In today’s fast-paced financial environment, understanding the dynamics of major asset management firms is crucial. Among these, BlackRock stands out as a colossal entity, with its funds under management reaching staggering heights. The significance of BlackRock’s influence in the global market cannot be overstated, as it plays a pivotal role in shaping investment strategies and economic trends. This article delves into the vast sea of BlackRock’s assets under management, uncovering insights into their portfolios, market strategies, and the implications for investors.

BlackRock Funds Under Management: An Overview

Recognized as one of the largest asset management companies in the world, BlackRock’s funds under management are a testament to its success and stability. With trillions of dollars in assets, the firm has established itself as a key player in the investing landscape. Investors, from individuals to large institutions, leverage BlackRock’s expertise to navigate their investment journeys. The scale of their operations allows for significant diversification across various sectors and asset classes, ultimately leading to risk mitigation and potential returns.

The Evolution of BlackRock’s Assets Under Management

Over the years, BlackRock has seen exponential growth in its funds under management, a trend driven by its innovative investment strategies and commitment to research. This growth can be attributed to various factors, including the increasing global demand for investment management services and the firm’s strategic acquisitions over the years. By integrating advanced technology and data analytics into their investment processes, BlackRock has continuously outperformed many of its competitors, making it a preferred choice for both institutional and retail investors.

Visualizing BlackRock’s Dominance

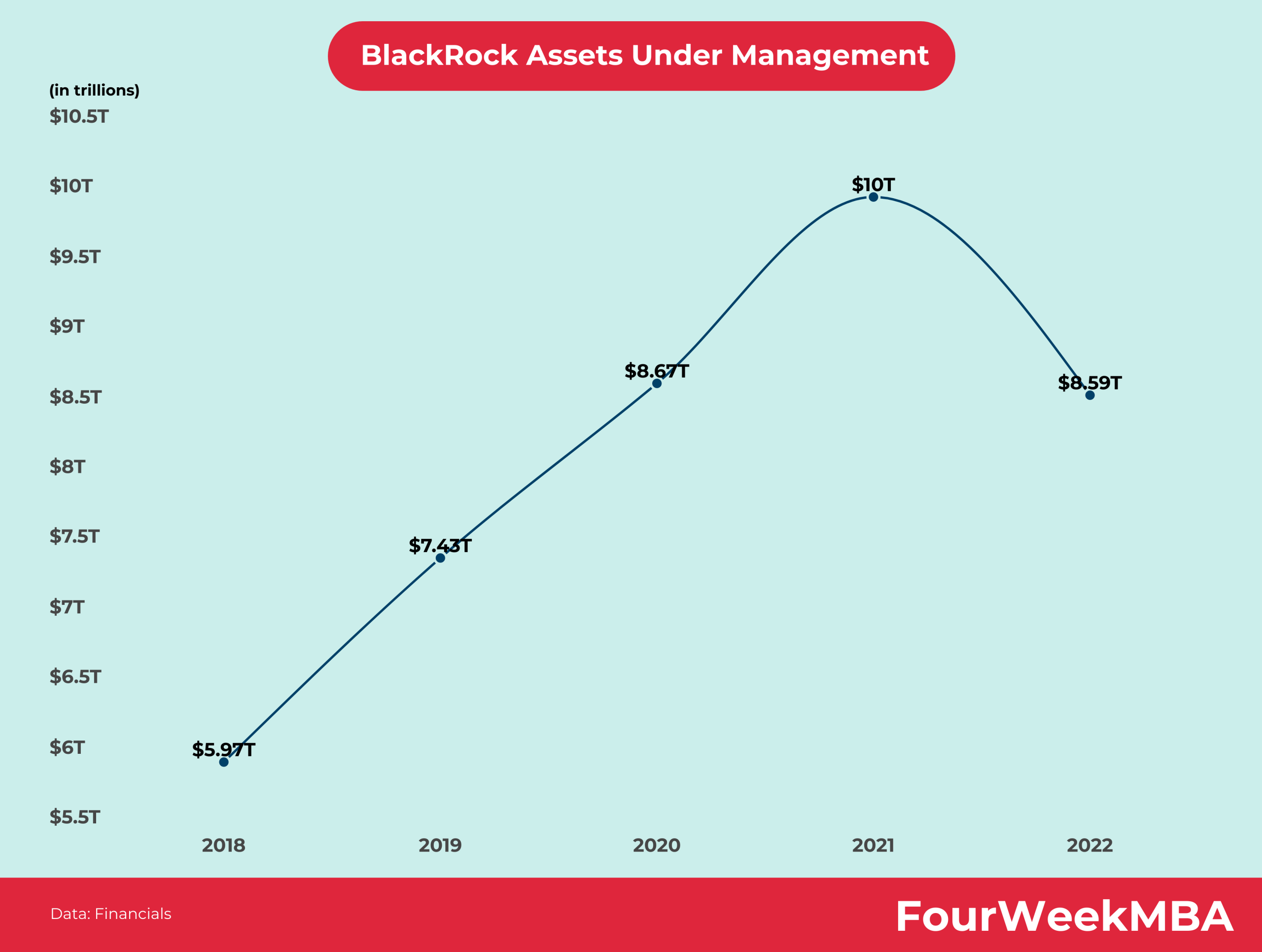

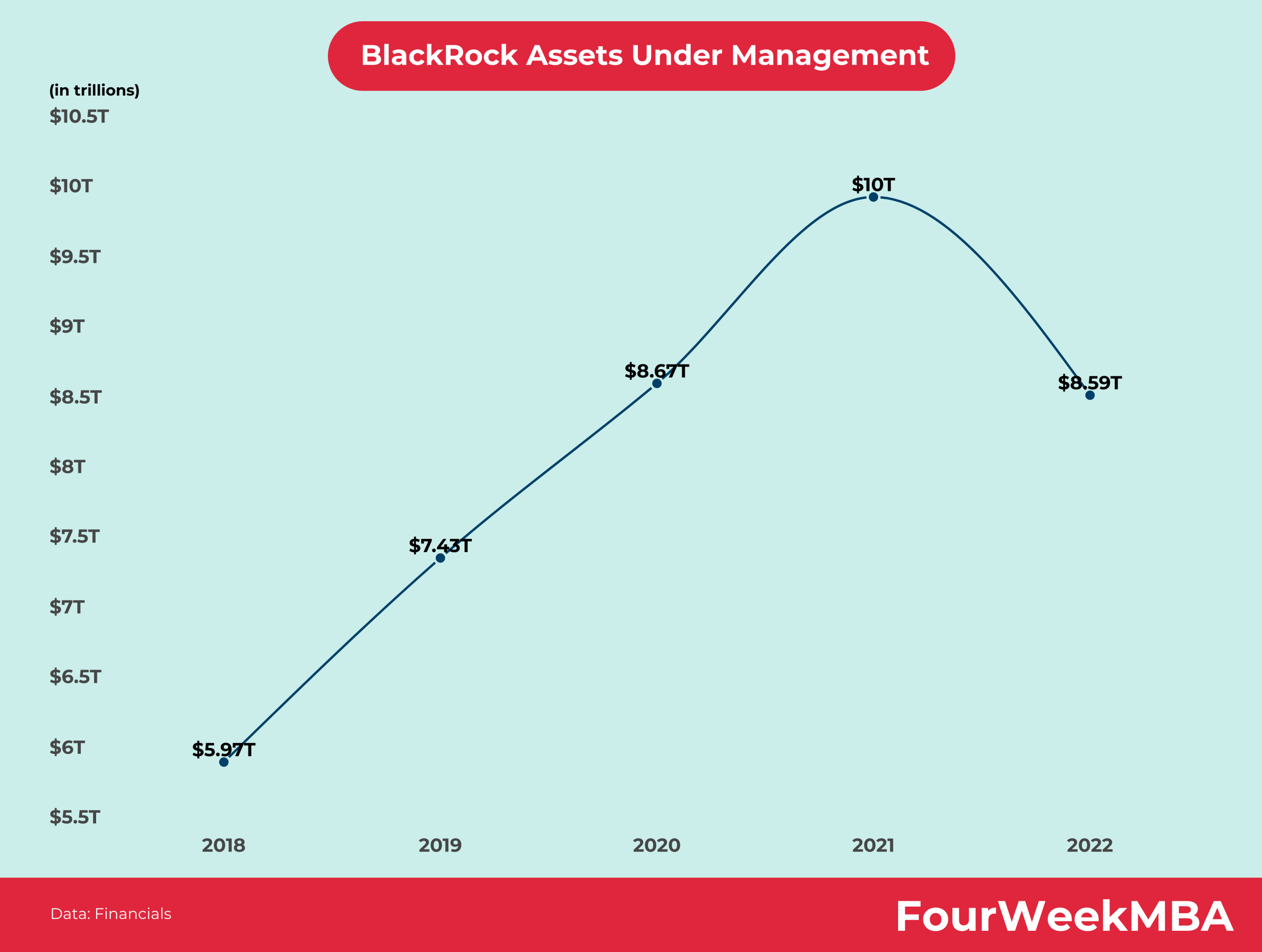

BlackRock Assets Under Management

The above graph illustrates the remarkable growth in BlackRock’s assets under management. As we can see, the trajectory is not only upward but suggests a firm resilience against market fluctuations. Such visuals underscore why investors feel secure placing their capital in BlackRock’s funds. With a comprehensive approach to portfolio management, they attract a diverse range of investments, from equities to fixed income and alternative investments.

Understanding the Scope of BlackRock Funds Under Management

At its core, BlackRock’s approach emphasizes diversification and innovative financial strategies. Their funds under management extend across various asset classes, including index funds, ETFs, active mutual funds, and more. This multifaceted strategy allows BlackRock to cater to different investor needs and philosophies, ranging from conservative strategies to aggressive growth plans. As a result, investors have the flexibility to choose from a plethora of options, each designed to meet specific financial goals.

Market Impact of BlackRock’s Funds Under Management

The impact of BlackRock’s invested capital on the broader economy is profound. With their enormous funds under management, BlackRock has the power to influence market trends, corporate governance, and even public policy. Their investment decisions can lead to increased capital allocation to specific sectors, which often shapes the economic landscape. Regulatory environments and market sentiments can also be swayed significantly by BlackRock’s investment patterns, given their status as a market bellwether.

Investment Strategies Employed by BlackRock

Central to BlackRock’s ongoing success is their ability to employ several core investment strategies that adapt to changing market conditions. They use a combination of quantitative and qualitative analysis to make data-driven investment decisions. By leveraging their proprietary technology and advanced analytics tools, BlackRock identifies opportunities where they can add value to their clients’ portfolios. This inclination toward innovation is further solidified by partnerships with tech firms that enhance their analytical capabilities.

BlackRock Funds Under Management: A Risk Management Perspective

Risk management is a critical component of BlackRock’s investment philosophy, and their vast funds under management serve as a safety net for investors. Through their advanced risk management tools, they are equipped to identify and mitigate potential downturns. This focus not only ensures the protection of capital but also aids in navigating the complexities of the investment landscape. BlackRock’s risk management teams continuously monitor market dynamics, identifying vulnerabilities and optimizing portfolio performance across various market cycles.

The Role of ESG in BlackRock’s Asset Management

Environmental, Social, and Governance (ESG) considerations have become increasingly significant in investment management. BlackRock recognizes the importance of sustainability and has incorporated ESG criteria into its investment analysis. This approach has attracted a growing number of socially conscious investors who are keen to support responsible investing. By aligning their funds under management with ESG principles, BlackRock not only meets the demand for sustainable investing but also positions itself as a leader in the market.

The Future of BlackRock Funds Under Management

Looking forward, the trajectory of BlackRock’s funds under management appears promising. With a focus on innovation and sustainability, coupled with strategic investments in technology, BlackRock is well-positioned to adapt to the evolving investment landscape. Furthermore, as global economies recover and evolve from recent challenges, BlackRock’s adaptive strategies will likely play a significant role in guiding future investment decisions. The firm’s commitment to research and development will continue to bolster its offerings, ensuring that it remains at the forefront of asset management.

Conclusion: The Lasting Influence of BlackRock’s Funds Under Management

BlackRock’s assets under management symbolize a substantial powerhouse in global finance. From its expansive range of investment options to its commitment to innovation and risk management, BlackRock has carved out a unique niche that appeals to a broad spectrum of investors. As it continues to navigate the complexities of modern finance, the future of BlackRock—and the influence of its funds under management—will undoubtedly leave a lasting impact on the investment world. With a commitment to excellence and a vision for sustainable growth, BlackRock remains a leading force, guiding investors toward financial success.