Are you considering the Commonwealth Bank for your savings needs? With a plethora of financial institutions available, choosing the right one can feel daunting. In this comprehensive review, we’ll delve deep into the Commonwealth Bank savings review, breaking down aspects such as interest rates, fees, customer service, and overall performance. By the end, you’ll have a clear understanding of whether this bank truly lives up to the hype—and whether it’s the right choice for your financial goals.

Overview of Commonwealth Bank Savings Options

The Commonwealth Bank of Australia, known for its robust presence in the banking industry, offers a range of savings products. But what makes their offerings stand out? In this section, we’ll explore the different types of savings accounts they provide and highlight what you need to know before making a decision.

Types of Savings Accounts Available

When it comes to savings accounts, Commonwealth Bank has a variety of options to cater to different financial needs. Here’s a brief overview:

1. **NetBank Saver**: This account is tailored for those looking to earn a competitive interest rate while having easy access to their funds. With no monthly account fees, it sounds appealing, but let’s see how it stacks up in the Commonwealth Bank savings review.

2. **Goal Saver**: Perfect for savers who want a bit of motivation! This account encourages you to set savings goals and rewards you with a higher interest rate when you regularly deposit funds without withdrawing.

3. **Youthsaver Account**: Aimed at younger savers, this account has no monthly fees and offers incentives for good saving behavior. It’s an excellent option for teaching children about money management.

4. **Retirement Saver**: As the name suggests, this account is for those looking to bolster their retirement savings. The interest rates are competitive, but let’s explore in detail how they compare against other institutions in our Commonwealth Bank savings review.

Understanding these options is crucial. Each account has its specific perks and requirements, and it’s essential to pick one that aligns with your saving habits.

Interest Rates and Fees

One of the most significant aspects of any bank’s savings account is the interest rate it provides. In the Commonwealth Bank savings review, we’ll compare these rates against other banks to see how they perform on this front.

Competitive Interest Rates

Commonwealth Bank offers various interest rates depending on the account type and balance. For instance, the NetBank Saver can begin with a competitive base rate, but your earnings can significantly increase with regular deposits and avoiding withdrawals. Is it truly the best you can get? We’ll find out!

It’s worth mentioning that rates fluctuate based on several market conditions. Therefore, it’s advisable to keep an eye on their official website or contact them for the most current rates, as our Commonwealth Bank savings review could quickly become outdated.

Monthly Fees and Considerations

While some accounts do not charge monthly fees, others might have specific requirements to waive them. Take the Goal Saver account—if you don’t meet the saving criteria, you may face deductions that could erode your savings. It’s crucial to read the fine print and ensure that you can comfortably meet the requirements laid out in the Commonwealth Bank savings review.

Customer Service Experience

In today’s digital world, customer service can often make or break your banking experience. Does the Commonwealth Bank shine in this department? Let’s dive into the nuances of its customer service in our Commonwealth Bank savings review.

Support Channels

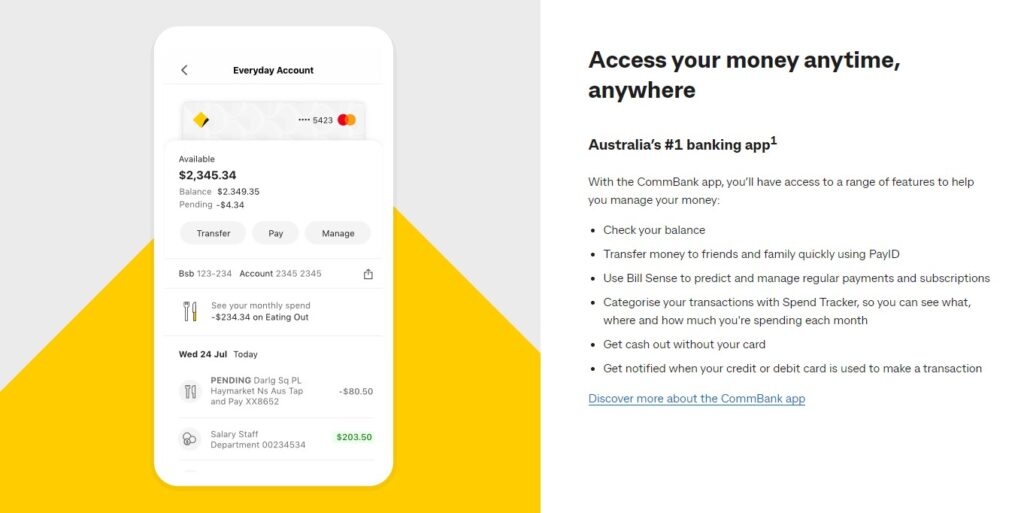

Commonwealth Bank provides various support channels, including 24/7 phone support, online chat, and a comprehensive website. Their mobile app is designed for convenience, allowing customers to manage their accounts on the go seamlessly.

However, there’s always the burning question—how do they perform in practice? Customer feedback consistently highlights responsiveness, but response times may vary based on the complexity of the inquiry.

Physical Branch Availability

Despite the rise of digital banking, many customers still appreciate the option of actual branch visits. With an extensive network of physical branches, Commonwealth Bank ensures accessibility as part of their service model. However, it’s worth mentioning that you may sometimes wait longer due to clientele demands, which could affect your overall satisfaction level with their services.

Motivational Saving Options: Behavioral Insights

An intriguing element of the Commonwealth Bank savings review is their ability to promote better saving habits among their customers through innovative features.

Features that Encourage Saving

Commonwealth Bank has introduced several tools designed to cultivate a consistent saving tendency. The Goal Saver account, for instance, comes with features that allow you to set and track personal savings goals. This option engages users by allowing them to see progress visually through their app, making saving feel more rewarding.

Additionally, customers have found creative uses for reminders and alerts within their app to help maintain their saving objectives. This proactive approach appears to resonate well with individuals trying to build financial discipline.

Account Safety and Security

In our Commonwealth Bank savings review, it’s impossible to overlook one of the most critical aspects—security. Customers want peace of mind knowing their money is safe.

Securing Your Investment

Commonwealth Bank employs robust security measures, including biometric logins, two-factor authentication, and continuous monitoring for suspicious activity. Moreover, their commitment to customer privacy is commendable, as they routinely update security protocols to protect sensitive data.

Insurance and Guarantees

In Australia, deposits up to a certain limit in authorized banks, including Commonwealth Bank, are insured by the Financial Claims Scheme (FCS). This security measure ensures that your funds are protected in unstable financial situations, adding another layer of comfort for savers.

Final Thoughts on the Commonwealth Bank Savings Review

In conclusion, after thoroughly reviewing all aspects of the Commonwealth Bank savings account offerings, it’s clear they have both pros and cons. While they offer competitive interest rates and various account options, fees and customer service experiences can vary.

It’s essential to weigh the specific features that best fit your financial goals and saving habits. For those who are willing to engage proactively with their accounts and take advantage of the tools available, Commonwealth Bank can prove to be a solid choice. Will it live up to the hype for you? Only time and personal experience will tell.

We encourage you to weigh your options carefully and consider all aspects mentioned in this Commonwealth Bank savings review, ensuring that you make an informed decision that suits your financial landscape. Happy saving!

Visual Guide to Commonwealth Bank Offerings

This visual highlights the key considerations we discussed. Remember, the right savings strategy can significantly impact your financial wellbeing, so take your time and choose wisely!