Household financial management is a crucial skill that empowers individuals and families to optimize their financial resources, ensuring long-term stability and growth. As we navigate through various economic challenges, the necessity of implementing effective budgeting, saving, and investing strategies becomes increasingly apparent. This article provides insights into household financial management, discussing its importance and offering practical tips to enhance personal financial health.

Understanding Household Financial Management

At its core, household financial management involves overseeing financial decisions and planning for the future of a household. It encompasses budgeting, managing expenses, saving for goals, and investing wisely. By developing a solid financial strategy, households can achieve their personal financial objectives, reduce stress related to money, and create a more secure lifestyle.

The Importance of Household Financial Management

Proper household financial management has numerous benefits. It allows families to:

- Maintain a budget that reflects their income and expenses, reducing financial stress.

- Save for emergency funds, ensuring that unexpected expenses do not derail financial plans.

- Invest for the future, contributing to retirement accounts or other investment vehicles to grow wealth over time.

- Make informed decisions about major purchases, like homes and vehicles, ensuring they fit within overall financial plans.

Practical Strategies for Effective Household Financial Management

Implementing efficient household financial management strategies is essential for achieving financial well-being. Here are some key practices to consider:

- Create a Comprehensive Budget: The foundation of household financial management starts with a detailed budget. Track all sources of income and list monthly expenses systematically, differentiating between fixed and variable costs.

- Emergency Fund: Aim to save three to six months’ worth of living expenses as a safety net. This fund provides peace of mind in unforeseen circumstances, such as job loss or medical emergencies.

- Debt Management: Prioritize paying off high-interest debts first, such as credit cards. Consider consolidating debts to lower interest rates and simplify payments.

- Invest Wisely: Developing an investment strategy is vital for long-term financial health. Consider diversifying investments, balancing risk with potential returns to optimize growth.

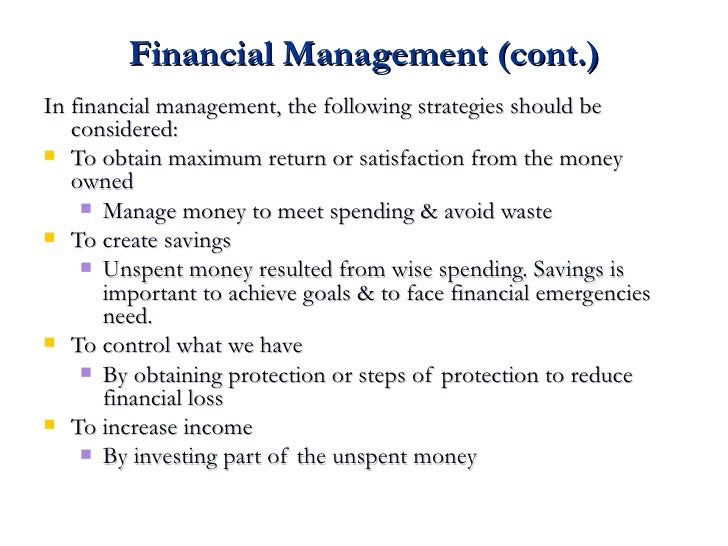

Image of Effective Household Financial Management

This image represents effective household financial management, highlighting the critical elements that contribute to a sound financial plan. A well-structured approach to finances can withstand economic fluctuations and enhance overall quality of life.

Review and Adjust Your Financial Strategies Regularly

Household financial management is not a one-time task; it requires ongoing assessment and adjustment to meet changing circumstances. Regularly review your financial plan to ensure it aligns with your current financial status, goals, and market conditions.

- Monthly Reviews: Conduct monthly check-ins to compare actual spending against your budget, allowing for adjustments where necessary.

- Annual Revisions: At year-end, reassess your financial goals and make any necessary changes to accommodate life changes, such as a new job, a house purchase, or the birth of a child.

- Seek Professional Advice: Consider consulting with financial planners for specialized guidance, particularly regarding investments and retirement planning.

Household Financial Management Tools

Utilizing technology can simplify household financial management significantly. Various tools are available to streamline budgeting, tracking expenses, and planning for savings. A few recommended tools include:

- Budgeting Apps: Applications such as Mint, YNAB (You Need A Budget), or Tiller can help track spending and manage budgets more effectively.

- Investment Platforms: Services like Betterment or Wealthfront automate investment strategies to help users meet their financial objectives.

- Financial Calculators: Use online calculators for budgeting, retirement planning, and estimating loan payments to gain quick insights into your financial status.

The Role of Financial Education in Household Financial Management

Financial education is a valuable component of effective household financial management. Being informed about financial concepts and practices enables individuals to make better choices. Consider the following approaches to enhance your financial literacy:

- Online Courses: Numerous platforms offer free or low-cost courses on personal finance, investing, and budgeting.

- Books and Publications: Invest time in reading books on personal finance. Classics such as “The Total Money Makeover” by Dave Ramsey can provide valuable insights and practical tips.

- Seminars and Workshops: Attend community workshops or webinars hosted by financial institutions to learn more about managing your finances effectively.

Setting Financial Goals and Household Financial Management

Establishing clear financial goals is essential to household financial management. Goals can range from short-term savings objectives to long-term investment plans, and should adhere to the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound).

- Short-Term Goals: These could be saving for a vacation, paying off credit cards, or accumulating a specific amount in your emergency fund within the next year.

- Long-Term Goals: Encompass objectives such as retirement savings, purchasing a home, or funding college education for children, typically targeted over multiple years.

Creating a Household Financial Management Action Plan

Your action plan to implement household financial management should include:

- Set Up a Budgeting System: Choose a budgeting method that suits your lifestyle and attention to detail—be it zero-based budgeting, the envelope system, or a simple percentage allocation.

- Regular Saving and Investing: Automate savings and investments wherever possible to ensure contributions happen consistently, regardless of market conditions.

- Communication: Maintain open dialogue among family members regarding financial issues; collective decision-making often leads to better financial outcomes.

In conclusion, mastering household financial management is an essential skill that can significantly affect your life quality and financial prosperity. By implementing sound strategies, utilizing the right tools, and committing to ongoing education, individuals and families can empower themselves to achieve their financial goals and secure a brighter financial future.