In today’s fast-paced world, managing finances effectively is paramount to achieving personal and business success. Whether you’re an individual trying to get your finances on track or a small business owner looking for a trustworthy method to keep your accounts organized, having the right tools can make all the difference. One such tool that stands out in the crowd is the excel template for finances. In this article, we’ll explore how to use the excel template for finances to your advantage and make better financial decisions.

Unlocking the Benefits of an Excel Template for Finances

An excel template for finances serves as a fantastic resource for managing your monetary affairs. The usability and familiarity of Excel mean that you won’t have to learn a new software program or adapt to a different interface, and customization options are virtually limitless. This template is your first step towards financial freedom.

Why Choose an Excel Template for Finances?

With technology evolving rapidly, financial management tools are becoming more advanced, yet many individuals and businesses still prefer the straightforwardness of Excel templates. Here are several reasons why the excel template for finances is your best ally:

- User-Friendly: Even users who are not tech-savvy can quickly get the hang of finance management using an Excel template.

- Customizable: You can adjust the template according to your specific needs and financial circumstances. Want to track expenses differently? Go for it!

- Data Analysis: Excel’s powerful formulas and functions can help you perform detailed data analysis, which in turn can guide you in making informed financial decisions.

Getting Started with Your Excel Template for Finances

Step 1: Download the Template

The first step in your journey towards effective financial management is obtaining the right excel template for finances. For convenience, you can find various templates online at no cost. One excellent resource is Template.net, where you can download a finance sheet template for free. This template serves as a perfect starting point for managing your personal or business finances.

A Look at the Excel Template for Finances

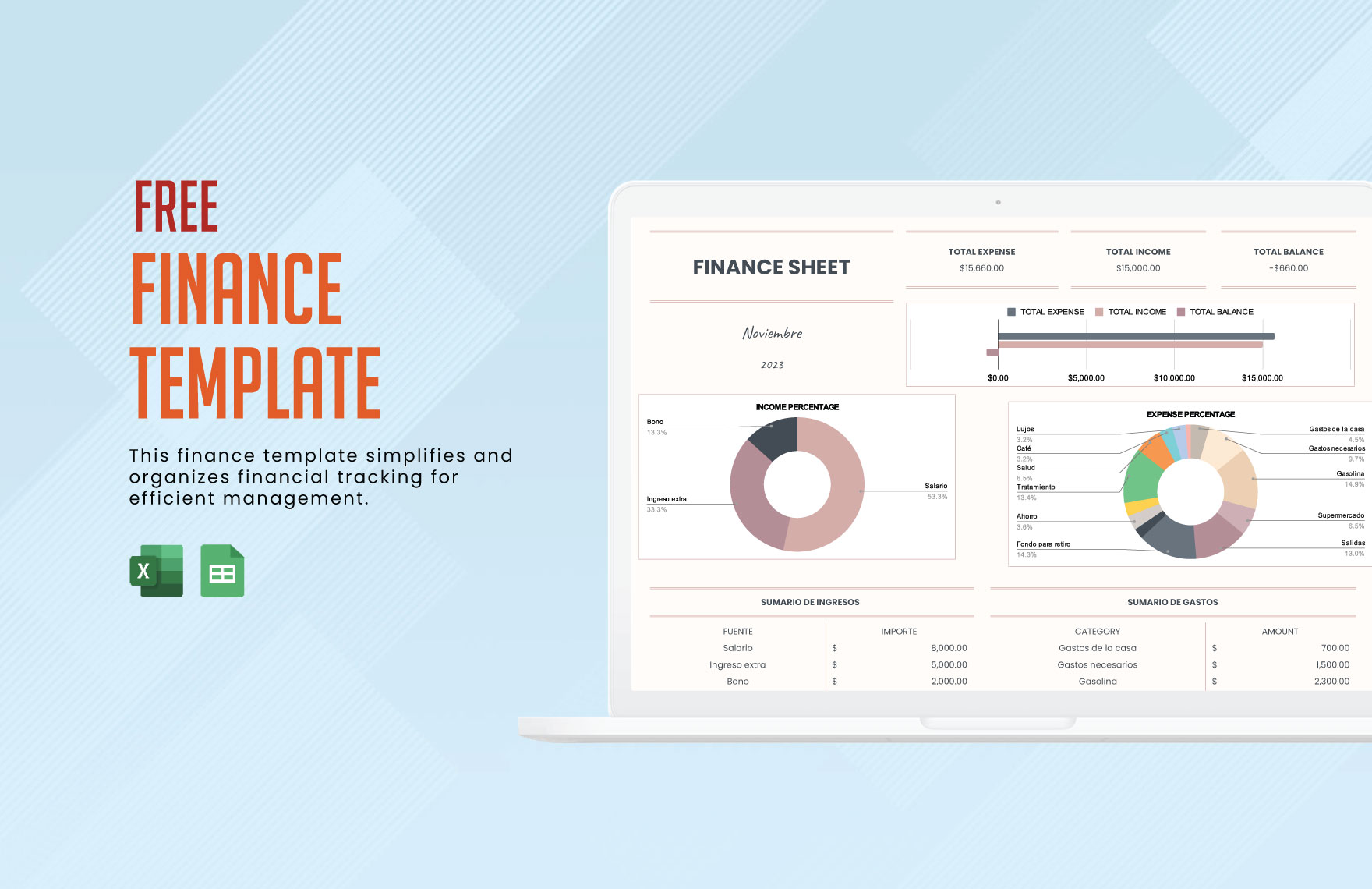

Your Free Financial Dashboard

This is a visual representation of what your finance sheet could look like. Having everything laid out in one document helps track income, expenses, and savings more effectively.

Step 2: Set Up Categories

Once you have downloaded your excel template for finances, the next step is to categorize the different areas of your finances. You’ll want sections for income, fixed expenses, variable expenses, savings, and investments. Customizing these categories based on your unique financial situation will provide more accurate tracking.

Step 3: Input Data Regularly

Now that your categories are set, it’s time to enter the data. Make it a habit to update your sheet regularly. Whether it’s daily, weekly, or monthly, consistent tracking empowers you to see trends and adjust your spending habits accordingly.

Analyzing Your Finances With Excel

Monthly Overview

With your excel template for finances updated regularly, you can quickly analyze your financial standing each month. Create visual dashboards that represent your income versus expenses, highlight areas for improvement, and offer insights into your savings rate. This overview is crucial for adjusting spending and making meaningful financial decisions.

Budgeting with an Excel Template for Finances

A major component of financial management involves budgeting. An excel template for finances can streamline this process significantly. You can use the template to assign spending limits per category and monitor your adherence to these budgets. The template can also help you evaluate whether you are overspending in one category and give you guidance on cutting back.

Additional Features to Look For

Automated Calculations

One of the most significant advantages of using an excel template for finances is the ability to automate calculations. This feature can help minimize human error, especially when summing up totals or calculating percentages. Make sure that your template has built-in formulas to make your financial analysis smoother. You can set up formulas to automatically sum your expenses, calculate totals for specific periods, and even highlight areas that require attention.

Visual Representation of Data

Visualizing your data can be enormously beneficial, as it allows you to grasp complex information quickly. Look for an excel template for finances that allows for creating charts and graphs. Tracking your financial trends over time becomes intuitive when you can see the data laid out graphically. Visual indicators can alert you when you’re nearing budget limits or if savings goals are not on track.

When Things Don’t Go as Planned

Every financial journey has its ups and downs. If you encounter setbacks or discover an imbalance, an excel template for finances can assist in reassessing and restructuring your approach. You can conduct root cause analyses of why specific expenditures exceeded your expectations and determine ways to mitigate the issue moving forward. Being proactive in addressing inconsistencies can save you time and money down the line.

Seeking Professional Help

Sometimes, the most straightforward template might not be enough. If your financial situation is becoming overwhelming or increasingly complex, seeking professional guidance can be a wise decision. Accountants and financial advisors can provide invaluable insights using the data compiled in your excel template for finances. They can help you identify areas for optimization, investment opportunities, and ways to meet your long-term financial goals.

Conclusion: Your Financial Future Awaits

Embarking on the journey towards financial stability starts with having the right tools in place. An excel template for finances is a robust resource that is readily available and can be tailored to fit your individual needs, allowing you to take charge of your financial destiny. Start downloading your template today, begin tracking your finances diligently, and watch as you pave the path towards financial freedom and security.

Remember, effective financial management isn’t just about the numbers; it’s also about creating a mindset that prioritizes financial health. Share these insights with friends and family, and encourage them to embrace their financial futures. Together, you can all work towards being financially savvy and contributing positively to your economic landscape.