In today’s fast-paced world, navigating personal finances can feel overwhelming. Whether you’re considering investments, budgeting for your family, or simply trying to manage daily expenses, having a well-structured financial plan is crucial. This article will offer you a thorough financial planning guide and checklist, ensuring you are equipped to make informed financial decisions. By incorporating a checklist into your planning, you can keep track of all necessary tasks and make progress towards achieving financial stability and security.

Understanding the Importance of a Financial Planning Guide and Checklist

Financial planning is not just about saving; it’s about building a path to your goals. A financial planning guide and checklist can serve as a roadmap, helping you understand where you are and where you want to be financially. With this guide, you’ll be able to evaluate your current financial situation, set goals, and create actionable steps to reach those goals.

Setting Your Financial Goals

The first step in any reliable financial planning guide and checklist is identifying your financial goals. Do you wish to own a home, travel the world, secure a comfortable retirement, or perhaps prepare for your children’s education? Write down your short-term and long-term goals, as this will guide all your subsequent decisions.

Creating a Budget

A comprehensive budget is essential in your financial planning journey. Your financial planning guide and checklist should include the need to track income and expenses meticulously. Start by categorizing your monthly income and listing all recurring expenses. This approach will offer clarity on where your money goes and identify areas where you can cut back.

Essential Components of Your Financial Planning Checklist

To make the most out of your financial planning guide, it’s important to include key components in your checklist:

- List all sources of income

- Track all monthly expenses

- Set up an emergency savings fund

- Plan for retirement contributions

- Assess your insurance needs

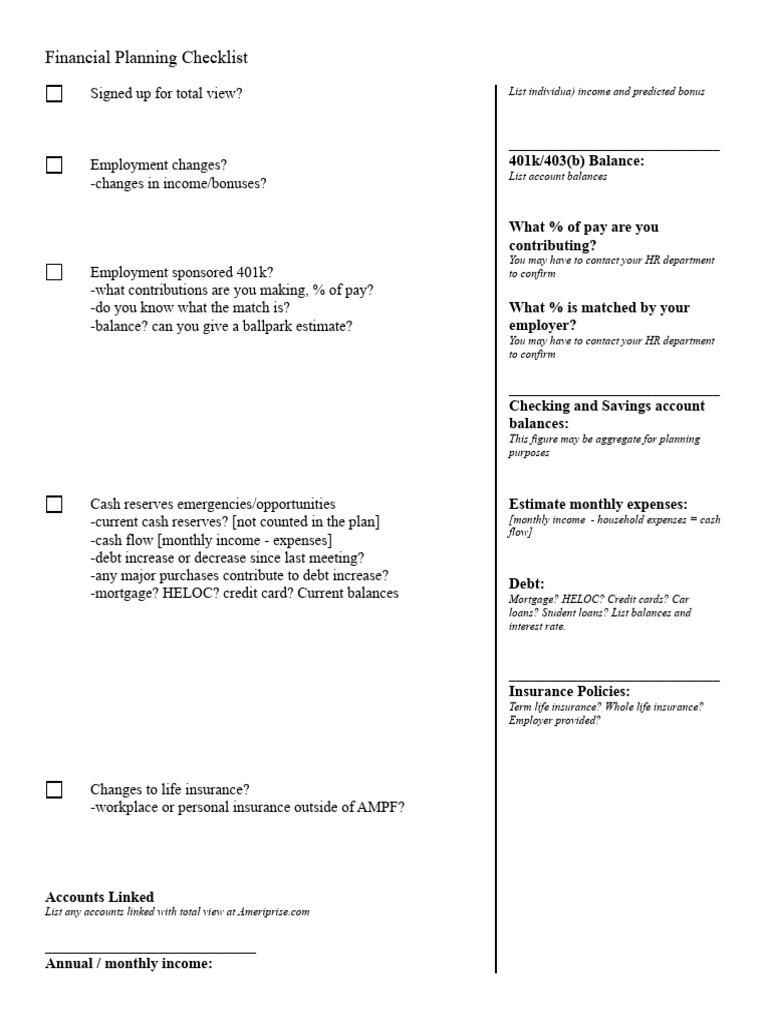

Image of a Financial Checklist

Visuals like the one above serve as an excellent reference point to help you craft and refine your own financial planning checklist. Utilizing such tools can empower you to maintain focus on your financial activities.

Emergency Fund: A Critical Element in Your Checklist

One key element of a robust financial plan is establishing an emergency fund. Ideally, this fund should cover three to six months of living expenses to offer a cushion in case of unexpected financial hardships. Including the goal of creating an emergency fund in your financial planning guide and checklist will help to ensure that you can manage financial surprises with ease.

Investing for the Future

Investing is crucial for long-term wealth accumulation. After setting your budget and establishing your emergency fund, it’s time to consider your investment options. A strong financial planning guide and checklist will encourage you to explore various investment avenues, such as stocks, bonds, and real estate. You might also want to research mutual funds and ETFs as they can diversify your portfolio with relatively less risk.

Retirement Planning

Retirement may seem far away for some, but starting early can yield significant benefits. Contributing to retirement accounts such as a 401(k) or an IRA should be a priority in your financial planning checklist. Incorporate a strategy for how much you wish to contribute and select investment options with good growth potential. Your financial planning guide and checklist should reflect both your current age and your work scenario so you can appropriately plan for a comfortable retirement.

Assessing and Reviewing Your Financial Status

Periodically reviewing your financial status is vital for sustained success. Your financial planning guide and checklist should include regular check-ins to assess your budget, track your progress towards goals, and adjust your strategies as necessary. Implementing a quarterly or bi-annual review process can help identify areas for improvement and ensure that you remain on course.

Insurance Considerations

Your financial planning guide and checklist must also accommodate adequate insurance coverage to protect your assets and income. Consider reviewing your health, life, auto, and homeowners’ insurance. Make sure that you are not only compliant but also adequately covered, as this can save you significant financial strain in emergencies.

Building a Strong Credit Profile

Your credit score plays an essential role in your overall financial health. A strong financial planning guide and checklist will remind you to assess your credit report regularly and take corrective actions if necessary. Improving your credit score can enhance your borrowing potential, whether you are purchasing a home or seeking a personal loan.

Education and Continuous Learning

Lastly, your financial planning checklist should always prioritize education. Financial literacy is a powerful tool that can change your perspective on money. Allocate time each month to read books, take courses, or attend workshops on personal finance. Knowledge is the foundation of a solid financial plan.

Final Thoughts on Your Financial Planning Guide and Checklist

The importance of having a thorough financial planning guide and checklist cannot be overstated. By laying everything out in a clear manner, you can navigate your financial future with confidence. Whether it’s setting realistic goals, tracking your expenses, budgeting effectively, planning for retirement, or investing wisely, each task you complete brings you one step closer to your financial aspirations. Your checklist serves not just as a guide but as a motivational roadmap, reminding you of what’s important and keeping you focused on the goals ahead. Embrace the journey towards financial literacy and planning—your future self will thank you.

With discipline, commitment, and the right planning tools, financial well-being is well within reach. Start today by creating your personalized financial planning guide and checklist. You’ll find that taking charge of your finances can be an empowering and enriching experience.