In today’s fast-paced world, achieving financial stability is more paramount than ever. An essential component of ensuring one’s financial security is establishing an emergency fund. An emergency fund is a savings reserve specifically allocated to cover unforeseen expenses such as medical emergencies, job loss, or any unforeseen financial burdens. This article delves into building an emergency fund in India, addressing its significance, recommended practices, and strategies tailored for the Indian landscape.

Why Is an Emergency Fund Important in India?

The necessity of an emergency fund in India cannot be overstated. With the rising costs of living and uncertainties surrounding employment, having a financial cushion provides peace of mind. An emergency fund helps prevent individuals from falling into debt during tough times, thus promoting financial resilience. This fund ensures that unexpected challenges do not derail long-term financial goals and investments.

How to Start an Emergency Fund in India?

Starting an emergency fund in India involves several strategic steps. Below are key recommendations to consider when setting up a fund:

1. Set Clear Goals for Your Emergency Fund

Before you begin saving, it’s crucial to determine how much money you’ll need in your emergency fund. A general rule of thumb is to save at least three to six months’ worth of living expenses. However, this can vary based on individual circumstances, lifestyle, and risk tolerance.

2. Open a Separate Savings Account

Having a dedicated account for your emergency fund is essential. It helps in tracking your savings without mixing them with daily expenses. Look for high-yield savings accounts that offer better interest rates than traditional banks, enabling your funds to grow over time.

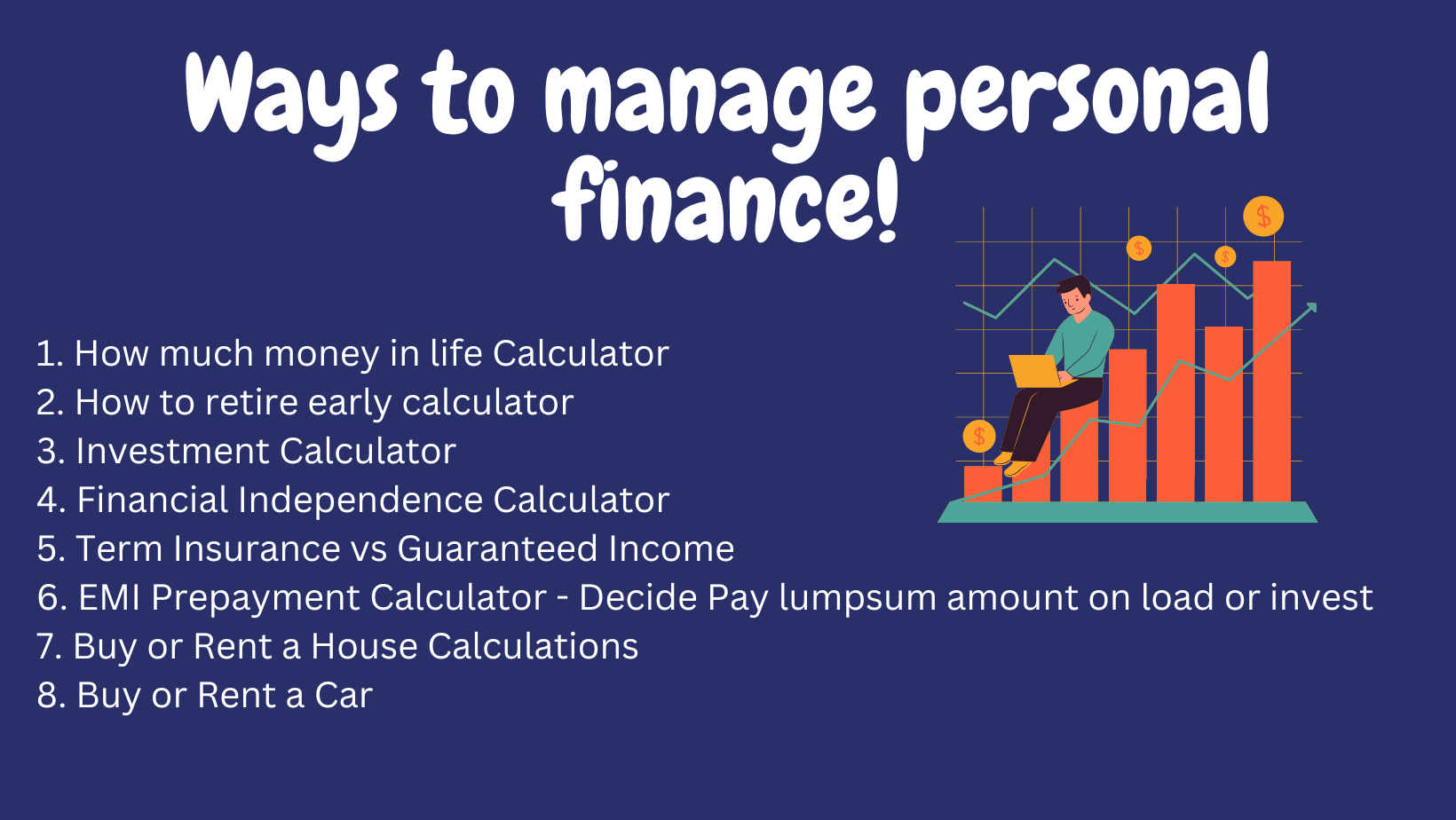

Visualizing Your Financial Stability

Your Emergency Fund in India: A visual breakdown

The visual representation above highlights the essential steps and impact of maintaining an emergency fund in India. It serves to educate individuals on the significance of having a financial safety net, emphasizing the importance through graphics that are easily comprehensible.

3. Regularly Contribute to Your Emergency Fund

Consistency is key when it comes to building an emergency fund in India. Aim to allocate a certain percentage of your monthly income specifically for this purpose. Automating your savings can simplify the process, ensuring that you don’t overlook contributions during busy months.

4. Review and Adjust Your Fund Periodically

As your income and expenses fluctuate over time, it’s important to revisit your emergency fund strategy periodically. Adjust your savings goals according to life changes, such as getting married, having children, or changing jobs. Regularly assessing your financial situation will help you keep your emergency fund aligned with your current needs.

How to Mobilize Your Emergency Fund When Needed

Having an emergency fund means being prepared to use it wisely. In times of crisis, the last thing you want is the added stress of managing your finances. Here’s how to effectively use your emergency fund when the need arises:

1. Identify Genuine Emergencies

When considering utilizing your emergency fund, it’s essential to distinguish between needs and wants. Emergencies often include medical crises, unexpected repairs, or loss of income. Ensure that you only use these funds in times of genuine need to preserve the financial security that the fund offers.

2. Avoid Impulse Withdrawals

Though emergencies can be challenging, be mindful not to dip into your savings for non-urgent matters. Emotional decisions during tough times can lead to and cause unnecessary depletion of your emergency fund. Always evaluate the situation critically.

Challenges in Building an Emergency Fund in India

While many recognize the importance of having an emergency fund in India, there are challenges that may prevent individuals from achieving this goal:

1. High Cost of Living

With escalating expenses in urban areas, many individuals struggle to allocate funds towards savings. It’s crucial to take a close look at your monthly budget. Identify non-essential expenditures that can be reduced to free up more funds for your emergency savings.

2. Lack of Financial Literacy

Many people in India have limited understanding of personal finance, which hampers their ability to develop effective savings strategies. Educating oneself on financial management can significantly enhance the chances of successfully creating and maintaining an emergency fund. Various resources, such as online courses, books, and financial blogs, can provide invaluable insights.

The Role of Financial Institutions in Savings

Indian banks and financial institutions play a crucial role in promoting savings and investment habits among individuals. They offer various products tailored to help customers create emergency funds and establish financial wellness. Here are some methods to leverage their offerings:

1. Explore Savings Account Options

Research different banks to find the best savings account options that offer higher interest rates. Credit unions and cooperative banks are often more flexible and customer-oriented, making them viable options for savings accounts.

2. Utilize Fixed Deposits Wisely

Fixed deposits can be a great adjunct to an emergency fund. These not only offer higher interest rates but also ensure that your funds remain untouched for a predetermined period. However, exercise caution; access to funds in fixed deposits may take longer, which is not ideal during emergencies.

Final Thoughts on Building an Emergency Fund in India

In conclusion, establishing an emergency fund in India is key to fostering a secure financial future. Prioritize building this safety net to navigate life’s unpredictable challenges more effectively. By setting clear goals, making consistent contributions, and using your funds wisely when necessary, you can create a reliable financial cushion that insulates you from adversity.

Remember, the peace of mind that accompanies having a well-funded emergency savings reserve is invaluable. It empowers individuals to tackle unforeseen circumstances with confidence, ensuring that they remain on track towards achieving broader financial aspirations. Start today, and take control of your financial security!