is crucial for financial analysts.

- Leadership Abilities: Strong leadership skills to manage teams effectively, providing guidance and support while fostering a positive work environment.

- Communication Skills: The capacity to convey complex financial information to non-experts clearly and concisely.

- Accounting Knowledge: A solid understanding of accounting principles is necessary to manage budgets, financial statements, and reports accurately.

- Attention to Detail: Precision is vital in financial planning. The ability to notice minute details can prevent costly errors.

- Technological Proficiency: Familiarity with financial software and tools to analyze and visualize data efficiently.

Qualifications Required for the Role

While the educational background may vary, specific qualifications are widely expected in a financial planning manager job description:

- Educational Background: A bachelor’s degree in finance, accounting, business administration, or a related field is commonly required. Many employers prefer candidates with a master’s degree or a relevant professional designation.

- Professional Certification: Designations such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Management Accountant (CMA) are highly regarded and often preferred.

- Experience: Typically, at least 5-7 years of experience in financial planning, budgeting, or analysis is required. Experience leading teams is also advantageous.

The Importance of a Financial Planning Manager

The role of a Financial Planning Manager is not just a position; it is essential for the overall health of an organization. Through strategic financial oversight, the Financial Planning Manager helps ensure that the company remains financially stable and poised for growth. Essential aspects of why this role is so pivotal include:

- Strategic Decision-Making: Financial Planning Managers play a critical role in shaping the strategic direction of the company by providing insights based on financial data.

- Resource Allocation: They decide where financial resources should be allocated to produce the highest returns, ensuring the organization uses its assets efficiently.

- Performance Evaluation: Regularly measuring the company’s financial performance against pre-established benchmarks can identify areas for improvement and inform management strategy.

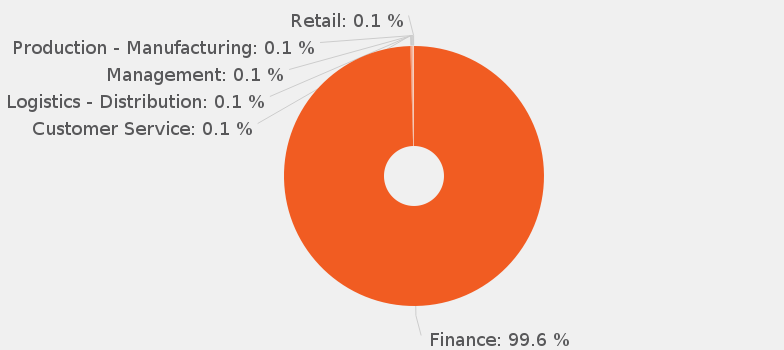

Visual Representation of the Financial Planning Manager Role

This visual representation encapsulates the core responsibilities and qualifications of a Financial Planning Manager, summarizing the essential elements of the financial planning manager job description in a concise format.

Career Path and Advancement Opportunities

Evolving in the role of a Financial Planning Manager can lead to various advanced career opportunities. Those who demonstrate strong leadership and analytical capabilities may find pathways into higher executive roles such as:

- Director of Finance: Overseeing all financial departments within an organization, making high-level decisions regarding financial strategy.

- Chief Financial Officer (CFO): Holding the most senior finance position within a company, ensuring overall financial health and strategic use of resources.

- Financial Consultant: Offering expert financial advice to clients or organizations, potentially working independently or with a consultancy firm.

Challenges Faced by Financial Planning Managers

While the role can be rewarding, it also comes with its share of challenges. Recognizing and preparing for these can ensure that a Financial Planning Manager is well-equipped to handle adversity:

- Market Volatility: The ability to adapt to sudden market changes or economic downturns is essential, demanding innovative financial strategies.

- Regulatory Changes: Financial regulations can change frequently, requiring continual education and adaptability to ensure compliance.

- Technology Integration: Staying updated with the latest financial technology and tools can be daunting but is essential for optimizing financial operations.

Conclusion

The job of a Financial Planning Manager is both challenging and dynamic. Those interested in a career in this field should strive to develop a strong foundation in finance, hone their analytical abilities, and maintain a keen understanding of market trends and technological advances. Ultimately, recognizing the significance of a financial planning manager job description can help prospective candidates prepare effectively for their future roles in the finance sector and ensure their organizations thrive financially.