In today’s fast-paced world, the dream of achieving financial independence motivates many individuals. The pursuit of Financial Independence, Retire Early (FIRE) has gained traction, especially among millennials and Gen Z. So, what exactly is financial independence? It is the ability to live your life without being financially dependent on employment. This journey requires diligent planning, disciplined saving, and an effective financial independence number calculator that helps pinpoint your savings goals.

Understanding the Financial Independence Number Calculator

The financial independence number calculator is an essential tool for anyone wishing to break free from the traditional workforce. By inputting your current savings, desired retirement age, expected expenses, and investment growth rates, you receive an estimate of the amount you need to save to reach your goal. This calculator considers various factors such as inflation, lifestyle changes, and potential market fluctuations to give you a clearer picture of your financial future.

Why is a Financial Independence Number Calculator Important?

The importance of a financial independence number calculator cannot be overstated. It serves as a compass, guiding you toward your financial goals. Here are a few reasons why utilizing this tool is vital:

- Clarity: It helps clarify your savings goals and the steps needed to achieve them.

- Tracking Progress: By regularly updating your inputs, the calculator allows you to track your progress and adjust your savings strategy accordingly.

- Empowerment: Having a clear target empowers you to take control of your financial future.

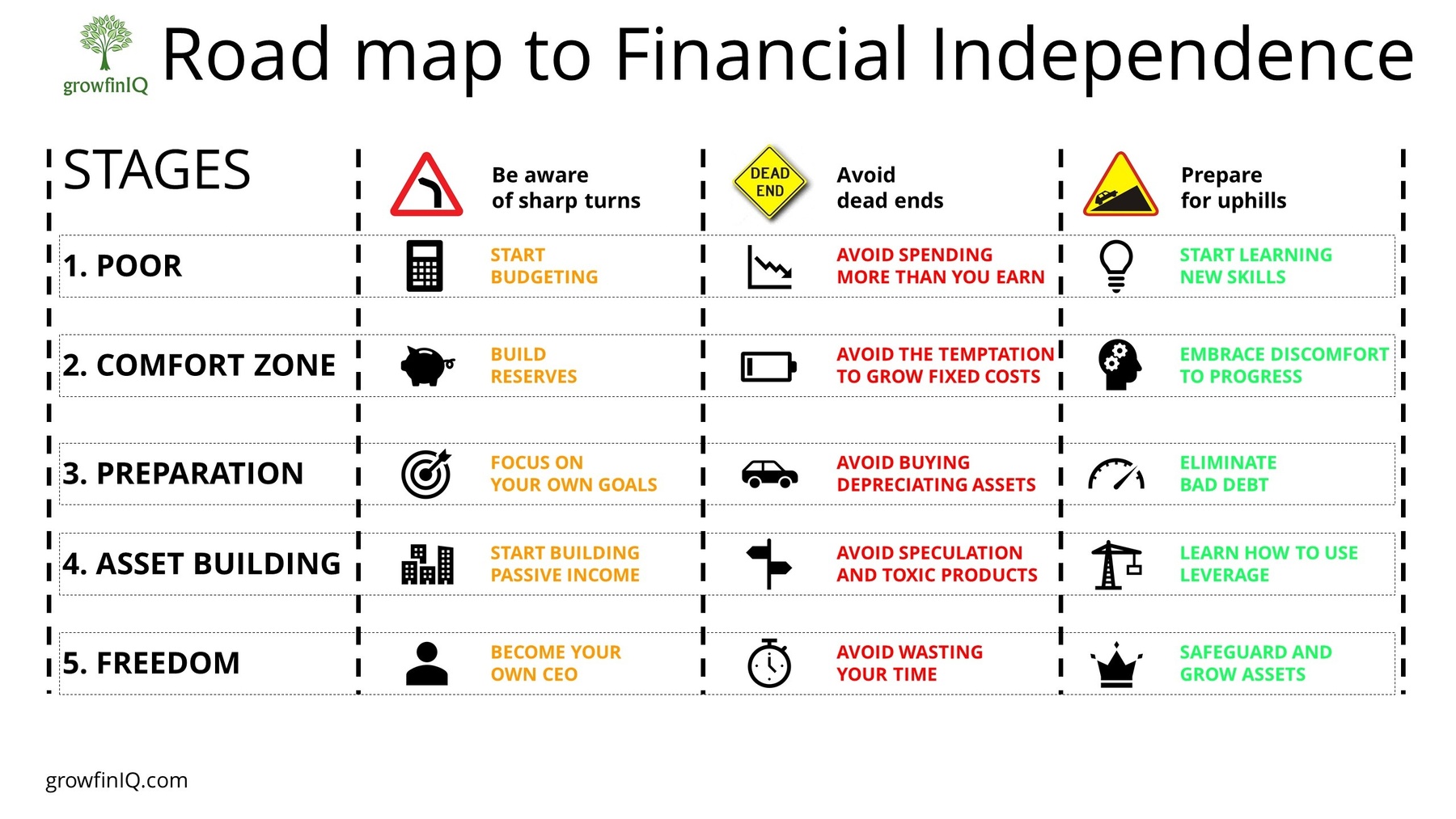

Your Pathway to Financial Independence

Reaching financial independence is not just about accumulating wealth; it’s about creating a lifestyle that allows you to enjoy your freedom. By diligently applying the insights from a financial independence number calculator, you can design a personalized plan that suits your unique circumstances. Below are several strategies to help you on this journey:

1. Set Clear Goals

The first step towards financial independence is to establish clear and achievable goals. Define what financial independence means to you. It might be retiring at 40, traveling the world, or simply having the freedom to choose how you spend your days. Setting specific targets makes it easier to calculate your financial independence number.

2. Create a Budget

Once your goals are defined, the next step is to create a budget that reflects these aspirations. Use the financial independence number calculator to steer your monthly savings. You must allocate your income wisely, prioritizing necessary expenses while minimizing unnecessary ones. Remember, a budget isn’t just about constraints; it’s about making informed choices about how you spend your money.

Visualizing Your Journey

Discover the FIRE Budget/Calculator

This budget/calculator is a practical tool that you can use to start or continue your journey towards financial independence. By examining your cash flow and understanding how much you need to save monthly, this calculator can make your financial goals feel tangible.

3. Increase Your Income

Consider exploring ways to boost your income. This could involve asking for a raise, pursuing a promotion, or dabbling in side hustles. Any additional income can significantly impact the results from your financial independence number calculator. Remember, even small streams of income can add up over time and accelerate your journey.

4. Invest Early and Wisely

Investing is crucial in building wealth over time. A financial independence number calculator takes into account various investment growth rates, which can dramatically change your projections. Start investing as early as you can, and consider diversifying your portfolio to include stocks, bonds, real estate, and mutual funds. The earlier you invest, the more your money can benefit from compound interest.

Living Below Your Means

To achieve financial independence, living below your means is key. This practice not only frees up cash for savings and investments but also teaches discipline. Reassess your lifestyle choices; prioritize your long-term goals over short-term comforts. The financial independence number calculator can project the benefits of frugal living, showcasing how savings can translate into freedom down the line.

Monitor and Adjust Your Strategy

As your life circumstances evolve, so too should your financial strategies. Regularly revisit the financial independence number calculator to adjust your goals and savings plan. This monitoring ensures that you are always aligned with your changing aspirations, whether it’s career developments, family growth, or lifestyle changes. Flexibility is key in navigating your financial independence journey.

5. Educate Yourself Continuously

Continue educating yourself about personal finance and investment strategies. The world of finance is ever-evolving, and staying informed equips you with the tools to make better decisions. Engage in reading books, articles, or even watching informative videos on financial planning and investing. Knowledge is power, especially when it comes to securing your financial independence.

The Emotional Aspect of Financial Independence

Beyond the numbers, achieving financial independence is a journey filled with emotions. From the excitement of progress to the anxiety of market fluctuations, it’s essential to manage these feelings. Utilize your financial independence number calculator not just as a tool, but as a role in building your confidence and reducing uncertainty about the future.

Conclusion: Take the Leap Towards Financial Independence

With the right tools, mindset, and approach, achieving financial independence is within reach. Embrace the journey with the help of a financial independence number calculator, adjustments to your lifestyle, and an attitude of continuous learning. Remember that this is not merely about wealth accumulation but about crafting a life where you control your destiny. Take that first step today, and you’ll be on your way to living the life you’ve always desired.

So, are you ready to begin? Dive into calculating your financial independence number and explore the wealth of resources available to guide you on your path!