Managing debt can often feel overwhelming, especially in today’s fast-paced world where financial obligations seem to be ever-increasing. Whether it’s student loans, credit card balances, or other financial commitments, gaining control over these debts is crucial for achieving peace of mind and financial stability. In this comprehensive guide, we will delve into advanced debt management strategies that can transform your financial life, giving you the tools and knowledge necessary to tackle your debts with confidence.

Understanding Debt Management Strategies

Debt management strategies refer to the various methods and techniques used to handle personal debt effectively. The goal of these strategies is not only to pay off debts but also to avoid future pitfalls that can lead to a cycle of borrowing and repayment. An effective debt management strategy takes into consideration your income, expenses, and overall financial goals.

Advanced Debt Management Strategies for Financial Freedom

The Importance of Creating a Budget

Creating a budget is one of the foundational steps in any robust debt management strategy. A budget helps you see the bigger picture of your financial situation. It allows you to track your income and expenses meticulously, enabling you to allocate funds towards debt repayment effectively. Start by listing all sources of income and expenses. Next, categorize your expenses into fixed, variable, and discretionary. By doing so, you’ll identify areas where you can cut back and redirect those funds towards debt repayment.

Utilizing Debt Snowball and Debt Avalanche Methods

Two of the most popular debt repayment methods are the Debt Snowball Method and the Debt Avalanche Method. Each method has its merits and can be a crucial part of your debt management strategies.

- Debt Snowball Method: This strategy focuses on paying off your smallest debts first, gaining momentum as you eliminate each balance. This psychological win can be incredibly motivating.

- Debt Avalanche Method: On the other hand, this approach prioritizes debts with the highest interest rates, helping you save money on interest payments over time.

Smart Use of Credit

Managing credit wisely is another essential aspect of advanced debt management strategies. It’s vital to understand how credit scores work and how they can affect your financial decisions. Keeping your credit utilization below 30% and making payments on time can significantly boost your credit score. Having a good credit score opens opportunities for lower interest rates, which can ease the burden of existing debts.

Regularly Reviewing Your Financial Situation

Once you’ve implemented your debt management strategies, it’s crucial to regularly review your financial situation. This review should entail evaluating your budget, debt repayment progress, and any changes in your financial landscape. Consider conducting these reviews quarterly. Doing so will help you identify areas for improvement and ensure you stay on track towards achieving your financial goals.

Investing in Financial Education

Knowledge is power when it comes to managing debt. Investing time in learning about personal finance can prove invaluable. There are many resources available, from books to online courses and seminars, that can offer insights on effective debt management strategies. Empowering yourself with this knowledge equips you to make informed financial decisions that can lead to lasting financial independence.

Leveraging Professional Help

If your debts feel unmanageable, it might be time to seek professional help. Financial counselors or debt management services can provide personalized advice and assistance. They can help you understand your options, negotiate with creditors, and set up a realistic repayment plan that aligns with your financial goals.

Visualizing Your Financial Journey

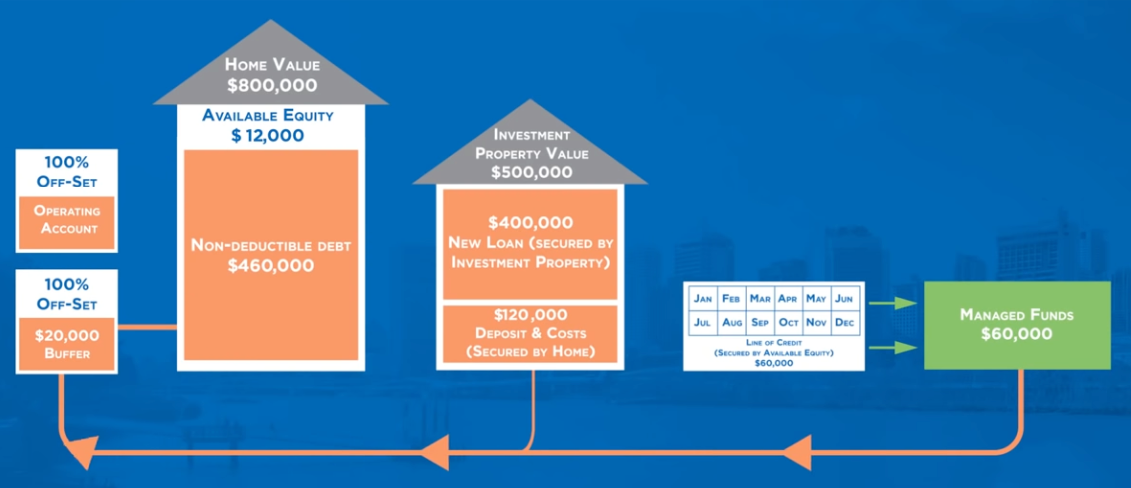

Your Path to Debt Management

This image encapsulates the journey of debt management, illustrating the path from overwhelming debt to financial freedom. Understanding and utilizing effective debt management strategies is fundamental in navigating and triumphing over financial struggles, empowering individuals to reclaim control over their lives.

Staying Motivated and Inspired

It’s easy to feel demotivated when tackling significant debts, but staying inspired is essential. Celebrate small victories—whether it’s paying off a single credit card or rebalancing your budget to incorporate debt repayment. Reward yourself for the hard work and dedication you put towards managing your debts. Remember, consistency is key in following through with your debt management strategies.

Acknowledging the Role of Mental Health

Debt can take a toll on your mental health. Thus, incorporating mental wellness into your debt management strategies is essential. Make sure to practice self-care and reach out for support when needed. Financial stress can be overwhelming, and seeking help from friends, family, or counselors can provide relief and perspective.

Reassessing Goals and Adjusting Strategies

Your financial goals may evolve over time, prompting a need to reassess your debt management strategies. Life changes, such as a new job, relocation, or family changes, can affect your financial landscape. Make it a habit to regularly evaluate your goals and make adjustments to your strategies as necessary.

The Future of Your Financial Health

Adopting advanced debt management strategies is not just about addressing current debts; it’s about paving the way for a healthier financial future. By effectively managing your debts now, you lay the groundwork for future financial opportunities, such as investing, saving for retirement, or purchasing a home.

Final Thoughts

Debt management is a journey that requires patience, dedication, and strategic planning. By embracing these advanced debt management strategies, you can turn your financial situation around. It’s never too late to start; take that first step today towards achieving financial freedom. Remember, the journey may be long, but the rewards of a debt-free life are undoubtedly worth the effort.