The journey towards financial stability can often feel overwhelming, but having the right tools at your disposal makes all the difference. A financial planning checklist template is crucial for assessing your current financial situation and setting achievable goals. This article will guide you through the essentials of using a financial planning checklist template effectively, ensuring you stay on track towards securing your financial future.

Why You Need a Financial Planning Checklist Template

In the fast-paced world we live in today, managing one’s finances offers a unique set of challenges. A financial planning checklist template serves as a roadmap, helping individuals navigate through various responsibilities and obligations with ease. Whether you are a student, a professional, or a retiree, it provides the kind of clarity that is essential for effective money management.

Components of a Financial Planning Checklist Template

Let’s take a closer look at what constitutes a comprehensive financial planning checklist template.

- Budgeting: Start by assessing your income and expenses. Create a budget that outlines your financial inflow and outflow. This will be the foundation of your planning.

- Debt Management: Include a section in your checklist dedicated to monitoring and managing personal debts. Whether it’s student loans, credit card debts, or mortgages, keeping these figures in check is crucial.

- Emergency Fund: Ensure your checklist includes saving for emergencies. Aim for at least three to six months’ worth of expenses saved up for unforeseen circumstances.

- Investments: Diversification is key. Include categories for stocks, bonds, retirement accounts, and other investment opportunities.

- Retirement Planning: Your checklist should include contributions to retirement funds, ensuring you will have a stable income post-retirement.

- Insurance: Another point to cover is health, life, and property insurance. Review your current coverage and make adjustments as necessary.

How to Utilize the Financial Planning Checklist Template

Setting Up your Template

Once you have a grasp of the components you need, you can set up your financial planning checklist template. You can create this template in various file formats, such as Excel, Word, or even as a printable PDF. For those who prefer a more visual format, consider using spreadsheet applications which allow you to incorporate charts and graphs to better visualize your financial data.

Enhancing Your Financial Planning Checklist Template with Graphics

Visual Representation

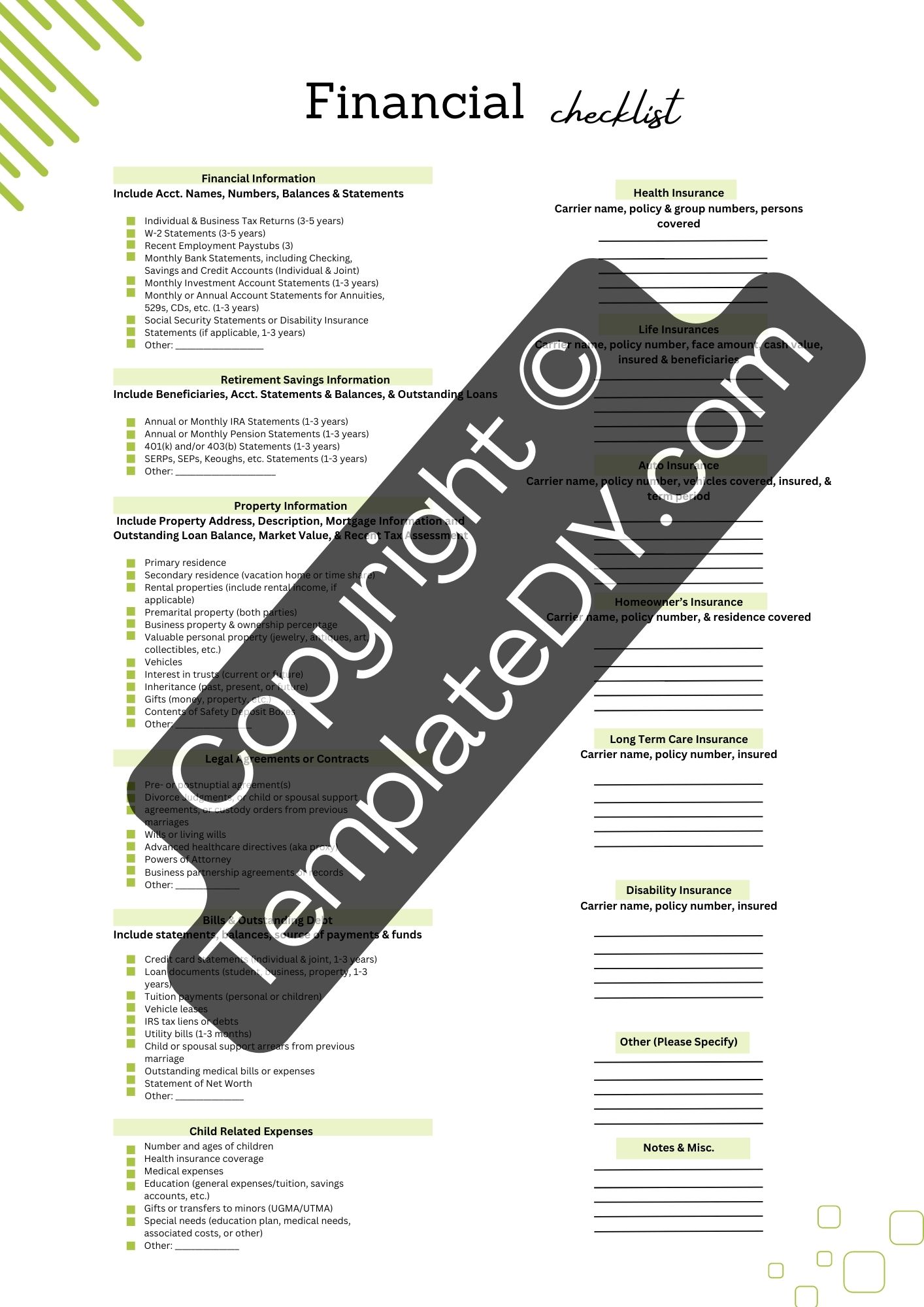

Integrating visuals into your financial planning checklist template can significantly enhance its usability. Here’s a handy financial checklist template to get started!

Visual aids not only make it easier to assess your financial situation but can also motivate you to adhere to your goals.

Reviewing and Updating Your Checklist

Once you have laid out your financial planning checklist template, it is essential to review and update it regularly. Attempt to review your checklist on a monthly or quarterly basis. This iterative process allows you to stay informed of any changes in your financial landscape, whether they are increases in income or changes in your expenses. Additionally, updating your financial goals as you move through different life stages is crucial.

The Importance of Accountability

Engage a Buddy

Accountability can significantly accelerate your progress. Share your financial planning checklist template with a friend or family member who can provide encouragement and reminders. This is especially important when it comes to sticking to your budget and saving goals. By regularly discussing your financial situation with a trusted individual, you are more likely to stay committed to your financial journey.

Common Pitfalls in Financial Planning

Having a financial planning checklist template is undoubtedly a great starting point, but one must be aware of potential pitfalls that can jeopardize their financial health. Below are some of the common mistakes to avoid:

- Ignoring Inflation: “Price creep” can significantly affect your long-term savings and investment strategies. Make sure to adjust your goals in consideration of potential inflation.

- Underestimating Expenses: It’s common to underestimate personal expenses, leading to budgetary failures. Ensure your checklist fully accounts for both fixed and variable expenses.

- Avoiding Investments: Many individuals shy away from investing due to a lack of understanding. Education is essential; don’t allow fear to dictate your financial choices.

Tailoring Your Financial Planning Checklist Template to Fit Your Needs

Every individual’s financial situation is different, thus, customizing your financial planning checklist template is fundamental. Add or modify sections that cater specifically to your scenarios and requirements. Whether you want to focus on short-term savings, long-term investments, or both, tailoring your checklist ensures it remains relevant and effective.

Utilizing Technology

In today’s digital age, leveraging technology can immensely enhance the effectiveness of your financial planning checklist template. Financial management apps can greatly simplify budgeting and tracking expenses. Consider incorporating these tools into your planning process. Many of these applications can sync directly with your bank accounts, providing insightful analyses and reminders that align with your financial checklist.

Staying Educated on Financial Literacy

Using a financial planning checklist template is just one part of achieving financial success. It’s equally important to continuously educate yourself on financial literacy. There are countless resources available — from online courses to workshops and podcasts. The more knowledgeable you become, the better equipped you will be to make sound financial decisions.

Conclusion

In summary, a financial planning checklist template is an invaluable resource for anyone seeking to secure their financial future. By understanding its components, utilizing it effectively, and reviewing it consistently, you can foster a proactive approach to financial management. Remember, it’s not just about creating a template — it’s about implementing a mindset that prioritizes long-term financial wellness. Take charge of your financial journey today, using these insights to build a roadmap that leads to a stable and prosperous future.

Equip yourself with the tools necessary for effective financial planning and transform your financial aspirations into accomplishment!