As we step into 2024, many of us find ourselves looking forward to new goals and resolutions. Among these, personal finance often tops the list. Whether you’re aiming to save for a big purchase, pay off debt, or simply gain better control of your financial situation, knowing the best personal finance tips for 2024 can make all the difference. This year is all about making deliberate financial choices that empower your future, and with the right strategies, you can navigate your financial journey with confidence.

The Best Personal Finance Tips for 2024: Prioritizing Your Budget

Your budget is the foundation of your financial health. Without a well-thought-out budget, it’s difficult to track your expenses, save money, or make informed decisions about your spending habits. To start off on the right foot in 2024, consider these budgeting strategies.

1. Embrace the 50/30/20 Rule

One of the most effective methods for budget creation is the 50/30/20 rule. This simple allocation method advises that you divide your after-tax income as follows: 50% for needs (essential expenses like housing, groceries, and transportation), 30% for wants (discretionary spending on things you enjoy), and 20% for savings and debt repayment. This approach provides clarity and balance in your financial planning.

2. Use Budgeting Apps

In our digital age, leveraging technology can help streamline your budgeting efforts. Numerous budgeting apps can help you track your spending, manage your bills, and even remind you of due dates. Popular options include Mint, YNAB (You Need A Budget), and PocketGuard. Each app comes with unique features, so explore your choices to find one that suits your needs.

An Essential Reminder: The Best Personal Finance Tips for 2024 is to Build an Emergency Fund

Life is unpredictable, and emergencies can happen when we least expect them. By having an emergency fund, you’re safeguarding yourself against unexpected expenses, such as medical emergencies or car repairs. Here’s how to effectively build your emergency fund:

1. Start Small

You don’t need to have a fully funded emergency fund overnight. A good starting goal is to save at least $1,000. This can cover most minor emergencies. Once you hit that goal, aim for three to six months’ worth of expenses.

2. Open a Dedicated Account

To avoid the temptation of dipping into your emergency savings for everyday expenses, open a separate savings account specifically for this fund. Look for a high-yield savings account, so your money can grow while remaining accessible. This separation makes tracking progress much easier, and it keeps your funds out of harm’s way.

Save Smart: Additional Best Personal Finance Tips for 2024

Utilize Automation Tools

Automating your savings can prevent you from neglecting this crucial aspect of your financial health. Set up automatic transfers from your checking to your savings account each month. By treating savings like a monthly bill, you’re consistently putting money toward your future without having to think about it.

Shop Around for Better Rates

When it comes to banking, insurance, and investment accounts, the rates you receive can greatly affect your finances. In 2024, take the time to compare rates across different institutions. Look for better interest rates on savings accounts, lower premiums on insurance, and better returns on investment accounts. Saving money on these regular expenses can add up significantly over time.

Invest Wisely: The Best Personal Finance Tips for 2024

Investing is a critical component for long-term financial health. Even if you’re not ready to dive into the stock market, there are still steps you can take to make your money work for you.

1. Start with Retirement Accounts

If your employer offers a retirement plan, like a 401(k), take full advantage of it. At a minimum, contribute enough to receive any employer match. This is essentially free money and can significantly boost your retirement savings. If you’re self-employed or your employer doesn’t offer a retirement plan, explore options like an IRA or Roth IRA to get started.

2. Diversify Your Investments

Diversification is a key strategy in investing. This means spreading your investments across various asset classes to reduce risk. Consider a mix of stocks, bonds, and possibly real estate. Mutual funds or ETFs (exchange-traded funds) are great options for achieving diversification without having to pick individual stocks yourself.

Enhancing Financial Literacy

One often overlooked aspect of personal finance is the importance of financial literacy. Continuously educating yourself on money matters can empower you to make wiser financial decisions.

1. Read Books and Articles

There are countless resources available, from books by renowned authors like Dave Ramsey and Suze Orman to informative blogs and articles online. Set a goal of reading a certain number of finance-related materials each month to broaden your understanding of personal finance.

2. Attend Workshops and Seminars

Look for financial workshops and seminars in your area or virtual options. Engaging with experts can provide valuable insights, and you may meet like-minded individuals who share your financial goals.

The Journey to Financial Freedom in 2024

Achieving financial freedom takes time and effort. By implementing the best personal finance tips for 2024 that resonate with you, you’re on the path to achieving measurable results. Remember that small, consistent changes often lead to the most significant transformations. Reflect on your financial goals regularly and adjust your strategies as necessary.

Evaluate Your Progress

Set regular check-ins to evaluate your financial progress. Are you sticking to your budget? Is your emergency fund building? Are your investments growing? By assessing your financial health periodically, you can identify areas for improvement and celebrate your achievements.

Plan for the Future

Don’t forget to plan for future goals, whether that’s buying a home, traveling, or retirement. As you create these plans, break them down into achievable milestones. The more tangible your goals, the more likely you will stay motivated to reach them.

Conclusion: The Best Personal Finance Tips for 2024 in Review

Ultimately, successful personal finance management is about making informed decisions and following through on your commitments. By incorporating the best personal finance tips for 2024 into your lifestyle, you’ll be positioning yourself for financial growth. Remember to be patient with yourself; change doesn’t happen overnight. With determination and the right approach, you can conquer your financial goals and pave the way for a secure future.

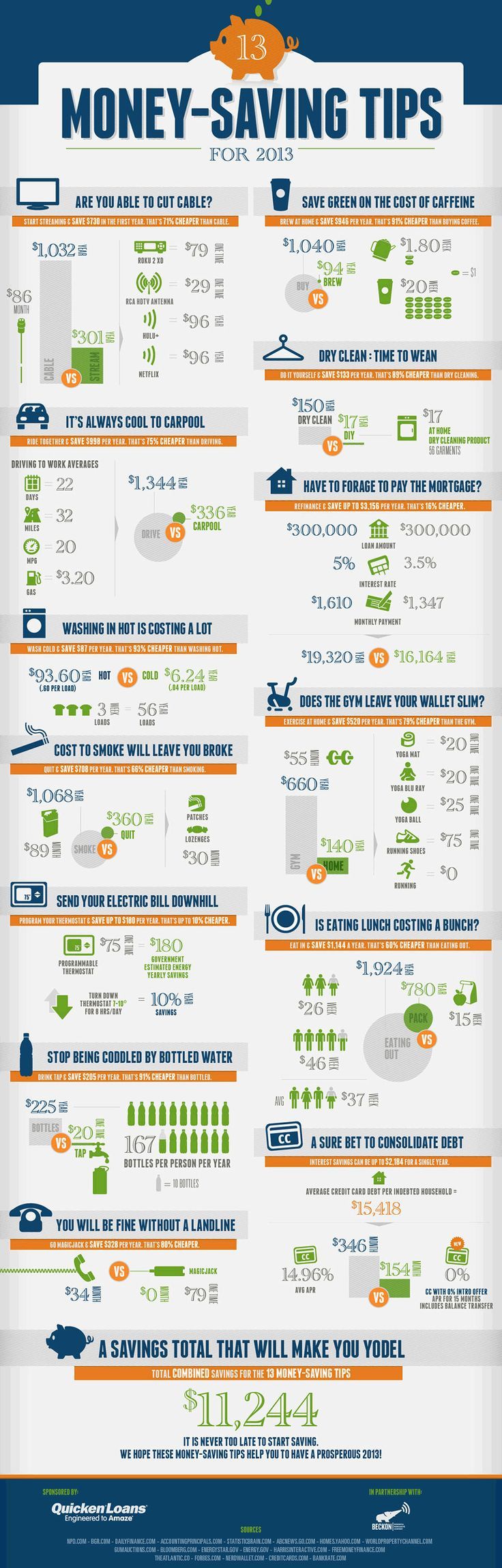

Visual Reminder of Your Financial Journey

Personal Finance Tips 2024

This visual can serve as a reminder and inspiration as you embark on your financial journey this year. Make the most of the insights shared, and here’s to a financially sound 2024!