Your credit score plays a crucial role in your financial journey, especially when seeking a home improvement loan. Did you know that a strong credit score can open doors to lower interest rates and better loan terms? In this article, we will explore how your credit score influences your ability to secure financing for home improvement projects, the steps you can take to improve your score, and why it’s essential to understand the relationship between credit scores and home loans.

Understanding the Credit Score for Home Improvement Loan

Before diving into home improvement financing, it’s important to grasp the concept of a credit score. A credit score is a numerical representation of your creditworthiness, based on the information in your credit report. Lenders use this score to assess the risk of lending to you. Typically, the higher your credit score, the more favorable the terms of your loan will be.

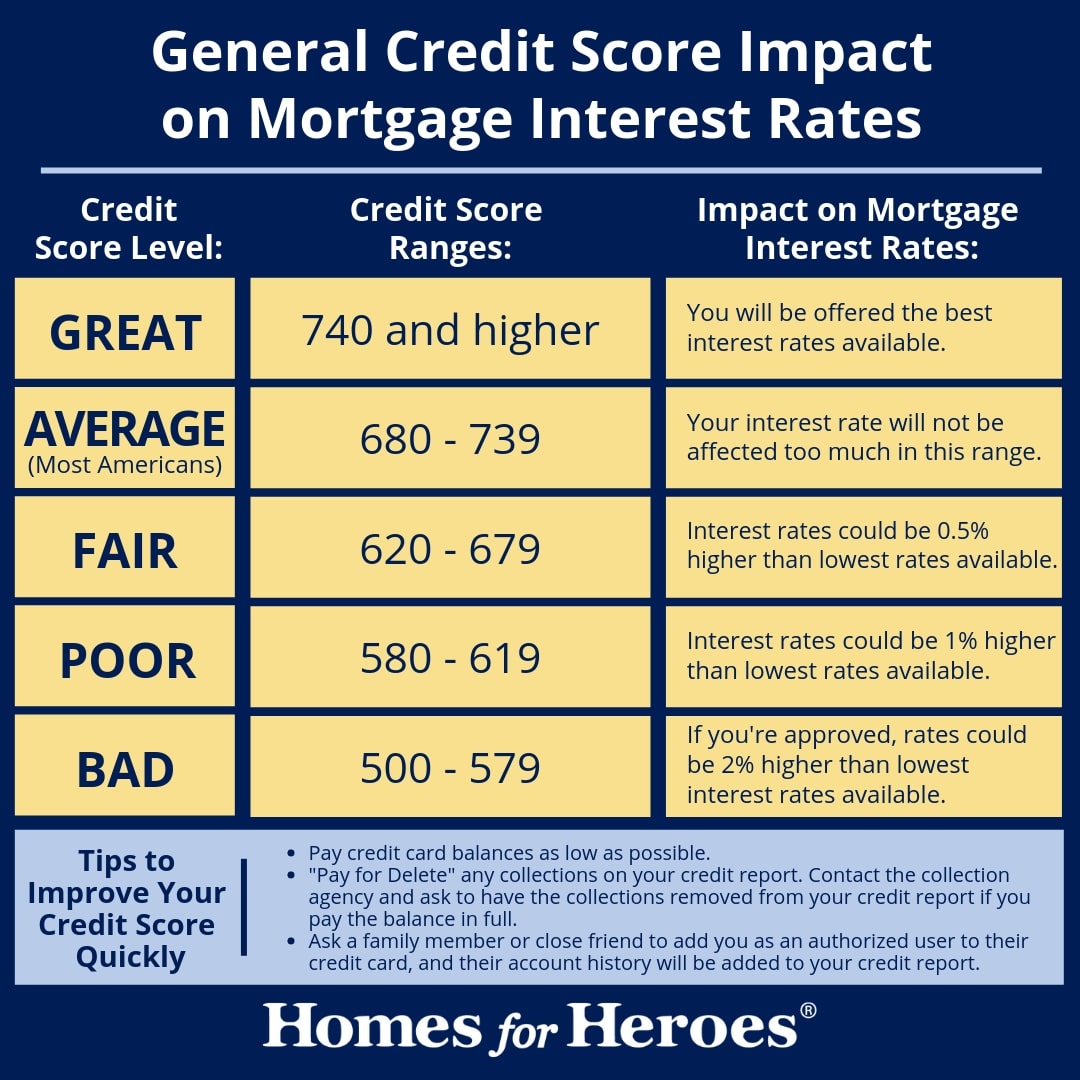

When it comes to home improvement loans, a strong credit score can significantly impact the options available to you. For instance, those with a credit score above 700 usually enjoy lower interest rates compared to those with scores in the 580 to 600 range. Understanding this can help you take the necessary steps to improve your financial standing before applying for a loan.

The Importance of Credit Score for Home Improvement Loan Applications

Applying for a home improvement loan can be daunting. However, if you’re equipped with the right knowledge about your credit score for home improvement loan, you position yourself for success. Lenders often require a minimum credit score, and lacking this can limit your financing options or even lead to rejection.

How Credit Scores Affect Loan Terms

Visualizing the Credit Score for Home Improvement Loan

This infographic beautifully illustrates how different credit score ranges affect mortgage loan interest rates. By referring to this, you can better understand how improving your score can lead to substantial savings in the long run.

Many borrowers often overlook how a solid credit score impacts their ability to secure financing. It can often mean the difference of thousands of dollars over the life of a loan. Thus, if you’re contemplating a home improvement project, reviewing and boosting your credit score is an essential step in the planning process.

Steps to Improve Your Credit Score for a Home Improvement Loan

With the knowledge of how crucial credit scores are for home improvement loans, you may be wondering how to elevate yours. Here are several actionable steps to consider:

- Check Your Credit Report: Start by obtaining a copy of your credit report. Look for any errors or discrepancies that could be hurting your score.

- Pay Bills on Time: One of the most significant factors in your credit score is your payment history. Ensure you pay all your bills promptly.

- Reduce Debt: Work on paying down existing debt. A lower credit utilization ratio can positively influence your score.

- Avoid Opening New Credit Accounts: While establishing new credit can appear appealing, too many inquiries can negatively impact your score.

Taking these steps can gradually improve your credit score over time, allowing you to qualify for better terms on your home improvement loan. Remember, patience and persistence are key!

Exploring Loan Options with a Strong Credit Score

Credit Score for Home Improvement Loan Types

With an improved credit score, you’ll find yourself with more options available for financing home improvements. Here are some popular types of loans you might consider:

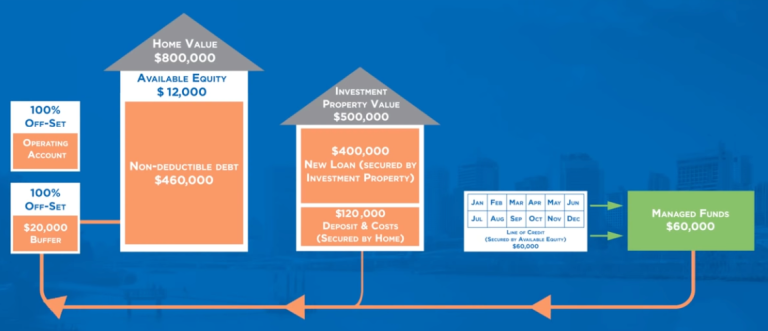

- Home Equity Loan: If you have existing equity in your home, a home equity loan can be a viable option. Generally, lenders will offer favorable rates to borrowers with good credit scores.

- Personal Loans: Unsecured personal loans can provide funding for home improvements. Again, your credit score plays a vital role in the interest rate you may receive.

- HELOC: A Home Equity Line of Credit (HELOC) allows you to borrow against your home’s equity, providing a flexible source of funding for projects.

- FHA Title I Loan: This government-backed loan helps homeowners improve their property without the equity requirement, usually suitable for borrowers with lower credit scores yet needing to showcase reliability.

Regardless of which option you choose, a strong credit score can help you secure a lower interest rate, leading to significant savings over the life of your loan. The value of a good credit score cannot be overstated when looking at long-term financial health.

Conclusion: Achieving Financial Empowerment through Credit Awareness

In conclusion, understanding the importance of your credit score for a home improvement loan is essential as you embark on home enhancement projects. Not only can it affect whether you’re approved, but it can also influence the terms of your loan, including interest rates and repayment options. By taking proactive steps to improve your credit, leveraging your current financial standing, and understanding all available loan options, you can make informed decisions that will lead to favorable outcomes.

As you continue to monitor and improve your credit score, remember that each step can significantly enhance your ability to secure the necessary funds for your next home improvement project. Your future self will thank you for the efforts you make today!