When delving into the world of real estate investing, you may find yourself pondering the merits of various strategies. One of the most significant distinctions is the choice between active vs passive income real estate. Understanding this difference is crucial for aligning your investment style with your financial goals. Whether you envision yourself managing properties directly or prefer a more hands-off approach, knowing these two paths will help you make informed decisions in your investment journey.

Active vs Passive Income Real Estate: What’s the Difference?

Active income in real estate requires a direct involvement in the management and operations of a property. This can mean anything from purchasing, renovating, and renting out properties to dealing with tenants and ongoing maintenance. On the other hand, passive income real estate focuses on investments that require little to no day-to-day management. This might include real estate investment trusts (REITs) or partnerships where someone else manages the properties for you.

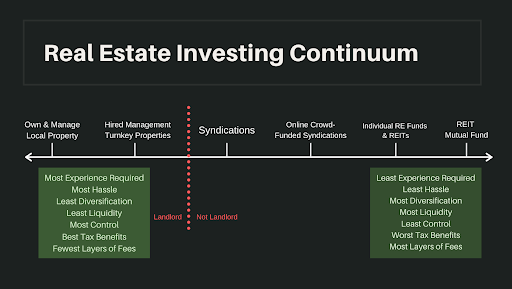

Visualizing Active vs Passive Income Real Estate

This image illustrates the contrasting methods of income generation in real estate, setting the stage for a deeper examination of each approach.

Exploring Active Income Real Estate Strategies

For investors who are willing to roll up their sleeves, active income real estate can provide lucrative results. This method includes the following strategies:

- Buy and Hold: This involves purchasing a property, often at a lower price, and holding onto it through appreciation and cash flow from tenants.

- Fix and Flip: In this strategy, investors buy undervalued properties, renovate them, and sell them at a profit. It demands not just capital but also scheduling and project management skills.

- Short-term Rentals: Platforms like Airbnb and VRBO have made it possible for individuals to become landlords without long-term commitments. However, they require active marketing and management.

Being an active investor also means constantly educating yourself about the market trends, local regulations, and property management best practices.

Challenges of Active vs Passive Income Real Estate

Active income comes with its fair share of challenges. Investors need to be prepared for the demands of time and effort involved. This is particularly true in property management, where dealing with tenants can range from straightforward tasks to significant hurdles. Additionally, fluctuations in the real estate market can impact cash flow and property value.

Passive Income Real Estate Investments: A Serene Alternative

Conversely, passive income real estate provides a less hands-on approach that many find appealing. Here are some common passive income strategies:

- Real Estate Investment Trusts (REITs): These are companies that own, operate, or finance income-producing real estate. Investors can buy shares of REITs on stock exchanges, gaining exposure to real estate without physical property management.

- Real Estate Crowdfunding: This method allows multiple investors to pool resources to invest in real estate projects. The investor typically makes a one-time investment and receives returns as the property appreciates.

- Real Estate Partnerships: In these arrangements, you partner with an experienced property manager or investor who handles the day-to-day operations while you provide the capital.

Passive investors typically enjoy the income generated while avoiding the hands-on commitments that active income demands. This allows individuals to pursue other interests or investments, leading to a more balanced life.

Weighing the Pros and Cons of Active vs Passive Income Real Estate

Both active and passive income strategies come with unique advantages and disadvantages. Active income real estate investing can yield higher returns but demands more effort and risk management. In contrast, passive income strategies often provide stability and ease but may result in lower returns or fees paid to active managers. Understanding these trade-offs is essential in determining which path suits your lifestyle and financial goals.

Which Method Is Right for You?

The decision to pursue active vs passive income real estate boils down to personal preferences, available time, investment strategy, and financial objectives. Ask yourself the following questions:

- How much time can you dedicate to real estate investing?

- Are you comfortable managing properties and dealing with tenants?

- Do you prefer a hands-on or hands-off investment experience?

Your answers will guide you towards a strategic choice that aligns with your lifestyle. For example:

- If you’re busy with a full-time job or other commitments, passive income real estate may suit you better.

- If you have experience in property management and enjoy being hands-on, exploring active income strategies could be beneficial.

The Path Forward: Taking Action

Regardless of which income style you choose, establishing a clear plan is crucial. Start by determining a budget and finding a reliable source of information. It’s wise to conduct thorough research and possibly consult with a financial advisor with experience in real estate. Whether active or passive, the best strategy is one that not only fits your financial situation but also aligns with your personal goals and lifestyle.

Ultimately, understanding the nuances of active vs passive income real estate allows you to tailor your strategy in a way that could unlock your financial potential. Whichever path you choose, remember that investing in real estate is a long-term journey. Equip yourself with knowledge, seek support, and stay persistent. Your future self will thank you.

In conclusion, both paths present unique opportunities that cater to different investor profiles. Embrace exploration in either direction, and enjoy the journey of real estate investing!