In a world where financial stability is often a dream deferred, the Financial Independence, Retire Early (FIRE) movement stands out as a beacon of hope for many. This philosophy is not just about saving money; it’s a comprehensive lifestyle shift toward achieving true independence and early retirement. For those looking to take charge of their financial future, understanding the principles of FIRE is crucial. In this post, we delve into what FIRE truly means, how to implement its principles in your life, and provide resources for learning more, including a detailed financial independence retire early PDF that you can leverage on your journey.

Understanding the Basics of Financial Independence Retire Early (FIRE)

At its core, the FIRE movement is about gaining control over your finances. This control allows individuals to retire much earlier than traditional retirement age, usually in their 30s or 40s. Those who follow the FIRE strategy aim to save a significant portion of their income—often 50% or more—to build a robust nest egg that can sustain them through their golden years. Savings are supplemented by investments and any additional income generated from side hustles or passive income streams. By doing so, they create a pathway to financial independence.

The Key Principles of Financial Independence Retire Early (FIRE)

The journey towards financial independence is paved with principles that guide individuals on how to significantly alter their lifestyles and savings habits. Here are the key tenets that most adherents of the FIRE movement embrace:

- Frugality: Living below your means is essential. This often includes reducing unnecessary expenses and finding joy in simple pleasures.

- Investing Wisely: Saving money is just the beginning. Experts recommend investing funds into stocks, real estate, and retirement accounts to grow wealth over time.

- Building Passive Income: Creating multiple streams of income is crucial. Whether through rentals, dividends, or side businesses, passive income helps secure financial independence.

- Mindset Shift: The FIRE movement encourages a fundamental shift in how we view money and its role in our lives. It promotes living intentionally and prioritizing experiences over material possessions.

The Journey: Steps to Achieve Financial Independence Retire Early (FIRE)

Now that you have a grasp on the basic principles of FIRE, let’s discuss actionable steps one can take to embark on this journey. It’s essential to remember that achieving financial independence is not an overnight process; it requires dedication and a strategic approach.

Step 1: Assess Your Financial Situation

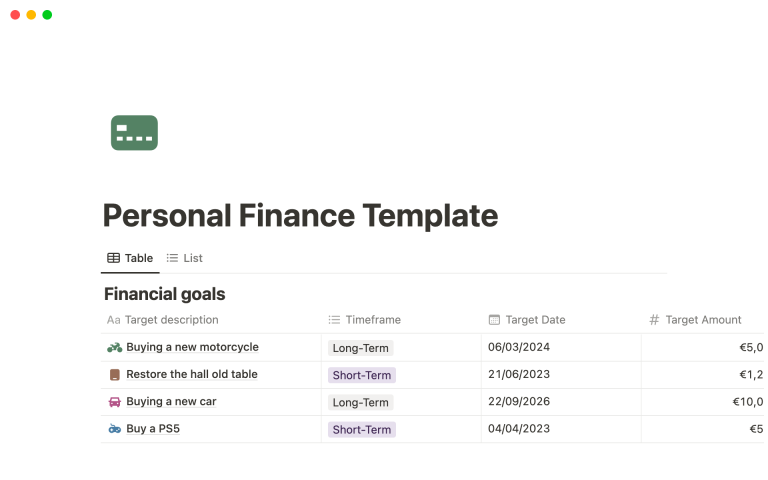

Before making any drastic changes, it’s vital to evaluate your current financial condition. Analyze your income, expenses, debts, and savings. Understanding where you stand financially will allow you to create a realistic plan and set achievable goals.

Step 2: Create a Detailed Budget

Budgeting is a fundamental aspect of achieving financial independence. Craft a budget that reflects your income and expenditures, allowing you to identify areas where you can cut costs. The goal is to ensure that your expenses are as low as possible so that you can increase your savings rate.

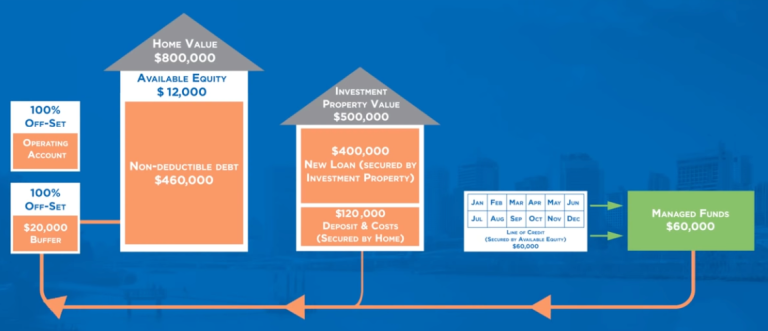

Visualizing Your Path to FIRE

This visual representation encapsulates the journey to financial independence and early retirement. It highlights the necessary steps and strategies to reach your FIRE goals.

Step 3: Elevate Your Income

Investigate opportunities for increasing your income. This could mean pursuing promotions, asking for raises, or exploring side hustles that tap into your skills and passions. The more you earn, the faster you can accelerate your path to financial independence.

Step 4: Invest Your Savings

Simply saving money isn’t sufficient. You need your savings to work for you through investments. Diversify your portfolio with different asset classes, including stocks, bonds, mutual funds, or real estate. Continuous learning about investment strategies via financial independence retire early PDFs and online courses can enhance your knowledge and decision-making abilities.

Step 5: Stay Committed to Your Goals

Persistence is key in this journey. Keep track of your progress and stay committed to your financial goals. Don’t get discouraged by setbacks; instead, learn from them. Regularly revisiting and adjusting your goals will help you stay on track.

Resources for Financial Independence Retire Early (FIRE)

Several resources can further assist you on your journey towards financial independence. Books, podcasts, and online communities are rich with information and support. A vital resource to consider is a financial independence retire early PDF, which can provide you with structured guidance and insights to deepen your understanding.

Online Communities and Forums

Joining online forums can be immensely beneficial. Platforms like Reddit have dedicated communities where you can find like-minded individuals who share their experiences and tips on achieving FIRE.

Books Worth Reading

Several books delve into the philosophy and mechanics of achieving FIRE. Consider starting with “Your Money or Your Life” by Vicki Robin and Joe Dominguez or “The Simple Path to Wealth” by JL Collins. These texts provide foundational knowledge and practical advice for navigating your financial journey.

Podcasts

Podcasts offer a convenient way to absorb knowledge on the go. Some popular options include “ChooseFI,” which shares a wide range of topics related to financial independence and practical advice on achieving it.

Maintaining Your Financial Independence Retire Early (FIRE) Lifestyle

Once you achieve financial independence, maintaining that lifestyle becomes the next challenge. Here are some tips to help you manage your financial independence post-retirement:

- Budgeting Post-Retirement: Staying on a budget is just as important in retirement as it was before. Track your spending to ensure that you are not depleting your savings too quickly.

- Tax Planning: Be mindful of tax implications on your withdrawals from retirement accounts. Understanding tax strategies will help in maximizing your savings.

- Stay Engaged: Many retirees find joy in engaging with their community or pursuing hobbies. Finding meaningful activities can help create a fulfilling post-retirement life.

In conclusion, the journey to financial independence is undoubtedly rewarding but requires diligent effort and a strategic approach. By embracing the FIRE principles, actively increasing your income, and making informed investment decisions, you can achieve your dream of retiring early. Utilize the resources at your disposal, such as financial independence retire early PDFs, books, and supportive communities to guide you through this incredible journey. Whether you seek to travel the world or simply enjoy a peaceful life free from financial worries, the FIRE movement can pave the way for a bright future. Now is the time to take action and redirect your life towards financial freedom.