Debt can feel like a heavy anchor weighing you down, but fear not; there are advanced debt management strategies that can help you regain your financial freedom. In today’s economy, managing debt effectively is essential for anyone looking to build a stable financial future. With insightful approaches and persistent effort, you can conquer your debts and pave the way toward a positive financial outlook. In this article, we will discuss debt management strategies that can empower you to take control of your financial wellbeing.

Understanding Debt Management Strategies

Before diving into the specifics, it’s crucial to understand what debt management actually entails. Simply put, debt management is the process of creating a strategy to deal with outstanding debts. This includes evaluating your current financial status, prioritizing debts, and developing a plan tailored to your needs and capabilities. The first step in this journey is recognizing what debts you have and how they affect you financially.

Often, those who struggle with debt feel overwhelmed by the sheer volume and variety of debts they carry. This can range from credit card debts, personal loans, medical bills, and even student loans. Taking inventory can act as a cleansing process, allowing you to confront not just the numbers but also the emotional burden associated with debt. Once you’ve addressed this key factor, it becomes possible to discuss debt management strategies in earnest.

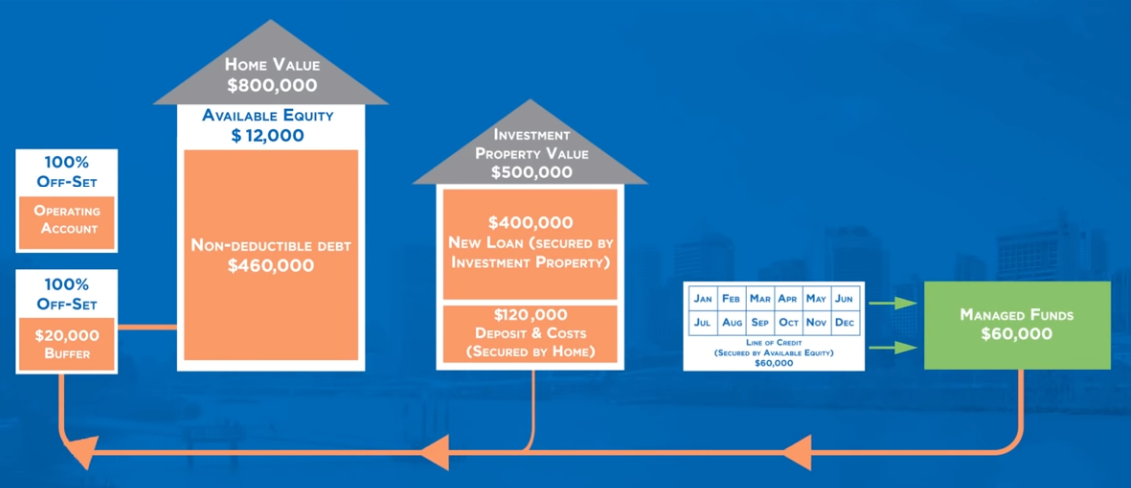

Visualizing Advanced Debt Management Strategies

Visual aids can significantly enhance your understanding of complex financial concepts. The image above illustrates how debt management strategies interact with various aspects of your financial life. By visualizing these relationships, you can better grasp the importance of creating a comprehensive plan to tackle your debts effectively.

1. Debt Consolidation

One of the primary advanced debt management strategies at your disposal is debt consolidation. This method involves combining multiple debts into a single loan, often with a lower interest rate. As a result, it simplifies the repayment process, allowing you to make one payment instead of multiple ones each month. Consolidation can also help to reduce the total amount of interest you pay over time, which is a significant advantage!

However, debt consolidation doesn’t come without its caveats. While it can streamline payments, it’s essential to address the root cause of your debt accumulation. Many people fall into the trap of accumulating new debts after consolidation, thinking they have effectively resolved their financial issues. Discuss debt management strategies with a financial advisor to ensure that your spending habits align with your new consolidated plan.

2. Snowball vs. Avalanche Method

Another effective strategy involves either the **snowball** or the **avalanche** methods. The snowball method encourages you to focus on paying off your smallest debts first, regardless of interest rates. The thrill of knocking out a debt—even a small one—can provide the psychological boost needed to stay motivated. On the other hand, the avalanche method prioritizes debts with the highest interest rates. This method aims to save you more in interest payments in the long term.

Choosing which method suits you best can depend on your financial habits and psychological tendencies. If you crave quick wins, the snowball method may be ideal. But if your focus is firmly on minimizing overall costs, the avalanche method may be the path to greater savings. Regardless of which route you choose, make sure to discuss debt management strategies with your loved ones—they can provide support and accountability as you embark on your debt-free journey.

Engaging with Credit Counseling

After evaluating your debts and methods of payoff, engaging with a credit counseling service can add another layer of expertise to your financial strategy. A professional counselor can help assess your financial situation, suggest personalized debt management strategies, and even negotiate with creditors on your behalf. This kind of intervention can significantly reduce stress and increase the clarity of your financial goals!

Additionally, credit counseling organizations often offer workshops and educational programs that can provide you with the tools needed to manage your finances moving forward. Don’t shy away from seeking help; speaking with professionals can offer fresh perspectives and renewed optimism in your financial journey.

3. Budgeting and Expense Tracking

At its core, budgeting is one of the most crucial advanced debt management strategies available to you. Every financial plan should include a budget that outlines your income and expenses. Not just for the sake of tracking, but to identify unnecessary spending. That said, being honest about your financial situation is essential. You’ll want to thrive, not just survive!

Expense tracking is another element that complements budgeting. This method involves keeping an eye on where exactly your money goes each month, allowing you to identify patterns of overspending or redundancy. With the data collected, you can create a realistic budget that accommodates necessities while still contributing towards paying down debts.

The Role of Negotiation

Don’t underestimate the power of negotiation! It’s possible to reach an agreement with creditors to reduce your total balance or lower interest rates. These discussions can result in modifications to your payment plan that are more manageable for you. Creditors often prefer to negotiate a solution rather than risk losing their money altogether, especially if they foresee that you are making a significant effort to repay your debts.

When approaching negotiations, ensure that you come prepared with all relevant financial information. Discuss your current situation candidly and suggest reasonable terms that would allow you to fulfill your obligations while maintaining some financial stability. Engaging with a debt management professional can further enhance your negotiation efforts, providing you with additional strategies and leverage.

4. Understanding Bankruptcy as a Last Resort

While not an ideal solution, it’s important to recognize that bankruptcy exists as a potential option for managing overwhelming debt. Filing for bankruptcy can provide relief from substantial financial burdens and give you a fresh start. However, this step should be approached cautiously and only pursued after considering all other available debt management strategies.

It’s essential to consult with a qualified bankruptcy attorney to explore your options fully. They can guide you through the entire process, explaining the pros and cons while helping you make an informed decision that aligns with your long-term goals.

In Conclusion: Discuss Debt Management Strategies Smartly

Creditors may wield significant power, but you can take back control by implementing advanced debt management strategies that best suit your unique situation. Remember, the journey to becoming debt-free requires persistence, accountability, and education. Discuss debt management strategies with various stakeholders in your life—family, friends, or financial advisors—to make informed decisions and remain motivated along the way. The knowledge you accumulate will serve as a strong foundation as you work towards achieving financial freedom. Take action today and pave the way for a brighter tomorrow!