Effective management of business finance is crucial for the sustainability and growth of small businesses. Entrepreneurs must navigate numerous financial tasks, from budgeting and forecasting to managing cash flow and expenses. In today’s competitive market, understanding the intricacies of business finance small business can be the difference between success and failure. This article delves into essential strategies, tips, and best practices to optimize financial management in small businesses.

Understanding Business Finance for Small Business Owners

The journey of a small business owner is often filled with challenges, particularly in the area of finance. Business finance small business encompasses a wide range of financial activities that help in the planning, organizing, directing, and controlling of business operations. With limited resources, small business owners must be adept at financial management to ensure their ventures are not only surviving but thriving.

Key Elements of Business Finance in Small Businesses

To effectively manage business finance small business, owners should focus on several key elements:

- Budgeting: Establishing a comprehensive budget allows small business owners to allocate resources appropriately and maintain control over their finances.

- Forecasting: Understanding and predicting future financial conditions is crucial for planning and mitigating risks.

- Cash Flow Management: Monitoring incoming and outgoing cash ensures that small businesses can meet their obligations and invest in growth opportunities.

- Expense Tracking: Keeping a close eye on expenses can highlight areas for cost reduction and improve overall profitability.

- Financial Reporting: Regularly reviewing financial statements helps small business owners assess the financial health of their company.

Strategies for Effective Business Finance Management in Small Businesses

Successful financial management is a continuous process. Here are some strategies that small business owners can adopt to enhance their business finance small business practices:

1. Implement a Robust Budgeting Process

A well-structured budget serves as the financial blueprint of a business. It outlines expected revenues and expenses, allowing small business owners to plan effectively. By setting realistic financial goals, businesses can track their performance and make adjustments as needed. It is advisable to review the budget regularly—at least quarterly—to ensure that it remains aligned with the business’s objectives and market conditions.

2. Optimize Cash Flow Management

Cash flow is the lifeblood of any small business. To manage cash flow effectively, owners must understand the timing of revenues and expenses. Creating a cash flow forecast can help predict cash needs, allowing businesses to take proactive measures when cash flow is tight. Strategies such as offering discounts for early payments or tightening credit terms with customers can also improve cash flow.

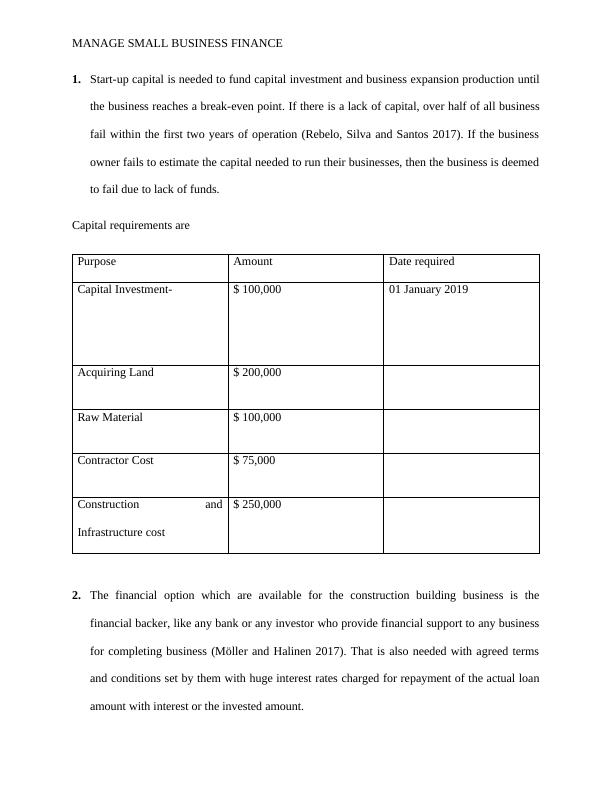

Visualizing Business Finance in Small Business

This image illustrates various aspects of business finance management, showcasing the importance of financial literacy in steering small businesses towards success. Understanding these aspects can empower business owners to make informed decisions, ultimately leading to improved profitability and stability.

3. Utilize Financial Software

With the advancement of technology, a range of software solutions is available to assist small businesses in managing their finances. Financial management software can simplify budgeting, forecasting, invoicing, and expense tracking. By automating these processes, small business owners can save time and reduce errors, enabling them to focus on their core operations.

4. Monitor and Analyze Key Financial Metrics

Keeping an eye on key performance indicators (KPIs) related to business finance small business allows owners to gauge their performance objectively. Important financial metrics include profit margins, return on investment (ROI), and current ratio. By regularly reviewing these figures, business owners can identify trends, uncover potential problems, and make informed decisions about their operations.

5. Prepare for the Unexpected

No business is immune to financial setbacks. Preparing for unexpected challenges, such as a sudden drop in sales or increased expenses, is vital. Maintaining an emergency fund can provide a financial cushion that helps navigate tough times. Additionally, developing a crisis management plan can outline steps to address potential financial challenges proactively.

Developing Financial Literacy in Small Business

Financial literacy is a critical skill for anyone involved in managing business finance small business operations. Small business owners should invest time in learning about financial principles, such as how to read financial statements, manage budgets, and analyze cash flow. There are numerous online courses, workshops, and resources available to help enhance financial knowledge.

Engage with Financial Advisors

Collaborating with financial advisors can provide small business owners with valuable insights and expertise. Financial advisors can assist in developing strategic plans, optimizing tax obligations, and offering investment strategies tailored to specific business needs. This collaboration can be instrumental in ensuring sound financial management throughout the business lifecycle.

The Impact of Effective Business Finance Management on Growth

Effectively managing business finance small business can significantly impact growth and sustainability. When finances are well-managed, businesses can invest in new opportunities, hire staff, and expand their product lines. A strong financial foundation allows small business owners to focus on innovation rather than merely reacting to financial pressures.

Building Long-Term Financial Strategies

Small businesses should not just focus on immediate financial goals but aim to build long-term strategies that support ongoing growth. This includes setting clear financial goals for the next five to ten years and regularly reviewing these targets in light of changing market conditions. Long-term planning can empower small business owners to make strategic investments and reduce dependency on short-term financing.

Networking with Other Entrepreneurs

Building relationships with other entrepreneurs can provide small business owners with valuable networks and resources. Peer support and shared experiences can lead to acquiring new insights about business finance small business. Joining local business organizations or online communities can foster collaboration and knowledge sharing among entrepreneurs facing similar challenges.

Conclusion: The Path to Financial Success for Small Businesses

The journey towards mastering business finance small business is continuous and multifaceted. By developing effective strategies for budgeting, cash flow management, and financial literacy, small business owners can pave the way for sustained growth and long-term success. Emphasizing the importance of financial planning while remaining adaptable to changes in the market are key components of a thriving small business.

As small business owners navigate the complexities of finance, they should commit to lifelong learning and be proactive in seeking out expert advice. By doing so, they not only enhance their financial skills but also build a solid foundation that can withstand the tests of time in the ever-evolving business landscape.