In today’s fast-paced world, effective financial management is crucial for both individuals and businesses. With the right tools, you can streamline your financial planning process, enabling you to make informed decisions about your finances. One of the most useful tools available is a financial planning Excel spreadsheet. This versatile application can help you track your income and expenses, set budgets, and plan for future savings and investment opportunities. In this article, we’ll delve deeper into the benefits of using a financial planning Excel spreadsheet, its key features, and how you can leverage it to achieve your financial goals.

Understanding the Financial Planning Excel Spreadsheet

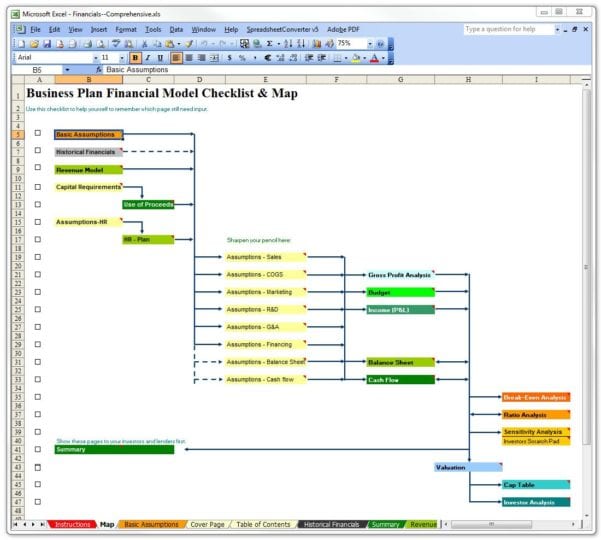

A financial planning Excel spreadsheet is a customized sheet designed to help you organize and manage your financial information effectively. It allows you to visualize your financial situation, making it easier to track your spending patterns and identify areas where you can cut costs or save more. Whether you’re a student managing your monthly expenses, a professional planning for retirement, or a business owner looking to budget for upcoming projects, a financial planning Excel spreadsheet can be tailored to fit your needs.

Why Use a Financial Planning Excel Spreadsheet?

There are numerous benefits to using a financial planning Excel spreadsheet. Firstly, it provides a clear overview of your financial health. By entering data related to your income, expenses, debts, and savings in one place, you can quickly assess your financial situation and make informed decisions. Moreover, the ability to customize the spreadsheet allows you to adapt it to your unique needs, making it a flexible tool that can grow with you.

Key Features of a Financial Planning Excel Spreadsheet

When selecting a financial planning Excel spreadsheet, look for several key features that will enhance your financial management experience. These include:

- Budget Tracking: Effective budgeting is fundamental to sound financial planning. A financial planning Excel spreadsheet typically includes features that allow you to input your income sources and categorize your expenses, helping you see where your money goes each month.

- Graphs and Charts: Visual representations of your financial data can help you understand complex information at a glance. Good financial planning Excel spreadsheets generate charts and graphs that illustrate your spending habits, savings goals, and debt levels.

- Forecasting Tools: Advanced spreadsheets include formulas and templates that help you predict future financial scenarios. These tools can be beneficial for long-term planning, enabling you to estimate savings growth, investment returns, and future expenses.

- Expense Tracking: Keeping track of your daily expenses is essential for creating a budget that works for you. A financial planning Excel spreadsheet allows you to log transactions, categorize your spending, and analyze where you might need to make adjustments.

Creating Your Own Financial Planning Excel Spreadsheet

If you decide to create your own financial planning Excel spreadsheet, you’ll find that the process is straightforward. Start by identifying your financial goals—whether it’s saving for a vacation, paying off debt, or building an emergency fund. Next, outline the categories that best suit your needs. Common categories might include housing, transportation, groceries, and entertainment.

Setting Up Your Spreadsheet

Once you have a plan in place, you can start setting up your spreadsheet. Begin by creating columns for each category and rows for your financial data. You’ll want to include sections for:

- Income: List all sources of income, such as salaries, freelance work, or rental income.

- Fixed Expenses: Include regular bills such as rent or mortgage payments, utilities, and insurance premiums.

- Variable Expenses: These are expenses that can change month to month, like groceries and entertainment.

- Savings and Investments: Track your contributions to savings accounts, retirement funds, and other investments.

Utilizing Formulas for Enhanced Financial Planning

Excel is a powerful tool that can automatically perform calculations. By using formulas, you can have your spreadsheet calculate totals, averages, and even against projected budgets. For instance, using the SUM function will allow you to quickly see your total income or expenses. To make things even more insightful, you can create formulas that compare your actual spending against your budget, highlighting any variances that need attention.

Your Essential Financial Planning Tool

Effective financial planning requires a sharp focus and a well-organized approach. Integrating visuals like graphs and charts into your financial planning Excel spreadsheet allows you to see where you stand at any moment. This way, you can better understand your data and make confident financial decisions. Whether you use built-in Excel templates or create your own from scratch, the key is to make the spreadsheet work for you.

Maintaining Your Financial Planning Excel Spreadsheet

Creating a financial planning Excel spreadsheet is just the beginning. The real work comes with maintaining and regularly updating this tool. Set aside time weekly or monthly to review your finances, ensuring that you input your latest spending and savings. As you continue to interact with your spreadsheet, you’ll gain a better understanding of your financial habits, and you’ll be better equipped to create realistic budgets and predictions.

Benefits of Regular Updates

Updating your financial planning Excel spreadsheet regularly enables you to track your progress toward your goals. You’ll celebrate small victories, such as paying off a debt or sticking to a budget for a month. Additionally, regular updates will help you identify patterns or trends in your spending. This awareness empowers you to make adjustments, preparing you for unexpected financial challenges.

Reviewing Your Financial Goals

Periodic review of your financial goals is crucial. Life circumstances change, and you may find that your previous goals no longer serve your current situation. Your financial planning Excel spreadsheet is a dynamic tool; adjust your budget categories as needed and update your plans according to your long-term aspirations.

Conclusion: Empower Your Financial Future

In conclusion, a financial planning Excel spreadsheet is an invaluable tool for both personal and business financial management. It provides clarity, structure, and accountability to your financial journey. Whether you’re aiming to save money, pay off debt, or invest for your future, using this tool can help you gain the insights necessary to achieve your goals. Embrace the power of a financial planning Excel spreadsheet today and take your first step towards empowering your financial future.